|

|

|

|

|||||

|

|

Artificial intelligence has moved from experimentation to execution across defense and national security, reshaping how governments process data, plan missions and manage complex operations. Against this backdrop, BigBear.ai BBAI and Palantir Technologies PLTR stand out as two AI-driven companies deeply embedded in defense and intelligence workflows. Both focus on mission-critical use cases where security, reliability and explainability matter as much as model performance, making them natural comparables for investors seeking exposure to defense AI.

The comparison is especially timely. Defense budgets are tilting toward software-defined capabilities, generative AI and data-centric platforms, while sovereign AI initiatives are accelerating globally. At the same time, market sentiment has diverged sharply between the two stocks, reflecting differences in scale, profitability and perceived execution risk.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one has more upside potential.

BigBear.ai is positioning itself as a pure-play defense and national security AI provider, blending decision intelligence, predictive analytics and, increasingly, secure generative AI. Management has emphasized that adoption of AI across defense and intelligence agencies remains in its early innings, creating a long runway for specialized vendors that understand classified environments and procurement complexity. A major strategic step was the acquisition of Ask Sage, a secure, cloud- and model-agnostic generative AI platform already deployed across thousands of government teams. Management expects this acquisition to materially strengthen BigBear.ai’s position in agentic AI for highly regulated defense use cases and accelerate growth once integrated.

From a strategic standpoint, BigBear.ai’s strength lies in its focus. The company is tightly aligned with national security missions, border security, logistics and defense operations, areas where switching costs are high and vendor trust is critical. Its backlog of government contracts provides visibility, and management has highlighted improving balance-sheet flexibility following recent capital actions, giving it room to invest in growth and selective M&A.

That said, BigBear.ai’s challenges are equally clear. Revenue remains lumpy due to the timing of government programs, as seen in recent quarters impacted by program delays and funding dynamics. Margins have been pressured by mix and integration costs, and profitability is still a work in progress. While losses are expected to narrow meaningfully by 2026, the investment case depends on the successful execution of the Ask Sage integration and a rebound in defense program activity. For investors, BigBear.ai represents a higher-risk, higher-reward proposition tied closely to defense AI adoption and contract conversion.

Palantir has evolved into a scaled, profitable leader in enterprise and government AI platforms, with its Artificial Intelligence Platform (AIP) emerging as a central growth driver. The company delivered a standout third-quarter 2025, posting strong revenue growth, expanding margins and robust free cash flow, while highlighting accelerating demand across both U.S. government and commercial customers. Management has repeatedly stressed that Palantir’s differentiation lies in operationalizing AI at scale, integrating models with workflows, data and decision-making systems rather than offering standalone tools.

In defense and national security, Palantir’s position appears deeply entrenched. Recent contract renewals with European intelligence agencies, expanded U.S. defense programs and large-scale initiatives such as the U.S. Navy’s ShipOS underscore its role as a long-term software partner rather than a project-based vendor. Beyond defense, sovereign AI initiatives across Europe and EMEA further broaden Palantir’s addressable market and reinforce its strategic relevance in geopolitically sensitive deployments.

The primary challenge for Palantir is valuation. The market is already pricing in sustained hyper-growth, strong margins and continued execution across multiple sectors. Any deceleration in growth, increased competition or shifts in government spending priorities could pressure the stock. Still, Palantir’s consistent profitability, expanding commercial traction and cash-rich balance sheet significantly reduce execution risk compared with smaller peers.

Over the past six months, BigBear.ai shares have plunged 19.4%, sharply underperforming both Palantir and the broader market. In contrast, Palantir stock has risen 13.1% during the same period, roughly in line with the S&P 500’s 12.8% gain, though still trailing the Zacks Computer and Technology sector’s 16.8% advance. This divergence reflects investor preference for scale, profitability and visibility amid a selective AI market, rather than skepticism about defense AI as a theme.

BBAI & PLTR Stocks 6-Month Performance

Valuation highlights the stark contrast between the two stocks. On a forward 12-month price-to-sales basis, BigBear.ai trades at about 15X sales, while Palantir commands a much richer multiple of roughly 63.1X. BigBear.ai’s lower multiple reflects execution risk and ongoing losses, but also offers optionality if growth accelerates as expected. Palantir’s premium valuation embeds confidence in sustained growth, margin expansion and long-term dominance in enterprise and defense AI platforms.

BBAI & PLTR Valuation

Earnings estimate trends reinforce these dynamics. Over the past 60 days, the Zacks Consensus Estimate for BigBear.ai’s 2026 loss per share has remained unchanged at 25 cents, representing a substantial improvement from the prior year’s expected loss, alongside projected revenue growth of 30.2%.

For BBAI Stock

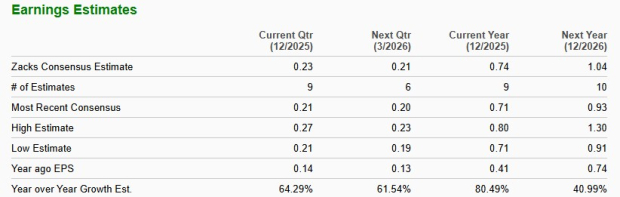

For Palantir, the Zacks Consensus Estimate for 2026 EPS estimates has also remained stable at $1.04, implying 41% year-over-year growth, with revenues expected to rise 41.1%. Stability in both cases suggests that analysts see limited near-term downside, but Palantir’s estimates point to far stronger operating leverage.

For PLTR Stock

Both BigBear.ai and Palantir are credible ways to gain exposure to defense AI, and the fact that both carry a Zacks Rank #3 (Hold) underscores that neither is an obvious near-term winner on ratings alone. However, when weighing fundamentals, Palantir holds the clearer edge today. Its scale, profitability, diversified growth engines and deepening defense and sovereign AI footprint provide a more balanced risk-reward profile, even at a premium valuation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BigBear.ai, by contrast, offers asymmetric upside tied to the successful integration of Ask Sage and a rebound in defense spending cycles, but it comes with higher execution and volatility risk. For investors prioritizing stability, cash generation and proven AI monetization, Palantir appears to offer the stronger upside potential at this stage. More risk-tolerant investors with a long-term horizon may still find BigBear.ai compelling, but it remains a story that requires patience and flawless execution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 min | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite