|

|

|

|

|||||

|

|

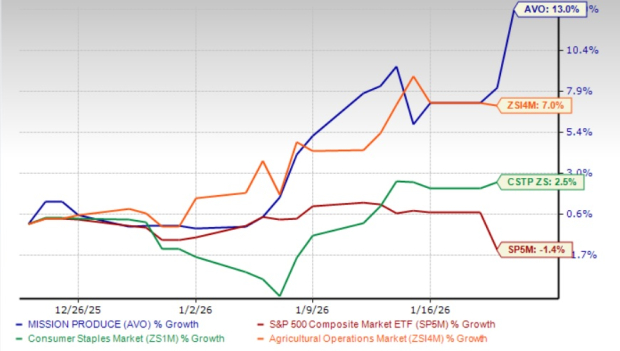

Mission Produce, Inc. AVO has regained momentum in the past month, climbing 13% as investor sentiment improved following the company’s solid fourth-quarter fiscal 2025 performance. The rally has propelled AVO ahead of its peers, with the stock comfortably outperforming the Zacks Agriculture – Operations industry’s 7% rise and the broader Consumer Staples sector’s 2.5% return over the same period. Notably, AVO bucked the broader market trend, delivering gains even as the S&P 500 declined 1.4%, underscoring growing investor confidence in the company’s operating execution and near-term outlook.

AVO’s recent rally also stands out relative to its closest peers. Over the past month, the stock has delivered stronger gains than Adecoagro AGRO, Corteva Inc. CTVA and Dole Plc DOLE, which advanced 12.2%, 6.5% and just 0.4%, respectively. This outperformance highlights Mission Produce’s growing momentum and suggests that investors are increasingly favoring its operational execution and outlook compared with other players in the space.

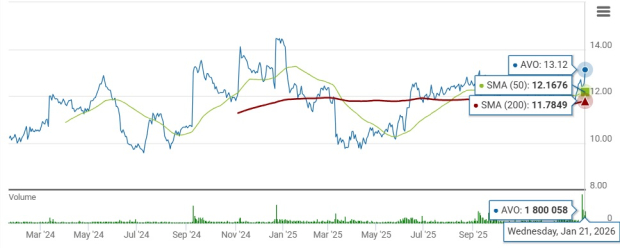

Currently at $13.12, the AVO stock trades 37.2% above its 52-week low of $9.56. The Mission Produce stock’s price also stands 7.1% below its 52-week high of $14.12, reflecting upside potential.

The stock trades above its 50-day and 200-day simple moving averages (SMA), indicating a bullish sentiment. SMA is an essential tool in technical analysis that helps investors evaluate price trends by smoothing out short-term fluctuations. This approach provides a clearer perspective on a stock's long-term direction.

Mission Produce’s recent stock momentum is rooted in growing investor confidence around execution, strategy and long-term positioning rather than short-term price dynamics. Management emphasized that the company’s performance reflects the strength of its fully integrated global platform, which allows the company to balance supply, demand and pricing volatility across regions. The ability to shift fruit seamlessly between North America, Europe and Asia has reinforced Mission Produce’s reputation as a reliable partner to large retailers, supporting steady volume growth even in fluctuating market conditions.

Another key driver is operational progress following the completion of a multi-year investment cycle. The company highlighted that its core infrastructure is now largely in place, enabling greater leverage of existing assets and a transition toward stronger free cash flow generation. Investors appear encouraged by management’s disciplined capital approach, improved balance sheet flexibility, and clearer path to shareholder value creation through organic growth and selective capital allocation.

Portfolio expansion and category development also underpin the rally. While avocados remain the cornerstone, Mission Produce continues to build momentum in adjacent categories such as mangoes and blueberries, using the same playbook of supply consistency, category management and consumer engagement. Management stressed that rising household penetration, increased promotional activity in higher-supply environments and data-driven customer insights are expanding consumption occasions and deepening retailer relationships.

Additionally, the upcoming CEO transition signals continuity rather than disruption, with a ‘steady-as-she-goes’ strategy aimed at accelerating global growth. These factors have driven investor confidence, leading to a re-rating of AVO based on execution credibility and long-term growth visibility.

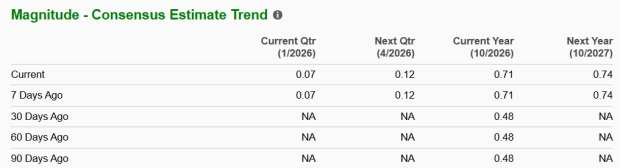

The Zacks Consensus Estimate for AVO’s fiscal 2026 EPS moved up 47.9% in the last 30 days. For fiscal 2026, the Zacks Consensus Estimate for AVO’s sales and EPS implies year-over-year declines of 10.2% and 10.1%, respectively.

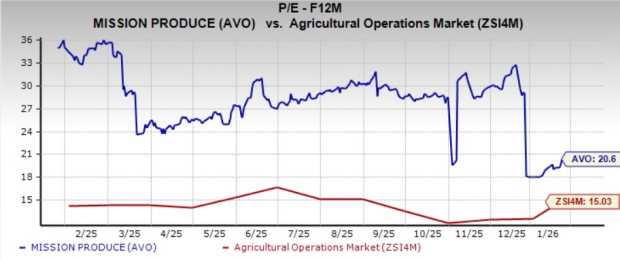

Mission Produce’s forward 12-month P/E of 20.6X significantly surpasses the industry average of 15.03X, reflecting market optimism around its growth prospects.

At 20.6X P/E, Mission Produce trades at a significant premium to its industry peers. The company’s peers, such as Adecoagro, Corteva and Dole, are delivering growth and trade at more reasonable multiples. Adecoagro, Corteva and Dole have forward 12-month P/E ratios of 7.37X, 19.41X and 10.54X — all significantly lower than that of AVO.

Although the current valuation may seem expensive, it suggests that investors have high expectations for AVO's future performance and growth potential. The company’s capability to execute its strategy and capitalize on a favorable pricing environment is essential for ensuring profitability and consistent performance in its Marketing and Distribution segment. While success in these areas can strengthen its market leadership, its failure can pose serious challenges for AVO.

Mission Produce has demonstrated strong momentum in the past month, supported by solid operational execution, positive estimate revisions and a clear path for growth. While the stock trades at a premium forward P/E ratio, reflecting heightened investor confidence, this valuation also signals the market’s expectation of continued outperformance.

For investors, AVO presents a compelling opportunity, particularly for those seeking exposure to a company with a robust global platform, expanding portfolio and disciplined capital strategy. We suggest considering AVO as a buy, ideally looking for attractive entry points to benefit from its momentum and long-term growth potential. AVO currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite