|

|

|

|

|||||

|

|

Tractor Supply Company TSCO is likely to register an increase in the top and bottom lines when it reports fourth-quarter 2025 results on Jan. 29, 2026, before market open. The Zacks Consensus Estimate for revenues is pegged at $4.04 billion, indicating a 7% jump from the year-ago figure.

The bottom line of the leading rural lifestyle retailer in the United States is expected to have risen year over year. The Zacks Consensus Estimate for earnings per share has been unchanged at 47 cents in the past 30 days, indicating a 6.8% rise from the year-ago period’s figure.

Tractor Supply has a negative trailing four-quarter earnings surprise of 1.8%, on average. In the last reported quarter, this Brentwood, TN-based company’s earnings surpassed the Zacks Consensus Estimate by 2.1%.

Tractor Supply enters the fourth quarter with steady momentum in its core consumable, usable and edible (C.U.E.) categories, which management continues to cite as the foundation of the business. Customer engagement remains strong, with transactions expected to stay positive, supported by loyalty-driven repeat purchases and stable rural consumer demand. While discretionary spending remains selective, everyday needs-based categories such as livestock, equine and animal care are likely to anchor comparable sales growth in the to-be-reported quarter.

The company’s fourth-quarter performance is expected to be heavily influenced by winter weather patterns rather than traditional holiday gifting alone. Management emphasized that cold weather events typically drive demand for heating, winter workwear, wood pellets and emergency-related products, creating a wide range of possible comps outcomes. With inventory depth, targeted merchandising and winter-readiness initiatives in place, Tractor Supply is positioned to capture upside should weather conditions turn favorable late in the quarter.

Ongoing investments in Final Mile delivery, direct sales and omnichannel fulfillment are expected to provide incremental support to top-line performance in the fourth quarter. Digital sales trends are expected to have improved sequentially, with store-based fulfillment remaining a key differentiator. In addition, loyalty programs such as Neighbor’s Club and seasonal community events like Hometown Heroes Day are likely to drive traffic and reinforce customer loyalty during the holiday and winter season.

Despite solid demand drivers, margin headwinds are expected to persist in the fourth quarter. Tariff-related cost pressures and higher transportation expenses are anticipated to continue flowing through the P&L, while SG&A is likely to remain elevated due to strategic investments and incentive compensation. Management has reiterated its commitment to disciplined pricing and cost controls, but near-term profitability will reflect the balance between maintaining value leadership and funding long-term growth initiatives.

Our model indicates an 8.2% year-over-year increase in SG&A expenses for the fourth quarter, with the SG&A expense rate rising 40 basis points to 24%. Depreciation and amortization expenses are expected to increase 17.3% year over year.

Our proven model does not conclusively predict an earnings beat for Tractor Supply this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Tractor Supply has an Earnings ESP of -4.10% and a Zacks Rank of 3 at present.

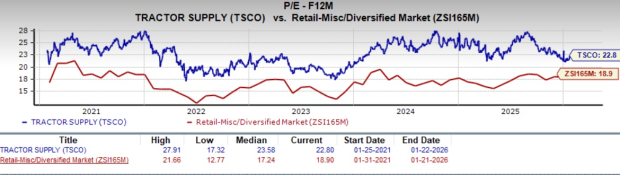

From a valuation perspective, Tractor Supply stock trades at a premium relative to the Retail - Miscellaneous industry. The company has a forward 12-month price-to-earnings ratio of 22.80X, above the industry’s average of 18.90X. However, the stock trades below the historical benchmarks, with a five-year high of 27.91X.

TSCO shares have lost 3.5% in the past three months against the industry's 7.6% growth.

Here are a few companies that have the right combination of elements to post an earnings beat this time around:

American Eagle Outfitters AEO currently has an Earnings ESP of +1.76 and sports a Zacks Rank of 1. AEO delivered a trailing four-quarter earnings surprise of 35.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year sales indicates growth of 7.7% from the year-ago period reported number.

Burlington Stores BURL currently has an Earnings ESP of +3.72% and a Zacks Rank of 3. The company is likely to register an increase in the top and bottom lines when it reports fourth-quarter fiscal 2025 numbers.

The Zacks Consensus Estimate for the quarterly earnings per share is pegged at $4.71, which implies a 15.7% rise from the figure reported in the year-ago quarter. Burlington Stores’ top line is expected to have increased year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $3.58 billion, which indicates a rise of 9.1% from the prior-year quarter. BURL delivered a trailing four-quarter earnings surprise of 14.8%, on average.

The TJX Companies, Inc. TJX currently has an Earnings ESP of +2.62% and a Zacks Rank of 2. TJX is likely to register growth in its top and bottom lines when it reports fourth-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $17.4 billion, indicating 6.4% growth from the figure reported in the year-ago quarter.

The consensus estimate for TJX’s fourth-quarter earnings is pegged at $1.38 a share, implying a 12.2% increase from the year-earlier quarter. The consensus mark has remained stable in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 6 hours | |

| 9 hours | |

| 9 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite