|

|

|

|

|||||

|

|

Whirlpool Corporation WHR is slated to release fourth-quarter 2025 results on Jan. 28, 2026, after the closing bell. The company is expected to have witnessed year-over-year sales growth in the to-be-reported quarter.

For fourth-quarter revenues, the Zacks Consensus Estimate is pegged at $4.29 billion, indicating a 3.7% rise from the prior-year quarter’s figure. The consensus estimate for quarterly earnings has remained stable in the past seven days at $1.50 per share. However, the consensus mark for earnings indicates a 67.2% fall from the year-ago quarter’s figure.

WHR delivered an earnings surprise of 48.2% in the last reported quarter. The bottom line has surpassed estimates by 8.9%, on average, over the trailing four quarters.

Whirlpool’s fourth-quarter results are expected to reflect the continued impact of its extensive product refresh cycle, particularly in North America, where new launches have begun to gain meaningful traction. The company introduced one of its largest waves of innovation in more than a decade during 2025, driving improved retail flooring and early sell-through momentum. These initiatives are likely to support revenue performance in the to-be-reported quarter, even as broader appliance demand remains constrained by macro- and housing-related pressures.

The Zacks Consensus Estimate for MDA North America is currently pegged at $2721 million, indicating growth of 4.9%.

Margin performance in the fourth quarter is likely to remain influenced by elevated promotional activity tied to tariff-related inventory dynamics. While Whirlpool continues to absorb incremental tariff costs, signs of slowing import volumes from foreign competitors suggest that pricing pressure may be approaching an inflection point. Given its predominantly U.S.-based manufacturing footprint, the company is relatively better positioned than peers to navigate these headwinds, which could help stabilize margins as competitive conditions gradually normalize.

Cost management is expected to be a key earnings driver in the quarter. Whirlpool has executed well on manufacturing and supply-chain efficiency initiatives, delivering consistent cost savings that partially offset pricing and tariff pressures. With raw material costs largely stable, these productivity gains should continue to provide support to operating margins and limit downside risk to earnings in the to-be-reported quarter.

On the demand side, performance may differ across regions and categories. While macro and housing-related softness continue to weigh on major appliances in certain international markets, Whirlpool’s Small Domestic Appliances (SDA) business remains a bright spot. Strong brand momentum at KitchenAid, successful direct-to-consumer execution and a favorable product mix have driven solid growth and margin expansion in this segment. Continued strength in SDA could help cushion overall results and contribute positively to earnings in the upcoming release.

The Zacks Consensus Estimate for SDA Global is currently pegged at $427 million, indicating growth of 11.2%.

However, competitive and macroeconomic challenges persist. On its last earnings call, management outlined a cautious outlook for 2025, projecting net sales of $15.8 billion, down from $16.6 billion in the prior year, along with an ongoing EBIT margin of 5% versus 5.3% in 2024. Ongoing EPS is expected to decline to $7.00 from $12.21 a year ago. Foreign competitors’ accelerated pre-tariff imports have kept inventory levels elevated, sustaining a highly promotional environment and pressuring price/mix. Additionally, unfavorable foreign currency movements, particularly in Latin America and Asia, are expected to have further weighed on overall performance.

Our proven model doesn’t conclusively predict an earnings beat for Whirlpool this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Whirlpool currently has an Earnings ESP of 0.00% and a Zacks Rank #2. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

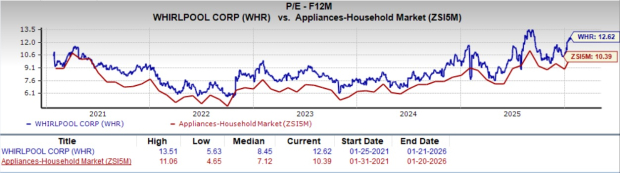

With a forward 12-month price-to-earnings ratio of 12.62x, which is below the five-year high of 13.51x and above the Household Appliances industry’s average of 10.39x, the stock offers compelling value for investors seeking exposure to the sector.

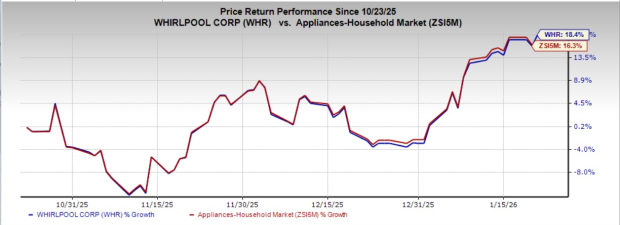

The recent market movements show that WHR’s shares have gained 18.4% in the past three months compared with the industry's 16.3% rise.

Here are some companies, which, according to our model, have the right combination of elements to post an earnings beat:

Central Garden & Pet CENT has an Earnings ESP of +5.89% and currently carries a Zacks Rank of 2. CENT is likely to register a bottom-line decline when it reports first-quarter fiscal 2026 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $644.3 million, indicating a 1.9% decline from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Central Garden’s earnings is pegged at 11 cents per share, implying a 47.6% decline from the year-ago quarter’s actual. The consensus mark for earnings has increased 26.7% in the past 30 days. CENT delivered an earnings surprise of 5.9% in the last quarter.

Steven Madden SHOO currently has an Earnings ESP of +2.92% and a Zacks Rank of 2. SHOO is likely to register a bottom-line decline when it reports fourth-quarter 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $753.3 million, indicating 29.4% growth from the figure reported in the prior-year quarter.

The consensus estimate for Steven Madden’s earnings is pegged at 46 cents per share, implying a 16.4% decline from the year-ago quarter’s actual. The consensus mark for earnings has increased by a penny in the past 30 days. SHOO delivered a negative earnings surprise of 2.3% in the last quarter.

Ralph Lauren Corporation RL currently has an Earnings ESP of +1.64% and a Zacks Rank of 3. RL is likely to register growth in its top and bottom lines when it reports third-quarter fiscal 2026 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.31 billion, indicating 7.9% growth from the figure reported in the year-ago quarter.

The consensus estimate for Ralph Lauren’s fiscal third-quarter earnings is pegged at $5.74 a share, implying 19.1% growth from the year-earlier quarter. The consensus mark has moved up by 2 cents in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 min | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite