|

|

|

|

|||||

|

|

DICK’S Sporting Goods, Inc. DKS delivered another solid performance in the third quarter of fiscal 2025. The company posted comparable sales (comps) growth of 5.7% for the DICK’S business in the fiscal third quarter and continues to operate from a position of strength, resulting in a two-year stacked comps of roughly 10%. Momentum remains healthy as the team executes against core priorities, including delivering a differentiated, on-trend product assortment and providing an industry-leading omnichannel athlete experience.

Third-quarter fiscal 2025 comps growth marked the seventh consecutive quarter of reporting comps above 4%, highlighting the consistency of execution and the effectiveness of the company’s long-term strategy. Management emphasized that this sustained performance reflects the appeal of its differentiated assortment, including newness from strategic partners, emerging brands, and vertically integrated brands that continue to resonate with both consumers and athletes.

Based on this strength, the company raised its fiscal 2025 guidance for comps growth for the DICK’S business between 3.5% and 4%. On the last earnings call, management raised its earnings per share view in the range of $14.25-$14.55, citing sustained momentum across product, stores and digital channels. The company’s operating margin is projected to be approximately 11.1% at the midpoint.

Strategic investments underpin the raised forecast. The company is accelerating its store transformation with the rapid expansion of House of Sport and Field House formats, which management described as delivering strong financial returns and deeper athlete engagement. E-commerce remains another durable growth lever, with the digital business growing faster than the overall company, supported by app innovation, personalization and data-driven capabilities like GameChanger and the DICK’S Media Network.

However, the outlook is not without near-term headwinds. The newly acquired Foot Locker business is expected to weigh on consolidated results as DICK’S aggressively clears underperforming inventory and closes weaker assets, pressuring margins in the fiscal fourth quarter. Importantly, management emphasized that the raised 2025 guidance excludes Foot Locker and reflects confidence in the standalone DICK’S model. Taken together, the guidance increase appears rooted in repeatable fundamentals—store productivity, product relevance and digital scale—rather than a short-lived demand spike, even as broader integration risks remain.

DICKS’s shares have lost 5.5% in the past three months against the industry’s growth of 7.2%. DKS presently carries a Zacks Rank #3 (Hold).

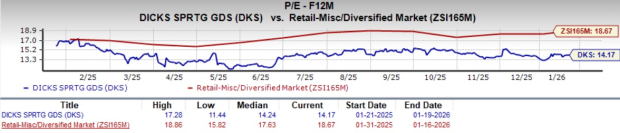

From a valuation standpoint, DKS trades at a forward price-to-earnings ratio of 14.17X, lower than the industry’s average of 18.67X.

The Zacks Consensus Estimate for DKS’s fiscal 2025 EPS implies a year-over-year decline of 6.6%. The estimate for fiscal 2026 EPS indicates year-over-year growth of 16.3%.

Some better-ranked stocks have been discussed below:

Five Below, Inc. FIVE operates as a specialty value retailer in the United States. Five Below currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FIVE’s current fiscal-year sales and earnings implies growth of 22.3% and 23.4%, respectively, from the year-ago figures. FIVE delivered a trailing four-quarter earnings surprise of 62.1%, on average.

Ulta Beauty, Inc. ULTA operates as a specialty beauty retailer in the United States, Mexico, and Kuwait. Ulta Beauty flaunts a Zacks Rank of 1.

The Zacks Consensus Estimate for ULTA’s current fiscal-year sales and earnings implies growth of 8.8% and 0.7%, respectively, from the year-ago figures. ULTA delivered a trailing four-quarter earnings surprise of 15.7%, on average.

Victoria’s Secret & Co. VSCO operates as a specialty retailer of women's intimate apparel and other apparel and beauty products worldwide. VSCO currently sports a Zacks Rank of 1.

The Zacks Consensus Estimate for Victoria's Secret’s current fiscal-year sales indicates growth of 4.7%, and the same for earnings suggests a decline of 1.5% from the year-ago figures. VSCO delivered a trailing four-quarter earnings surprise of 55.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 15 hours | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite