|

|

|

|

|||||

|

|

Both Western Digital Corporation WDC and Micron Technology MU are major players in the memory and storage ecosystem, with exposure to NAND flash and data-center demand tied to AI, cloud computing and cyclical memory pricing. Western Digital and Micron are both well-positioned to benefit from global data growth through storage and memory solutions, making them closely watched by investors betting on AI infrastructure and cloud expansion.

Both operate in the broader data storage ecosystem, but they play distinct roles. Western Digital is traditionally known for HDDs and, increasingly, enterprise storage systems. It also has flash memory exposure, though that part was largely spun off through SanDisk in 2025. Micron is a pure memory champion in DRAM, HBM and NAND flash. Both have soared in value recently, driven by demand tied to data growth and AI infrastructure. But their futures hinge on different markets and technology cycles.

However, if investors must choose between the two, which stock should they consider based on business models, growth drivers, risks, financials & valuation, outlooks and final verdict?

Here’s how it breaks down.

AI adoption is accelerating across industries, driving innovation, reshaping business models and advancing digital transformation through higher productivity and richer user experiences. As agentic AI scales and multimodal LLMs become mainstream, WDC is seeing growing AI use cases that are fueling sustained demand for data infrastructure. AI is both a major consumer and creator of data, transforming how data is generated, stored, scaled and monetized. As data volumes expand rapidly, HDDs remain the most reliable, scalable and cost-effective solution for storing the zettabytes of data powering the AI-driven economy.

AI is improving efficiency across corporate functions. At the same time, rising AI and data-driven workloads at hyperscalers are boosting demand for WDC’s storage solutions. Customers are shifting to higher-capacity drives, leading to strong shipments of its latest ePMR products, including up to 26TB CMR and 32TB UltraSMR drives. WDC continues to scale ePMR technology, invest in advanced media and wafer innovation, and use automation and AI to increase manufacturing capacity and efficiency. The reliability, scalability and cost advantages of Western Digital’s ePMR and UltraSMR drives continue to drive data center success, with the company preparing to build on this momentum through next-generation HAMR technology.

Strong customer commitments—extending into 2027—underscore confidence in its roadmap and its role in the AI data economy. HAMR development is progressing well, with customer qualification beginning in early 2026 and volume production targeted for the first half of 2027. Meanwhile, next-gen ePMR drives will complete qualification by early 2026, supporting a smooth transition. Management expects continued revenue growth and improved profitability in the fiscal second quarter, driven by strong data center demand and higher-capacity drive adoption. At the mid-point of its guidance, Western Digital anticipates non-GAAP revenues of $2.9 billion (+/- $100 million), up 20% year over year.

Western Digital remains committed to returning value to shareholders while continuing to invest strategically in technology and growth opportunities. Since launching the capital return program in fourth-quarter fiscal 2025, the company has returned a total of $785 million to shareholders through buybacks and dividends. For investors, this move reinforces its ongoing commitment to shareholder returns not just through operational execution but also through consistent capital allocation discipline.

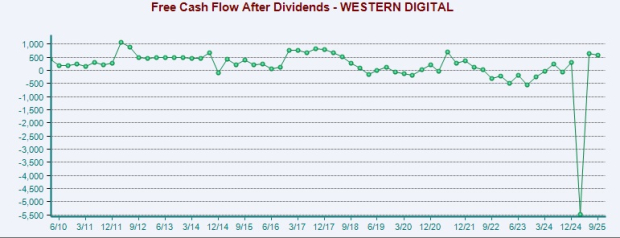

However, one of Western Digital’s main challenges is its heavy debt burden. This limits its flexibility to pursue value-adding acquisitions and other growth opportunities and requires the company to consistently generate strong cash flows to meet its debt obligations.

Micron’s management highlighted an extremely tight supply environment across DRAM and NAND, driven by accelerating AI adoption and data center growth. With the HBM total addressable market now projected to reach $100 billion by 2028, earlier than previously expected, and strong fiscal first-quarter financial results, Micron is increasing capital expenditures and accelerating supply investments. Management underscored disciplined cost control, solid pricing and technology leadership, expressing confidence in the company’s ability to capitalize on long-term industry trends despite supply constraints and higher capital intensity.

Micron is benefiting from the AI boom through strong adoption of its HBM3E solutions by hyperscalers and enterprises, driving multi-billion-dollar quarterly revenues. Management expects this momentum to fuel meaningful growth as AI infrastructure spending accelerates. At the same time, a recovering DRAM market is a key tailwind. Further, its HBM4, delivering industry-leading speeds above 11 Gbps, is on track for high-yield ramp-up in the second quarter of calendar 2026, aligned with customer product launches. Built using in-house advanced CMOS, metallization and DRAM process technologies, along with proprietary design, packaging and testing capabilities, HBM4 supports Micron’s leadership in performance and power efficiency.

Micron’s data center NAND revenue surpassed $1 billion in the fiscal first quarter, with strong momentum across its SSD portfolio driven by leadership NAND technology. The company launched the world’s first PCIe Gen6 SSD using G9 NAND, seeing rising qualification interest from hyperscalers. Demand for G9-based mainstream SSDs is strong, while high-capacity QLC 122TB and 245TB G9 SSDs are entering qualification with multiple hyperscale customers.

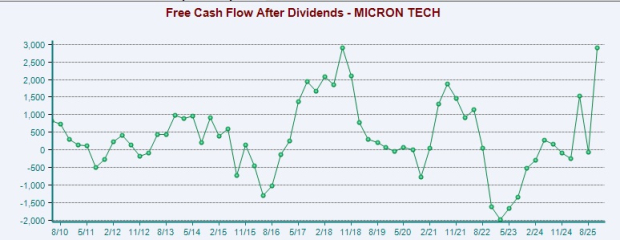

Micron maintains a strong balance sheet, having ended the fiscal first quarter with $12 billion in cash and investments and total liquidity of $15.5 billion. This financial strength supports strategic acquisitions, growth investments and shareholder returns through dividends and buybacks. Strong cash generation remains a key advantage, with $8.4 billion in operating cash flow, $3.9 billion in adjusted free cash flow after capital spending, $134 million paid in dividends and $300 million spent on share repurchases during the quarter.

However, the company’s performance is closely linked to DRAM and NAND pricing, making it vulnerable to oversupply and weaker-than-expected end-market demand. Elevated customer inventories across cloud, graphics and enterprise markets remain a key risk, while soft server demand from enterprise OEMs adds pressure. Ongoing Intel CPU shortages and broader macroeconomic uncertainty further complicate the outlook. Also, rising operating costs and a massive increase in capital expenditure pose a downside risk to Micron’s near-term profitability.

Over the past year, MU and WDC have registered gains of 340.9% and 283.1%, respectively.

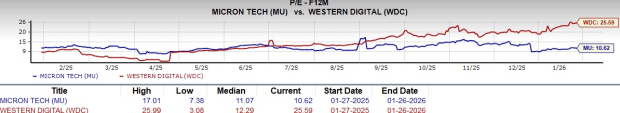

MU looks more attractive than WDC from a valuation standpoint. Going by the price/earnings ratio, MU’s shares currently trade at 10.62 forward earnings, lower than 25.59 for WDC.

WDC is overvalued as its Value Style Score of F suggests a stretched valuation at this moment, while MU has a score of B.

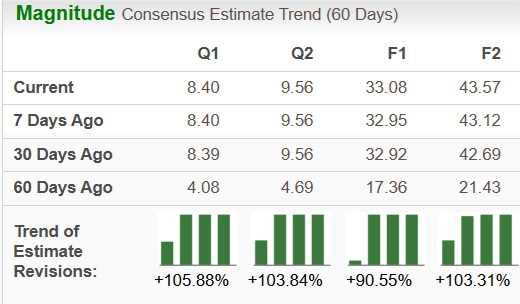

The Zacks Consensus Estimate for MU’s earnings for fiscal 2026 has been revised north 90.5% to $33.08 over the past 60 days.

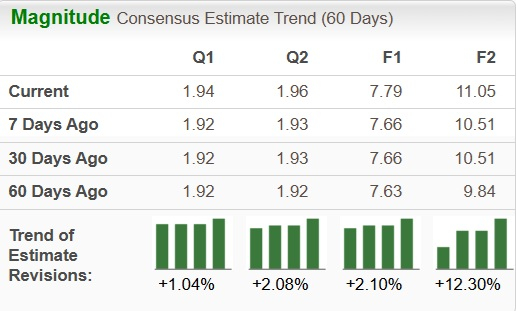

The Zacks Consensus Estimate for WDC’s earnings for fiscal 2026 has been revised up 2.1% to $7.79 over the past 60 days.

Micron is often the growth engine, while Western Digital can be the turnaround bet, and your choice depends on your risk profile, investment horizon and confidence in secular storage trends.

Both companies benefit from the same macro megatrends and sport a Zacks Rank #1 (Strong Buy) each. Consequently, in terms of valuation, MU seems to be a better pick at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite