|

|

|

|

|||||

|

|

The global drone industry has reached a pivotal growth phase driven by broad adoption across commercial, government and military sectors. According to a report from Grand View Research, the global drone tech market is expected to witness a CAGR of 14.3% from 2025 to 2030. The convergence of drones with artificial intelligence (“AI”), cloud computing and edge processing is further driving adoption across verticals.

Both Ondas Holdings ONDS and Red Cat Holdings, Inc. RCAT are players in this domain, but operate from very different positions of scale and maturity. These companies bring to the table unique strengths, which make this an intriguing comparison for investors.

So, now the question arises: which stock makes a better investment pick at present? Let us dive into the fundamentals, valuations, growth outlook and risks for each company.

ONDS’ Ondas Autonomous Systems (“OAS”) business is transitioning into a high-visibility growth engine, benefiting from increased deployments of Iron Drone Raider and Optimus autonomous platforms, along with initial revenue contributions from recently acquired businesses such as Apeiro Motion. At its Investor Day 2026, ONDS announced that it successfully launched and executed its core plus strategic growth plan and OAS is evolving from a collection of specialized autonomous drone systems into a multi-domain global autonomy platform.

Management stated that it expects strong results in the counter–unmanned aerial systems (“C-UAS”) segment, led by the Iron Drone and Sentrycs platforms. Momentum is also building across its ground robotics offerings, particularly within the Unmanned Ground Vehicle (“UGV”) portfolios from Roboteam and Apeiro. Additionally, acquisitions like 4M Smart are expected to expand the footprint as demining activity accelerates.

ONDS also announced preliminary financial results for 2025 and provided updated revenue targets for 2026. Fourth-quarter 2025 revenues are now expected to be between $27 million and $29 million, representing a 51% increase over its prior target. As of Dec. 31, 2025, backlog (preliminary estimates) was $65.3 million, up 180% from $23.3 million reported on Nov. 13. ONDS’ pro forma cash balance exceeded $1.5 billion, adjusted for its recently completed equity offering of approximately $1 billion, providing substantial financial flexibility for both organic and inorganic expansion.

For 2026, Ondas has raised its revenue outlook to a range of $170-$180 million, representing a 25% increase over the previous target of $140 million, which included an estimated $30 million contribution from Roboteam. This upward revision underscores improved backlog and revenue visibility.

However, this outlook assumes only a “modest contribution” from Ondas Networks. Heavy reliance on OAS for revenue growth in the increasingly crowded drone space is a concern. For ONDS, if a single large customer delays, reduces or cancels, revenues would decline materially. ONDS is in the middle of a massive transition and already incurring sizable expenses. The company is investing heavily in infrastructure building and team expansion. These moves strengthen long-term competitive moat, but amplify short-term financial pressure. So many acquisitions in such a short period of time can create integration overload risk.

Red Cat Holdings specializes in robotic hardware-software integration for applications for both military and commercial uses. Teal Drones and FlightWave Aerospace are two of its wholly-owned affiliates. The company is also broadening its reach into the maritime sector through Blue Ops, Inc., where it is developing uncrewed surface vessels (USVs). Its portfolio also includes Black Widow (small, unmanned aircraft systems), TRICHON (a hybrid VTOL) and FANG, an NDAA-compliant FPV drone.

RCAT recently reported preliminary results for the fourth quarter and full year ended Dec. 31, 2025. Fourth-quarter 2025 revenues are expected to be between $24 million and $26.5 million, significantly up from $1.3 million reported in the prior-year period, while 2025 revenues are projected to be between $38 million and $41 million, up about 153% from $15.6 million posted in 2024. The upward revision is driven by strong execution across the board.

RCAT is witnessing solid demand from defense and government clients and expanding program wins. The company is also sharpening its ability to rapidly scale production to meet mission-critical requirements. On the last earnings call, management emphasized “factories are the moat,” with expanded facilities in Salt Lake City, UT, and Los Angeles, and a newly opened 155,000-square-foot plant in Georgia (large-scale USVs manufacturing). The Georgia facility can churn out more than 500 to 1,000 vessels per year and has a sales showroom and lab in Southeast Florida and a prototype partner in Maine, added RCAT.

The inclusion of the FANG FPV drone on the Blue UAS cleared list, NATO NSPA catalog approval for the Black Widow system, and integration of Palantir’s Visual Navigation software for Black Widow in GPS-contested environments materially expand Red Cat’s addressable market. The company has also collaborated with AeroVironment, enabling the deployment of FANG from the P550 UAS, whereas Edge Autonomy is deploying the Black Widow on its long-range platform.

However, RCAT’s operating costs are expanding rapidly. It reported total operating expenses of more than $18.2 million in the third quarter of 2025, leading to an operating loss of $17.5 million, highlighting that the business remains loss-making despite topline acceleration. Significant capex spend is a concern as the Blue Ops division alone requires $20-$25 million of incremental investment, in addition to facility expansions, as well as investments in technologies like farming battery tech, AI and communications.

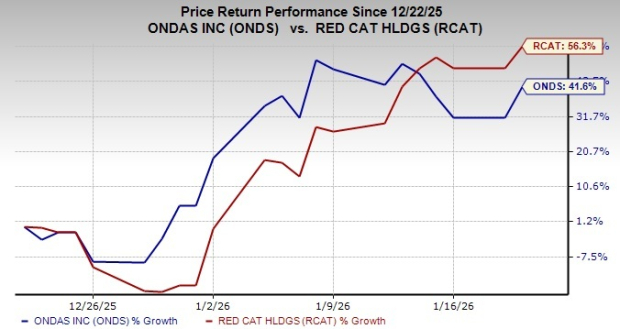

Over the past one month, ONDS and RCAT have registered gains of 41.6% and 56.3%, respectively.

In terms of the forward 12-month price/sales ratio, ONDS is trading at 33.37X, higher than RCAT’s 9.92X.

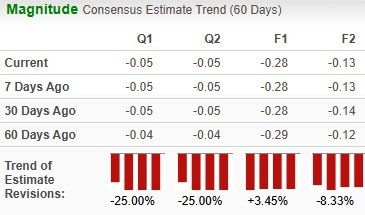

Analysts have revised earnings estimates by 3.5% for ONDS for the current fiscal year in the past 60 days.

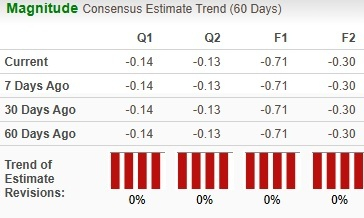

Estimates have remained unchanged for RCAT’s bottom line over the same time frame.

Both ONDS and RCAT carry a Zacks Rank #3 (Hold).

While both companies are well-positioned to benefit from the lucrative global drone market, Ondas emerges as the better pick at present due to its significantly larger scale, higher revenue visibility and materially stronger balance sheet (compared with RCAT’s $212.5 million in cash and receivables at the end of the third quarter 2025).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-07 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite