|

|

|

|

|||||

|

|

Digital healthcare platforms are expanding across both consumer wellness and precision medicine, with Hims & Hers Health, Inc. HIMS and Tempus AI, Inc. TEM operating in distinct segments of the market. HIMS is a consumer-first, subscription-based platform that provides access to personalized treatments through integrated telehealth consultations and pharmacy fulfillment. Tempus AI, by contrast, applies artificial intelligence (AI) to large-scale clinical and molecular data to support precision medicine and diagnostic decision-making for healthcare providers. The two companies address different points along the healthcare value chain, highlighting contrasting models within the broader shift toward technology-enabled care.

While Hims & Hers targets consumers seeking accessible, ongoing care through a digital storefront, Tempus AI serves healthcare providers and biopharma customers with advanced diagnostics and analytics. As digital health adoption broadens across both consumer and enterprise channels, the comparison highlights two different approaches to technology-enabled healthcare and raises the question of which model may offer greater long-term opportunity. Let’s take a closer look.

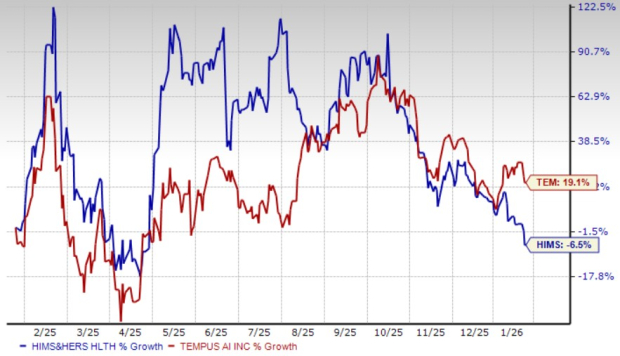

HIMS (down 40.4%) has underperformed TEM (down 24.9%) over the past three months. In the past year, Hims & Hers stock has lost 6.5% against Tempus AI’s gain of 19.1%.

Meanwhile, HIMS is trading at a forward 12-month price-to-sales (P/S) ratio of 2.35X, below its median of 3.90X over the past year. TEM’s forward sales multiple sits at 7.35X, below its last year's median of 8.09X. While TEM appears expensive compared with the Medical sector average of 2.35X, HIMS trades in line with it. Currently, Hims & Hers and Tempus AI stocks have a Value Score of C and F, respectively.

A key driver is Hims & Hers’ broadening portfolio of specialties, which continues to extend beyond its early focus areas. Recent launches across weight management, hormone health, diagnostics and preventive care are expanding the company’s addressable market while increasing relevance across different life stages. The addition of lab testing and proactive health tools further shifts the platform from episodic treatment toward ongoing health management, strengthening customer engagement over time.

Another important factor is the company’s vertically integrated, data-driven care model. Investments in compounding infrastructure, diagnostics and technology allow Hims & Hers to deliver more personalized treatment plans while maintaining control over quality, speed and cost. As scale increases, each customer interaction feeds back into the platform, improving clinical decision-making and reinforcing differentiation versus traditional telehealth peers.

Finally, global expansion and strategic capital deployment are reinforcing the long-term growth outlook. International market entry and targeted acquisitions are extending the brand beyond the United States, while recent financing has provided flexibility to invest in AI, technology leadership and new capabilities. Together, these initiatives position Hims & Hers to sustain growth while building a more durable, recurring revenue base.

A central driver is Tempus AI’s growing multimodal data advantage, built through years of genomic testing, real-world clinical data collection and strategic acquisitions. This expanding dataset underpins both the company’s diagnostic offerings and its data licensing business, making the platform increasingly valuable to healthcare providers, researchers and life sciences partners. As the data library deepens, it enhances Tempus AI’s ability to generate clinically relevant insights and supports longer-term monetization opportunities.

Another factor is the rising adoption of Tempus AI’s diagnostic and clinical decision-support tools. Continued growth in oncology and hereditary testing volumes reflects broader integration of TEM’s assays into clinical workflows. Regulatory clearances and reimbursement progress further strengthen confidence in the durability of this demand, helping translate technological capabilities into sustained clinical use.

Finally, product expansion powered by AI is reinforcing Tempus AI’s differentiation. New AI-driven solutions across digital pathology, imaging and predictive analytics extend the platform beyond traditional testing, positioning TEM as a technology partner rather than a single-service diagnostics provider. Together, these elements support a long-term growth narrative anchored in precision medicine and scalable AI infrastructure.

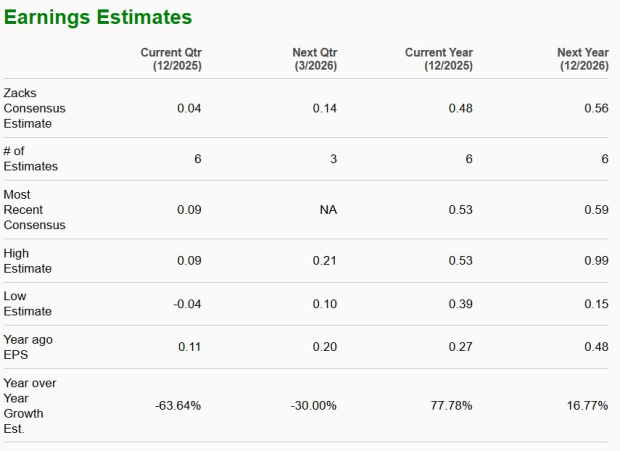

The Zacks Consensus Estimate for HIMS’ 2026 earnings per share (EPS) suggests a 16.8% improvement from 2025.

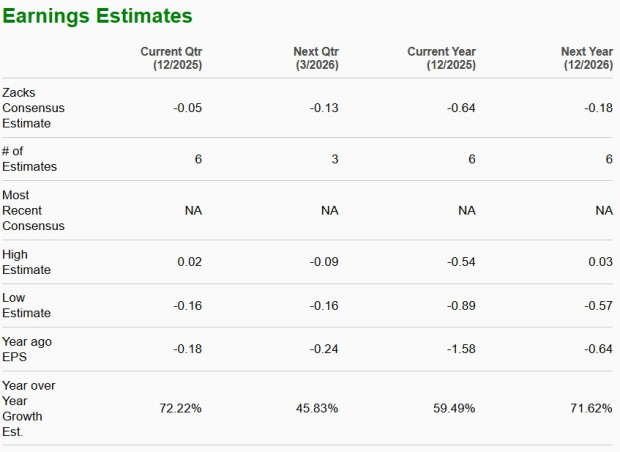

The Zacks Consensus Estimate for TEM’s 2026 loss per share implies an improvement of 71.6% from 2025.

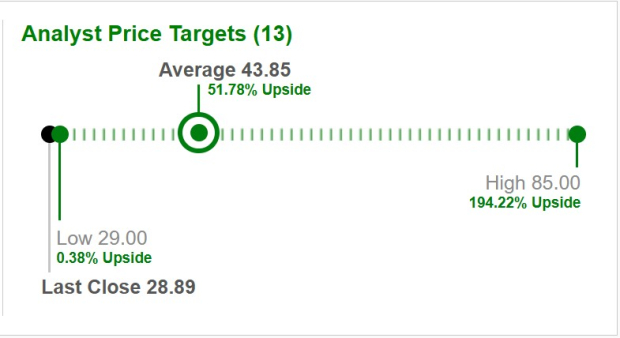

Based on short-term price targets offered by 13 analysts, the average price target for Hims & Hers is $43.85, implying an increase of 51.8% from the last close.

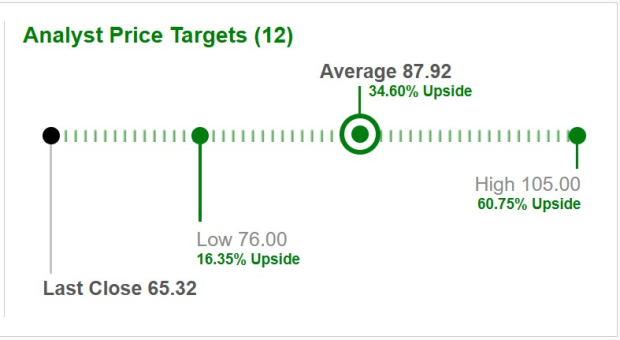

Based on short-term price targets offered by 12 analysts, the average price target for Tempus AI is $87.92, implying an increase of 34.6% from the last close.

While both Hims & Hers Health and Tempus AI are positioned to benefit from the broader shift toward technology-enabled healthcare, HIMS, a Zacks Rank #4 (Sell) stock, appears relatively better placed from a valuation and risk-adjusted perspective at this stage. Hims & Hers is steadily building a consumer-focused digital health ecosystem, supported by expanding specialty categories, deeper personalization through diagnostics and ongoing international expansion. Its subscription-led model emphasizes recurring engagement and predictable demand, helping anchor longer-term scalability even amid near-term stock volatility.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Tempus AI, also carrying a Zacks Rank #4, continues to differentiate itself through its data-driven precision medicine platform, supported by strong clinical adoption, regulatory progress and AI-powered product innovation. However, the stock trades at a significantly higher sales multiple compared with both HIMS and the broader Medical sector, reflecting elevated expectations tied to execution, reimbursement dynamics and continued enterprise adoption. While TEM’s long-term growth narrative remains compelling, its valuation leaves less margin for error in the near term.

For investors seeking comparatively balanced exposure to healthcare innovation with valuation in line with sector norms but well below recent historical levels, Hims & Hers stands out as the more favorable choice right now, while Tempus AI may appeal more to those with a higher risk tolerance and longer investment horizon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite