|

|

|

|

|||||

|

|

Agnico Eagle Mines Limited AEM and Kinross Gold Corporation KGC are two prominent players in the gold mining space with global operations. Gold prices have skyrocketed to unprecedented levels, driven by global economic uncertainties, trade and geopolitical tensions. Against this backdrop, comparing these two major gold producers is particularly relevant for investors seeking exposure to the precious metals sector.

Gold prices surged to record highs last year as global trade tensions lifted demand for safe-haven assets. Bullion repeatedly set new peaks, fueled by heightened geopolitical risks, a weaker U.S. dollar, strong central-bank buying and interest-rate cuts by the Federal Reserve, alongside expectations of further easing amid signs of economic and labor-market softness in the United States.

Heightened geopolitical tensions, including the U.S.-Venezuela conflict, the deadly unrest in Iran with the possibility of U.S. intervention, along with concerns over the Greenland tariff threats, have driven bullion to record levels recently. Gold prices zoomed to fresh highs near $4,900 per ounce yesterday on worries over a fierce U.S.-EU trade war and mounting tensions over Greenland, boosting safe-haven demand, further supported by a weaker U.S. dollar.

Let’s dive deep and closely compare the fundamentals of these two Canada-based gold miners to determine which one is a better investment now.

Agnico Eagle is focused on executing projects that are expected to provide additional growth in production and cash flows. It is advancing its key value drivers and pipeline projects, including the Odyssey project in the Canadian Malartic Complex, Detour Lake, Hope Bay, Upper Beaver and San Nicolas.

The Hope Bay Project, with proven and probable mineral reserves of 3.4 million ounces, is expected to play a significant role in generating cash flow in the years to come. The processing plant expansion at Meliadine was completed and commissioned in the second half of 2024, with mill capacity expected to increase to roughly 6,250 tons per day. At Canadian Malartic, Agnico Eagle is advancing the transition to underground mining with the construction of the Odyssey mine and executing other opportunities to beef up annual production. During the third quarter of 2025, AEM continued exploration drilling to extend the East Gouldie deposit at Canadian Malartic to the east.

At Hope Bay, drilling results at Patch 7 also suggest the potential for mineral resource expansion. Moreover, drilling at the Marban deposit, added through the acquisition of O3 Mining, focuses on mineral reserve and mineral resource expansion. AEM also continued to work on a feasibility study at San Nicolas. At Detour Lake, AEM started the development of the exploration ramp during the second quarter, and it advanced further in the third quarter.

The merger with Kirkland Lake Gold established Agnico Eagle as the industry's highest-quality senior gold producer. The integrated entity now has an extensive pipeline of development and exploration projects to drive sustainable growth. It also has the financial flexibility to fund a strong pipeline of growth projects.

AEM has a robust liquidity position and generates substantial cash flows, which enable it to maintain a strong exploration budget, finance a strong pipeline of growth projects, pay down debt and drive shareholder value. Its operating cash flow was roughly $1.8 billion in the third quarter, up around 67% from the year-ago quarter.

AEM recorded third-quarter free cash flow of roughly $1.2 billion, nearly doubling the prior-year figure of $620 million. The increase was backed by the strength in gold prices and robust operational results. The company remains focused on paying down debt using excess cash, with total long-term debt reducing by roughly $400 million sequentially to $196 million at the end of the third quarter. It ended the quarter with a significant net cash position of nearly $2.2 billion, driven by the increase in cash position and reduction in debt. AEM also returned around $350 million to its shareholders in the third quarter.

AEM offers a dividend yield of 0.8% at the current stock price. It has a five-year annualized dividend growth rate of 2.6%. AEM has a payout ratio of 23% (a ratio below 60% is a good indicator that the dividend will be sustainable).

Kinross has a strong production profile and boasts a promising pipeline of exploration and development projects. Its key development projects and exploration programs remain on track. These projects are expected to boost production and cash flow and deliver significant value. The successful execution of these projects will position the company for a new wave of low-cost, long-life production.

KGC recently said that it is progressing with the construction of three organic growth projects to expand its United States portfolio. This is aimed at extending mine life and cost optimization. The projects are Round Mountain Phase X and Bald Mountain Redbird 2 in Nevada, and the Kettle River–Curlew project in Washington.

Together, these projects are expected to contribute significantly to Kinross’ U.S. production profile and add a strong value proposition with a combined Internal Rate of Return (IRR) of 55% and a combined incremental post-tax Net Present Value (NPV) of $4.1 billion. These projects are expected to contribute 3 million ounces of life-of-mine production to KGC’s portfolio, adding grades and mine lives. Kinross Gold is planning to self-fund three growth projects entirely from operating cash flows, reflecting its disciplined strategy.

Tasiast and Paracatu, the company’s two biggest assets, remain the key contributors to cash flow generation and production. Tasiast remains the lowest-cost asset within its portfolio, with a consistently strong performance. Paracatu continues to deliver a strong performance, with third-quarter production rising year over year on higher grades. KGC also completed the commissioning of its Manh Choh project and commenced production during the third quarter of 2024, leading to a substantial increase in cash flow at the Fort Knox operation.

KGC has a strong liquidity position and generates substantial cash flows, which allows it to finance its development projects, pay down debt and drive shareholder value. Kinross reactivated its share buyback program in April 2025. It completed a $600 million share repurchase program as of Dec. 31, 2025. It returned more than $750 million to its shareholders through dividends and buybacks in 2025, ending the year with about $1 billion in net cash.

In 2025, the company repaid $700 million of debt. With $1.6 billion in available credit (as of Sept. 30, 2025) and no debt maturities until 2033, Kinross is positioned to support growth while strengthening its balance sheet and delivering shareholder value. KGC offers a dividend yield of 0.4% at the current stock price. It has a payout ratio of 9%.

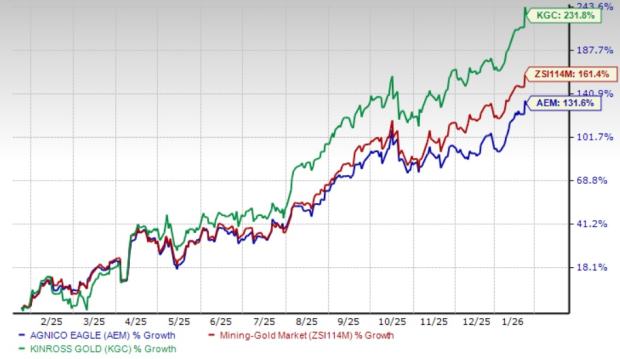

AEM stock has jumped 131.6% in the past year, while KGC stock has rallied 231.8% compared with the Zacks Mining – Gold industry’s increase of 161.4%.

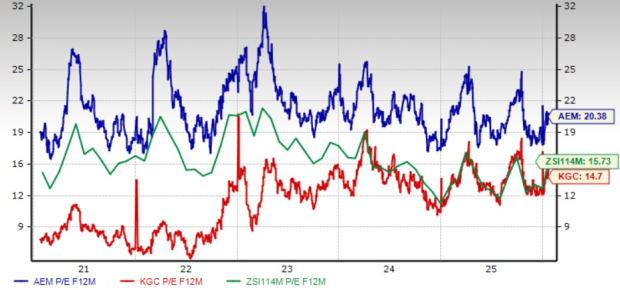

AEM is currently trading at a forward 12-month earnings multiple of 20.38, which represents a roughly 29.6% premium when stacked up with the industry average of 15.73X.

Kinross looks more attractively priced than Agnico Eagle. KGC stock is currently trading at a forward 12-month earnings multiple of 14.7, below the industry.

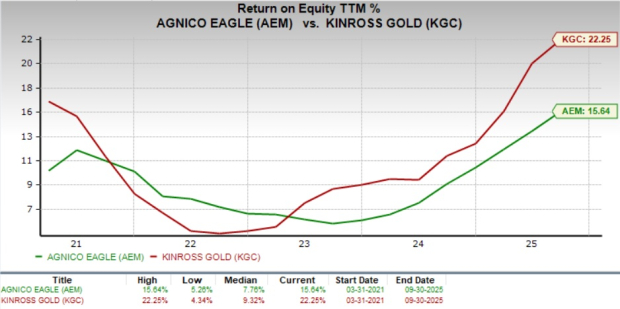

KGC’s return on equity (ROE) of 22.3% is higher than AEM’s 15.6%. This reflects Kinross’ efficient use of shareholder funds in generating profits.

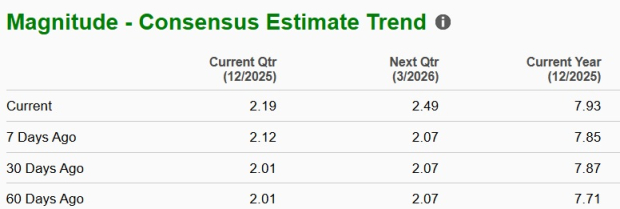

The Zacks Consensus Estimate for AEM’s 2025 sales and EPS implies a year-over-year rise of 38.6% and 87.5%, respectively. The EPS estimates for 2025 have been trending higher over the past 60 days.

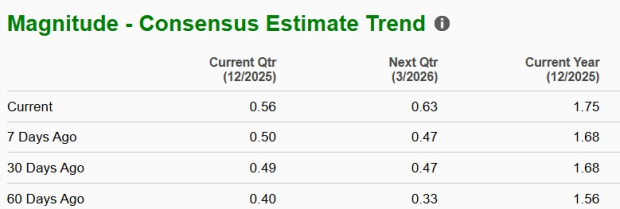

The consensus estimate for KGC’s 2025 sales and EPS indicates year-over-year growth of 34.5% and 157.4%, respectively. The EPS estimates for 2025 have been trending northward over the past 60 days.

Both AEM and KGC currently sport a Zacks Rank #1 (Strong Buy), so picking one stock is not easy. You can see the complete list of today’s Zacks #1 Rank stocks here.

Both AEM and KGC are well-positioned to benefit from the current favorable gold price environment, each demonstrating strong financial performance and commitment to shareholder returns. However, Kinross appears to have an edge over Agnico Eagle due to its more attractive valuation. KGC’s higher ROE also indicates that it is more effectively utilizing shareholder funds. In addition, KGC’s higher earnings growth projections suggest that it may offer better investment prospects in the current market environment. Investors seeking exposure to the gold space might consider Kinross as the more favorable option at this time.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 10 hours | |

| 11 hours | |

| 13 hours | |

| 16 hours | |

| 17 hours | |

| 21 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Mining Stocks Face Big Expectations Ahead Of Earnings, As Gold And Silver Sink

KGC

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite