|

|

|

|

|||||

|

|

Salesforce, Inc. CRM and Adobe Inc. ADBE are two well-established companies in the enterprise software space. Both help businesses boost productivity, improve customer engagement and advance digital transformation. While Adobe dominates the creative software market, Salesforce leads in customer relationship management solutions.

As artificial intelligence (AI) reshapes enterprise software, both companies are betting big on AI to power the next phase of growth. But which stock offers the stronger investment case right now? Let’s break it down.

Salesforce has long held the top position in the customer relationship management market, according to Gartner. The company’s vision now goes beyond customer management, and it is building a broader ecosystem focused on AI, data and collaboration. Acquisitions like Waii, Bluebirds, Informatica and Slack show Salesforce’s push to evolve into a more complete enterprise platform.

AI is now central to Salesforce’s growth story. Since the 2023 rollout of Einstein GPT, Salesforce has been embedding generative AI across its offerings to help companies automate processes, improve decision-making and strengthen customer relationships.

Its latest innovation, Agentforce, is gaining momentum. Combined with Data Cloud, these AI-driven offerings brought in $1.4 billion in recurring revenues in the third quarter of fiscal 2026, representing a 114% year-over-year increase. Agentforce alone generated $540 million in recurring revenues, calling for a 330% year-over-year increase.

Financially, Salesforce continues to deliver steady performance. In the third quarter of fiscal 2026, revenues and non-GAAP earnings per share (EPS) rose 10% and 34.9% year over year, respectively. The bottom line surpassed the Zacks Consensus Estimate by 14.04%, while the top line matched the consensus mark.

Salesforce Inc. price-consensus-eps-surprise-chart | Salesforce Inc. Quote

Total remaining performance obligation (RPO) was $59.5 billion at the end of the third quarter of fiscal 2026, up 12% year over year. Management expects the current RPO will increase approximately 15% in the fourth quarter of fiscal 2026, suggesting continued growth momentum for the company. The non-GAAP operating margin expanded 240 basis points to 35.5% in the third quarter.

These results suggest Salesforce is transitioning from a growth-heavy model to a more efficient, profitable enterprise solution provider while keeping innovation at its core.

Adobe is witnessing solid momentum across its AI-powered tools, such as Creative Cloud Pro and Acrobat. Its AI-first offerings, such as Firefly and Acrobat AI Assistant, are also gaining traction. By adding conversational and agentic interfaces to Adobe Reader, Acrobat and Express, the company is making its products more useful for consumers. These integrations also improve productivity for creative professionals, which supports higher adoption.

Firefly is becoming a key growth driver within Adobe’s creative ecosystem. Firefly models and applications like Photoshop, Illustrator and Premiere, which integrate third-party models, are gaining traction among Creators and Creative professionals. New solutions like Premiere mobile with YouTube integration and Photoshop mobile are helping creators develop content anywhere.

Adobe’s growing partner ecosystem further strengthens its AI strategy. The company has integrated with major AI platforms, including Amazon Web Services, Microsoft Azure, Google Gemini, Microsoft Copilot and OpenAI. Firefly also supports models from several well-known AI startups, giving users a broad set of generative options. In the Business Professional and Consumer segment, Adobe added 45 new partners in the fourth quarter of fiscal 2025, helping extend its products into marketing, social media and content management workflows.

Financially, Adobe is doing well. In the fourth quarter of fiscal 2025, the company’s top and bottom lines soared 10.5% and 14.3%, respectively, year over year. Revenues and earnings surpassed the respective Zacks Consensus Estimate by 1.5% and 2.04%, respectively.

Adobe Inc. price-consensus-eps-surprise-chart | Adobe Inc. Quote

Adobe now targets annualized recurring revenue growth of 10.2% for fiscal 2026, driven by an innovative AI-powered portfolio, the expanding adoption of enterprises and a large market opportunity. However, Adobe’s AI-related revenues are minuscule compared with Microsoft, Alphabet and Salesforce, which has been a concern for Adobe investors.

Both companies are riding on the AI wave, but near-term growth looks slightly stronger for Salesforce. The consensus estimates for fiscal 2026 point to 9.53% revenue and 15.29% earnings per share (EPS) growth for Salesforce. Estimates for Adobe’s fiscal 2026 call for 9.5% revenue and 12.03% EPS growth.

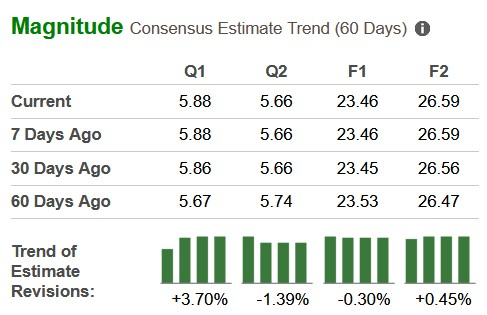

Moreover, the earnings estimate revision trend for the two companies reflects that analysts are turning more bullish toward CRM.

Over the past three months, both stocks have declined, but Salesforce has held up better. CRM has plunged 9.8%, while ADBE has dropped 15.3% — a wide performance gap reflecting investor confidence in Salesforce’s execution and resilience.

Salesforce looks attractive on the valuation front as well. Salesforce trades at 4.67 times forward 12-month sales, while Adobe trades at 4.74 times.

While both companies are strong players in the enterprise software space, Salesforce has a clearer path to monetizing AI, stronger customer stickiness through its platform ecosystem and better margin stability. Adobe continues to innovate, but competitive threats and slow AI monetization make its near-term prospects less compelling.

For investors seeking a blend of steady growth, expanding AI-driven opportunities and resilient financial performance, Salesforce stands out as the stronger investment option right now.

Salesforce carries a Zacks Rank #2 (Buy), making it a clear winner over Adobe, which has a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 14 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite