|

|

|

|

|||||

|

|

Freeport-McMoRan Inc. FCX and BHP Group Limited BHP are two heavyweights in the copper mining industry. Both are navigating fluctuating copper prices and global economic and trade uncertainties. Given the uncertainties surrounding trade tensions and their potential impact on copper prices, analyzing the fundamentals of these companies is timely and pertinent.

Prices of copper, the backbone of electrification, have been volatile yet mostly favorable in 2025 due to global economic and trade uncertainties. Copper prices have gained momentum this year, underpinned by robust demand from China and the United States. Structural tailwinds, including electric vehicles (EVs), renewable energy projects, data-center growth and grid modernization, continue to boost copper consumption. Meanwhile, worries about tightening supply amid rising EV and infrastructure demand are lifting the red metal. Supply risks have also grown amid worries over lower output and potential disruptions at major global mining operations. Prices of the red metal are currently hovering near $6 per pound.

Let’s dive deep and closely compare the fundamentals of these two copper miners to determine which one is a better investment option now.

Freeport is well-placed with high-quality copper assets and remains focused on strong execution and advancing its organic growth opportunities. At its Cerro Verde operation in Peru, a large-scale concentrator expansion provided incremental annual production of around 600 million pounds of copper and 15 million pounds of molybdenum. It has completed the evaluation of a large-scale expansion at El Abra in Chile to define a large sulfide resource that could potentially support a major mill project similar to the large-scale concentrator at Cerro Verde, with an estimated resource of approximately 20 billion recoverable pounds of copper.

FCX is also conducting pre-feasibility studies (expected to be completed in 2026) in the Safford/Lone Star operations in Arizona to define a significant sulfide expansion opportunity. It also has expansion opportunities at Bagdad in Arizona to more than double the concentrator capacity of the operation.

Also, PT Freeport Indonesia (PT-FI) substantially completed the construction of the new greenfield smelter in Eastern Java during 2024, with the start-up of operations having commenced in the second quarter of 2025. The first production of copper anode was achieved in July 2025. PT-FI is also developing the Kucing Liar ore body within the Grasberg district with a targeted ramp-up to commence before 2030. Gold production also started at the new precious metals refinery in late 2024. Plans are in place to transition PT-FI’s existing energy source from coal to natural gas, which is expected to significantly reduce greenhouse gas emissions at Grasberg.

FCX has a strong liquidity position and generates substantial cash flows, which allow it to finance its growth projects, pay down debt and drive shareholder value. It generated operating cash flows of around $1.7 billion in the third quarter of 2025. Freeport ended the third quarter with strong liquidity, including $4.3 billion in cash and cash equivalents, $3 billion in availability under the FCX revolving credit facility, and $1.5 billion in availability under the PT-FI credit facility.

At the end of the third quarter, Freeport had a net debt of $1.7 billion, excluding PTFI’s new downstream processing facilities. Its net debt is below its targeted range of $3-$4 billion. Freeport has a policy of distributing 50% of the available cash to shareholders and the balance to either reduce debt or invest in growth projects. FCX has no significant debt maturities until 2027.

FCX offers a dividend yield of roughly 0.5% at the current stock price. Its payout ratio is 19% (a ratio below 60% is a good indicator that the dividend will be sustainable). Backed by strong financial health, the company's dividend is perceived to be safe and reliable.

Despite these positives, weak copper volumes and higher costs may hurt FCX’s performance. Freeport’s outlook for copper sales volumes in the fourth quarter assumes minimal contribution from its Indonesian operations due to the Grasberg mine incident. FCX expects copper sales volumes of 635 million pounds, indicating a 35% sequential and a 36% year-over-year decline. The company has also issued weaker guidance for gold sales volume of 60,000 ounces, suggesting significant sequential and year-over-year decreases. Lower sales volumes are expected to weigh on its top line in the fourth quarter.

Freeport's outlook for the fourth quarter suggests significantly higher costs on a sequential basis. It expects unit net cash costs to rise to $2.47 per pound, up from $1.40 per pound in the prior quarter. Lower expected sales volumes are likely to impact costs in the quarter. Higher costs are likely to weigh on the company's margins.

BHP continues to reshape its portfolio toward commodities such as copper and potash, allocating nearly 70% of its medium-term capital expenditure to these areas. This strategy positions the company to benefit from decarbonization, electrification, population growth and rising living standards in emerging markets. It is also making operations more efficient on the back of smart technology adoption across the entire value chain.

Copper production reached a record 2,017 kt in fiscal 2025, the first time BHP crossed the 2,000-kt milestone. Output has risen 28% over the past three years, reflecting sustained investment.

In the first half of fiscal 2026, copper production remained constant year over year at 984 kt. Escondida, the company’s flagship copper operation, logged record concentrator throughput and improved recoveries during the period.

Factoring in a favorable copper pricing environment and strong delivery across its assets, BHP increased its fiscal 2026 copper output guidance to between 1,900 and 2,000 kt from its prior stated 1,800-2,000 kt. Production guidance for the fiscal year has been raised for Escondida and Antamina. BHP is advancing its copper growth initiatives and expects its significant copper projects to deliver roughly 2 Mtpa of attributable copper production in the 2030s.

In fiscal 2025, BHP’s net operating cash flow was $18.7 billion, which was down 10% year over year due to lower prices, offset by record copper output. Despite this dip, BHP Group has delivered a net operating cash flow of more than $15 billion from fiscal 2010 to fiscal 2025 (barring fiscal 2016). Strong cash flows have enabled BHP to materially reduce debt, with net debt at $12.9 billion at fiscal 2025-end, within its target of $10-$20 billion.

Total cash returns to shareholders announced for fiscal 2025 were $5.6 billion. Over the past five years, BHP has delivered more than $50 billion in cash dividends to its shareholders. BHP also offers a dividend yield of roughly 3.7% at the current stock price. It has a five-year annualized dividend growth rate of -22.3%.

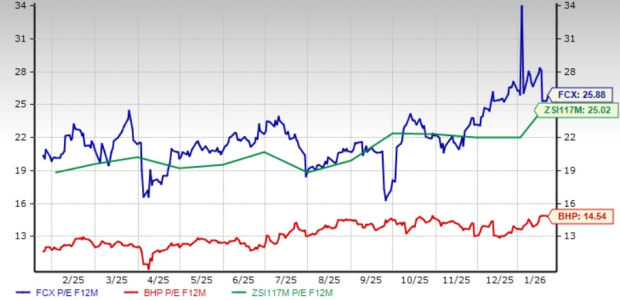

The FCX stock is up 49.3% over the past year, while BHP has gained 28.5% compared with the Zacks Mining - Non Ferrous industry’s rise of 62.4%.

FCX is currently trading at a forward 12-month earnings multiple of 25.88. This represents a roughly 3.4% premium when stacked up with the industry average of 25.02X.

BHP is currently trading at a forward 12-month earnings multiple of 14.54X, below FCX and the industry.

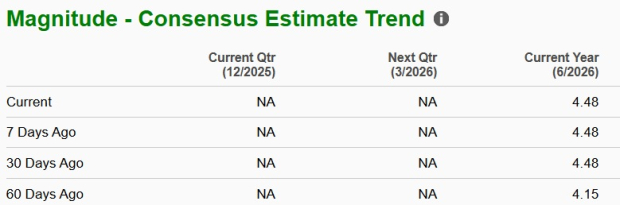

The Zacks Consensus Estimate for FCX’s 2025 sales and EPS implies a year-over-year decline of 0.7% and a rise of 4.7%, respectively. The EPS estimates for 2025 have been trending higher over the past 60 days.

The consensus estimate for BHP’s current fiscal year sales implies a year-over-year decline of 5.4%. The same for EPS suggests a 23.1% year-over-year increase. The EPS estimates for the current fiscal year have been trending northward over the past 60 days.

Both Freeport and BHP present compelling investment cases. FCX is poised to gain from progress in expansion activities that will boost production capacity. Robust financial health allows FCX to invest in growth projects and drive shareholder value. Strong cash generation, investment in growth projects and higher operational efficacy, aided by the adoption of technology, bode well for BHP Group. FCX, however, faces margin pressure as unit cash costs rise and copper volumes drop after the Grasberg mine incident.

BHP’s higher earnings growth projections, more attractive valuation and higher dividend yield suggest that it may offer better investment prospects in the current market environment. Investors seeking exposure to the copper mining space might consider BHP to be the more favorable option at this time.

FCX currently carries a Zacks Rank #3 (Hold), whereas BHP sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 11 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite