|

|

|

|

|||||

|

|

Bank of America BAC is one of the largest global banks, while Truist Financial TFC is a prominent regional banking franchise with growth ambitions. BAC benefits from its immense scale, an expanding branch footprint and a diversified suite of financial services, while TFC is pairing targeted regional branch growth with advanced digital banking capabilities.

Bank of America and Truist reported solid fourth-quarter 2025 results earlier this month. Both banks’ earnings and revenues experienced year-over-year growth. Let’s take a closer look at these two large banks to see which one is a better bet post fourth-quarter earnings.

Bank of America, one of the most asset-sensitive banks in America, is expected to witness solid net interest income (NII) growth this year despite the Federal Reserve lowering interest rates. The company is likely to benefit from asset repricing, loan and deposit growth, technological efficiency and a diversified business model. Hence, management expects NII to rise approximately 5-7% in 2026, with the first-quarter number likely to jump 7% year over year.

Moreover, Bank of America’s aggressive financial center expansion strategy across the United States will solidify customer relationships and tap into new markets, driving NII growth over time. By 2027, the company plans to expand its financial center network and open more than 150 centers. These efforts, along with the success of the person-to-person money transfer system Zelle and the digital financial assistant Erica, will enable BAC to offer enhanced digital services and cross-sell several products, including mortgages, auto loans and credit cards.

The shift toward easier monetary policy is expected to support client activity, deal flow and asset values. Bank of America’s non-interest income streams (asset management fees, investment banking and Sales & Trading) saw encouraging momentum last year, which is likely to continue in 2026. Also, lower rates are expected to aid the company’s asset quality, as declining rates will ease debt-service burdens and improve borrower solvency.

As the bank embarks on an ambitious expansion plan to open financial centers in new and existing markets, operating expenses are likely to remain elevated in the near term.

Unlike BAC, Truist Financial is less sensitive to interest rate cycles. Since the divestiture of its insurance subsidiary in 2024, the company has been trying to strengthen its balance sheet through repositioning and making efforts to enhance its non-interest revenue sources.

Further, in August 2025, TFC announced a growth plan – opening 100 branches and renovating more than 300 existing locations in high-growth opportunity cities by 2030 and investing in its business banking ecosystem – to capitalize on growth opportunities in dynamic U.S. markets while strengthening its digital capabilities.

Additionally, the company is focusing on wealth management and expects a broad-based recovery in trading and investment banking businesses to drive non-interest income higher. This will also help alleviate Truist’s dependence on spread income to sustain top-line growth as rates come down.

For 2026, TFC expects NII to grow almost 3-4%, driven by average loan growth (up 3-4%) and two 25-basis-point rate cuts alongside the benefits of fixed-rate asset repricing. Similar to Bank of America, the company’s asset quality is expected to benefit from relatively lower rates.

As Truist gets on with its branch expansion plan, upgrade technology and hire personnel to drive commercial banking business, operating expenses will likely remain high. The company expects adjusted non-interest expenses to rise 1.25-2.25% this year.

Over the past six months, TFC and BAC shares have risen 7.9% and 11.3%, respectively. Hence, in terms of price performance, Bank of America has a clear edge over TFC.

Six-Month Price Performance

In terms of valuation, Truist is currently trading at a 12-month forward price-to-earnings (P/E) of 11.11X. BAC stock, in contrast, is currently trading at a 12-month forward P/E of 11.94X.

P/E F12M

So, TFC is trading at a discount compared with Bank of America.

Bank of America and Truist undergo annual stress tests conducted by the Fed before they can announce their capital distribution plans. Following the 2025 stress test, BAC hiked its dividend by 8% to 28 cents per share, while TFC maintained its dividend payout at the same level of 52 cents per share. At present, BAC has a dividend yield of 2.15% and TFC’s dividend yield is 4.14%. Hence, based on dividend yield, TFC has an edge over BAC.

Dividend Yield

Bank of America’s return on equity (ROE) of 11.07% is way higher than Truist’s 9.03%. This reflects BAC’s efficient use of shareholder funds in generating profits.

ROE

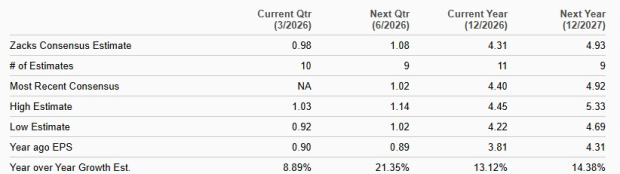

The Zacks Consensus Estimate for BAC's 2026 and 2027 earnings indicates 13.1% and 14.4% growth, respectively. In the past week, the company’s earnings estimates for 2026 and 2027 have remained unchanged.

BAC Earnings Estimates

The Zacks Consensus Estimate for TFC’s 2026 and 2027 earnings indicates a rise of 13.4% and 12.1%, respectively. Its earnings estimates for both years have been revised upward over the past seven days.

TFC Earnings Estimates

Given the Fed’s easing cycle and impressive fourth-quarter performance, Bank of America looks better positioned to capitalize on lower rates through its scale, diversified income streams and ongoing branch expansion strategy. While near-term expenses may rise, BAC’s stronger earnings growth outlook, superior ROE and recent dividend hike signal financial strength and shareholder value creation. Its digital innovations and cross-selling opportunities also provide a long-term competitive advantage.

Truist Financial, though less sensitive to rate shifts and offering a higher dividend yield, faces relatively modest earnings growth. Its discounted valuation and branch expansion strategy may appeal to value investors, but overall, Bank of America appears the stronger long-term bet.

Currently, TFC and BAC carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

NVDA Stock Rebounds In Premarket After Worst Drop In 10 Months; Analysts, Retail Investors Remain Optimistic

TFC

New feeds test provider finance

|

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite