|

|

|

|

|||||

|

|

Becton, Dickinson and CompanyBDX, popularly known as BD, recently announced that the FDA has granted 510(k) clearance for its EnCor EnCompass Breast Biopsy and Tissue Removal System. Anticipated to launch in early 2026, the advanced, multi-modality system is designed to give clinicians greater flexibility across various breast imaging techniques when diagnosing breast disease.

Per management, the FDA clearance of the EnCor EnCompass Biopsy System highlights BD’s commitment to meeting the changing needs of clinicians and patients in breast health. The multi-modality platform is designed to deliver versatility and precision with features that enhance clinician confidence while improving the overall patient experience.

This advancement supports early detection and diagnosis of breast disease and underscores BD’s long-term focus on transforming care through innovation. The company is dedicated to collaborating with clinical leaders to deliver patient-focused solutions and develop technologies that build confidence in patient care.

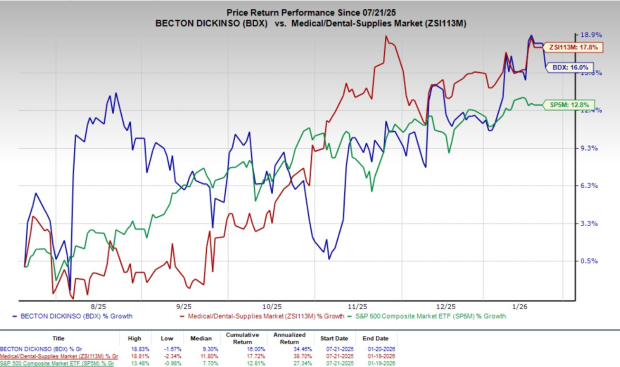

Shares of BDX have lost 2.4% since the announcement on Thursday. Over the past six months, shares of the company have climbed 16% compared with the industry’s 17.8% growth and the S&P 500’s 12.8% rise.

In the long run, expanding BD’s breast health offerings with the advanced EnCor EnCompass Biopsy System strengthens its leadership in women’s health diagnostics. The multi-modality capability of this platform, combined with BD’s broad commercial reach, supports sustained growth as clinicians adopt new technologies that improve workflow efficiency and clinical outcomes. With a planned market entry in early 2026, the system may drive future revenue growth, expand customer adoption and deepen relationships with healthcare providers, while supporting BD’s long-term strategy of advancing early detection technologies and patient-centered care.

BDX currently has a market capitalization of $59.01 billion.

The EnCor EnCompass Biopsy System is engineered to simplify breast biopsy procedures by allowing clinicians to work across multiple breast imaging modalities with a single, integrated platform. The system combines advanced functionality with a user-centered design to enhance workflow efficiency.

Key features of the system include multi-modality use, and adjustable high and low vacuum strengths, along with a variable sample notch during the procedure for better control. It has a 360-degree sampling capability to access lesions throughout the breast and enhanced visualization tools such as an echogenic cutting cannula and illuminated sample container, which enhance visibility during the procedure. In addition, the system offers a choice of 12G, 10G and 7G probes, enabling clinicians to select the most suitable option based on lesion type and location.

Dr. Shadi Aminololama-Shakeri, M.D., Chief of Breast Radiology at UC Davis, along with BD, aims to deliver the highest quality patient care while ensuring efficiency, precision and safety. The system brings multi-modality functionality and greater control into a single platform, enabling customization during procedures and helping to simplify the biopsy workflow. This physician’s perspective reinforces BD’s value proposition of delivering devices that improve both procedural efficiency and patient experience.

Going by data provided by Precedence Research, the global breast biopsy devices market is valued at $1.13 billion in 2025 and is expected to witness a CAGR of 4.2% through 2034. Factors likethe increasing incidence of breast cancer and the global increase in women's susceptibility to mammary cancer, together with screenings and awareness campaigns, are driving the market’s growth.

BD recently announced a partnership with the Institute for Immunology and Immune Health (I3H) at the University of Pennsylvania to develop a high-parameter flow cytometry panel — the BD FACSDiscover A8 Cell Analyzer — to improve understanding of the human immune system and support the development of immune-mediated treatments.

Further on the news, BD announced the expansion of its respiratory and sexually transmitted infection diagnostics portfolio in Europe, designed by Certest Biotec to deliver fast and reliable results using a fully automated system.

Becton, Dickinson and Company price | Becton, Dickinson and Company Quote

Currently, BDX carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Veracyte VCYT, Cardinal Health CAH and The Cooper CompaniesCOO.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rankstocks here.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.6% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

Cardinal Health, currently carrying a Zacks Rank #2 (Buy), reported a first-quarter fiscal 2026 adjusted EPS of $2.55, which surpassed the Zacks Consensus Estimate by 15.4%. Revenues of $64.0 billion beat the Zacks Consensus Estimate by 8.4%.

CAH has an estimated long-term earnings growth rate of 14.7% compared with the industry’s 9.5% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 9.4%.

The Cooper Companies, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of $1.15, which surpassed the Zacks Consensus Estimate by 3.6%. Revenues of $1.06 billion beat the Zacks Consensus Estimate by 0.5%.

COO has an estimated long-term earnings growth rate of 7.8% compared with the industry’s 9.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 2.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite