|

|

|

|

|||||

|

|

Guidewire Software GWRE stock has lost 12.4% in the past year compared with the Zacks Internet Software industry's decline of 2.3%. The broader Zacks Computer and Technology sector and the S&P 500 composite have returned 24.7% and 17.3%, respectively, over the same time frame.

GWRE closed last session at $158.99, down 4.3%. The stock hit a fresh 52-week low of $158.80. The recent pullback underscores growing investor caution around Guidewire’s near-term upside. The stock is trading below its 50 and 100-day moving averages, signaling a bearish sentiment.

How should investors approach the stock now?

Let us dive into GWRE’s pros and cons and determine the best course of action for your portfolio.

San Mateo, CA-based Guidewire is a provider of software solutions for property and casualty insurers. The platform offered by Guidewire combines core operations, digital engagement, analytics, machine learning, and artificial intelligence (AI), which is then delivered to its customers via self-managed software or cloud services. The company’s core solutions include InsuranceSuite Cloud, InsuranceNow, and InsuranceSuite for self-managed installations. Guidewire InsuranceSuite Cloud comprises PolicyCenter Cloud, BillingCenter Cloud and ClaimCenter Cloud.

One of the most important drivers of Guidewire’s investment thesis over the past several quarters has been its transition to a cloud-based subscription model. Its cloud business is fueled by rising demand from insurers moving away from legacy systems toward cloud-based solutions. In the last reported quarter, it signed eight new cloud deals. Five of the eight cloud deals were signed with major North American insurers, including The Hartford and Sompo. The strength of adoption is reflected in annual recurring revenues (“ARR”) growth of 22% year over year, or 21% on a constant-currency basis, reaching $1.063 billion.

The company has strategically expanded its cloud ecosystem, now encompassing more than 26,000 Guidewire-specialized practitioners across 38 system integrators. Its focus on enhancing the Guidewire Cloud platform with new capabilities, including digital frameworks, automation, tooling and other cloud services, is expected to boost sales of subscription-based solutions in the long haul.

International momentum further strengthens the bullish narrative. It secured three international cloud deals, including a win with a respected U.K. mutual insurer, a new deployment with a major Australian carrier and a significant migration at a large Japanese insurer.

Frequent product launches are also a tailwind. Management has added two new applications, PricingCenter and UnderwritingCenter, to the Insurance suite, along with PolicyCenter, BillingCenter and ClaimCenter. These new applications address highly fragmented and manual processes that directly affect insurers’ loss ratios, speed to market, and profitability. GWRE is also integrating AI across solutions to boost operations. Agentic AI capabilities integrated into PricingCenter and UnderwritingCenter have the potential to materially improve business constraints, added GWRE.

Guidewire Software, Inc. price-consensus-eps-surprise-chart | Guidewire Software, Inc. Quote

The acquisition of ProNavigator strengthens Guidewire’s AI strategy. ProNavigator is an AI-powered, insurance-specific knowledge management platform that delivers “instant, context-aware guidance” to users. Management expects ProNavigator to add approximately $4 million in ARR and $2 million in revenues in fiscal 2026.

Management’s efforts to drive cloud operations efficiency to boost cloud margins remain an additional tailwind.

Driven by strong revenue performance, GWRE expects total revenues for fiscal 2026 to be between $1.403 billion and $1.419 billion compared with $1.202 billion in fiscal 2025. The company earlier anticipated total revenues for fiscal 2026 to be between $1.385 billion and $1.405 billion.

Guidewire’s business remains exposed to complex enterprise sales cycles, particularly among large insurers. If Tier 1 pipeline witnesses a slowdown, especially in key regions like North America and Europe, it would stall overall momentum given their contribution to ARR growth.

Further, higher costs remain a concern for Guidewire, especially amid prevailing weakness in global macroeconomic conditions. Ongoing investments include capacity expansion, AI initiatives, and higher subcontractor utilization.

In the fiscal first quarter, total operating expenses increased 17.1% year over year to $191 million. Increasing costs can put downward pressure on the company’s profitability, especially if the revenue performance weakens.

Guidewire’s increasing global footprint, with new customers primarily coming from diverse markets, such as Japan, Brazil, Belgium and other international regions, presents foreign exchange as well as integration risks. Strengthening the U.S. dollar could further exacerbate these challenges. Also, these initiatives involve execution risk, especially in regions with different regulatory requirements. If integration delays arise, these could weigh on operating margins or delay expected revenue contributions.

GWRE stock is also not so cheap, as its Value Style Score of F indicates a stretched valuation at this moment. The stock is trading at a premium with a forward 12-month price/sales of 8.92X compared with the industry’s 4.46X.

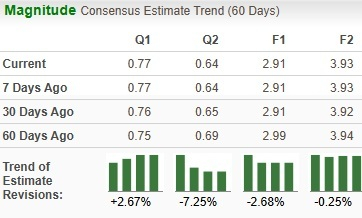

In the past 60 days, analysts have marginally revised estimates downwards for the current year.

With a Zacks Rank #3 (Hold), GWRE appears to be treading in the middle of the road, and new investors could be better off if they trade with caution. The stock is also trading at a premium valuation. New investors could wait for a better entry point to capitalize on its long-term fundamentals, while investors owning the stock can stay put.

Some better-ranked stocks worth consideration with the same industry space are Arista Networks ANET, Zoom Communications ZM and F5, Inc. FFIV. While ZM sports a Zacks Rank #1 (Strong Buy), ANET and FFIV carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANET’s 2025 earnings is pegged at $2.88 per share. ANET’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 10.2%. Its shares have gained 6.9% in the past year.

The Zacks Consensus Estimate for Zoom Communication’s fiscal 2026 EPS is pegged at $5.96, unchanged in the past 30 days. ZM’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 8.9%. Its shares have surged 3.1% in the past year.

The Zacks Consensus Estimate for FFIV’s fiscal 2026 EPS is pegged at $15.14, improved by 15 cents in the past seven days. FFIV’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 13.58%. Its shares have gained 0.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 6 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite