|

|

|

|

|||||

|

|

Novo Nordisk NVO and Viking Therapeutics VKTX have emerged as notable players in the obesity space.

A market leader in the GLP-1 space, Novo Nordisk markets its semaglutide drugs under brand names Ozempic (pre-filled pen) and Rybelsus (oral tablet) for type II diabetes (T2D), and Wegovy (injection and oral pill) for chronic weight management and cardiovascular (CV) risk reduction.

On the other hand, Viking Therapeutics is a clinical-stage biotech firm. Its investigational dual GIP and GLP-1 receptor agonist, VK2735, has shown blockbuster potential in early to mid-stage studies for treating obesity.

At first glance, comparing Novo Nordisk and Viking Therapeutics may seem uneven given the vast gap in scale, resources and commercial execution. Yet both are tethered to the same GLP-1–driven metabolic treatment space, where shifting demand dynamics, intensifying competition and mounting execution risks are weighing heavily on investor sentiment. The setbacks faced in 2025 by both players have only amplified the risks, making them far from straightforward investment choices. Against this backdrop, it becomes essential to evaluate their fundamentals closely to determine which, if either, presents the relatively safer option at this stage.

Novo Nordisk has achieved tremendous success in the cardiometabolic treatment space, all thanks to its semaglutide medicines, Ozempic, Rybelsus and Wegovy, which are its primary top-line drivers. As of September 2025-end, Novo Nordisk remained the market leader with a total GLP-1 volume market share of 59% globally across diabetes and obesity care.

NVO has been investing heavily to expand its manufacturing capacity as part of its strategic move to strengthen its leadership in the diabetes and obesity care market for its GLP-1 products.

Novo Nordisk is pursuing new indications for its semaglutide drugs, including CV and other indications. In 2025, Rybelsus became the first oral therapy approved in the United States to lower the risk of major adverse CV events in high-risk T2D patients, regardless of prior CV history. Wegovy’s label includes CV, HFpEF, and osteoarthritis indications, while Ozempic remains the only GLP-1 approved to slow kidney disease and reduce CV death in patients with diabetes. Higher-dose Wegovy injections are also under review in the United States and EU, and NVO is seeking to expand Ozempic’s label to include peripheral artery disease.

In late December, the FDA also approved NVO’s 25 mg oral semaglutide (Wegovy pill) for obesity and CV disease, marking the first GLP-1 pill approved in the United States, which was subsequently launched in early January. The pill is reportedly seeing robust initial demand, signaling an encouraging early uptake in the U.S. market, which could potentially reignite Wegovy’s sales momentum in 2026.

Novo Nordisk is advancing its next-generation obesity pipeline. It recently submitted a regulatory filing seeking the approval of CagriSema injection, a follow-up drug to Wegovy, for obesity. Meanwhile, its mid-stage asset, amycretin, recently showed strong weight-loss efficacy in a phase II study and is slated to enter phase III in first-quarter 2026. The company has bolstered its pipeline through several major collaborations and acquisition deals.

Beyond GLP-1s, NVO is building its Rare Disease franchise, advancing Mim8 in hemophilia A, and securing both EU and U.S. approvals for Alhemo to treat hemophilia A and B, with or without inhibitors. Meanwhile, the FDA has granted accelerated approval for Wegovy in treating MASH with fibrosis. Novo Nordisk and rival Eli Lilly LLY signed drug pricing agreements with the Trump administration in 2025, cutting prices of their respective GLP-1 medicines in exchange for Medicare access for the drugs and a three-year exemption from tariffs on pharmaceutical imports.

Despite the recent wins, Novo Nordisk is far from being out of the woods yet. The company stumbled through 2025 despite finally resolving U.S. supply constraints for Ozempic and Wegovy. NVO had cut its sales and operating profit growth outlook twice in 2025 due to weaker-than-expected momentum of these drugs because of intensifying GLP-1 competition from Eli Lilly, foreign exchange headwinds, and widespread compounded semaglutide use in the United States. Eli Lilly markets its tirzepatide (GLP-1) medicines as Mounjaro for T2D and Zepbound for obesity. Despite being on the market for just over three years, these drugs have become LLY’s key top-line drivers.

To turn things around, Novo Nordisk underwent a major structural shift, appointing a new CEO and making significant changes to its board of directors. CEO Mike Doustdar announced a major restructuring program in September 2025 to streamline operations and reinvest in its core diabetes and obesity businesses.

Viking Therapeutics is one of the few biotech stocks that has shown immense potential in this space. Its experimental obesity drug, VK2735, has shown blockbuster potential, having demonstrated superior weight reduction capabilities in clinical studies, both as a subcutaneous (SC) injection and an oral pill.

However, the stock price suffered a significant dive in 2025 after VKTX reported mixed top-line results from a mid-stage study evaluating the safety and efficacy of the oral formulation of VK2735. Patients on the highest drug dose lost up to 12.2% of their body weight after 13 weeks of daily dosing compared with 1.3% in the placebo group. However, a significant number of patients dropped out of the study due to adverse events. The discontinuation rate among VK2735-treated participants was about 28% compared with 18% for placebo.

The higher-than-expected dropout rates in the study were a disappointment. Viking Therapeutics assured investors that it might mitigate the side effects of oral VK2735 by gradually moving patients from lower to higher doses. However, the results have raised concerns about the drug’s tolerability and safety profile. The company is on track to meet with the FDA to determine the next steps for oral VK2735 soon.

Some investors also worry that the safety concerns seen in the oral formulation could affect the SC version, which is currently being evaluated in two late-stage studies. While one has already completed patient enrolment, VKTX expects to complete enrollment in the other in first-quarter 2026. However, from both phase III studies are not expected until 2027.

Beyond VK2735, Viking Therapeutics is expanding its obesity pipeline. It plans to file an investigational new drug application to begin clinical studies on its novel dual amylin and calcitonin receptor agonist for obesity treatment soon. VKTX has decided to focus only on the obesity pipeline while exploring collaboration opportunities for its non-alcoholic steatohepatitis and X-linked adrenoleukodystrophy candidates.

Yet, VKTX’s biggest challenge lies in its lack of an approved product in its portfolio and the intense competition from pharma giants that already dominate the obesity landscape.

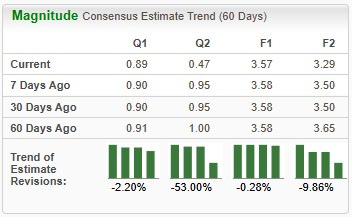

The Zacks Consensus Estimate for Novo Nordisk’s 2025 sales and earnings per share (EPS) implies a year-over-year increase of around 14% and 9%, respectively. EPS estimates for both 2025 and 2026 have been trending downward over the past 60 days.

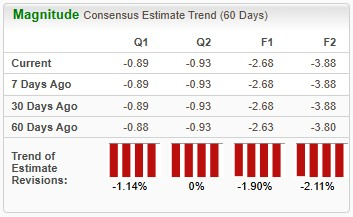

Devoid of a marketed product, we expect Viking Therapeutics’ 2025 loss per share to widen by approximately 165%. Loss estimates for 2025 and 2026 have widened over the past 60 days.

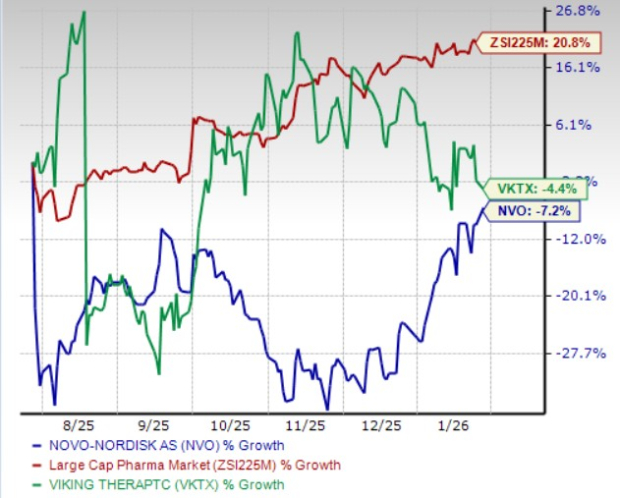

In the past six months, shares of NVO have lost 7.2%, while those of VKTX are down 4.4%. In comparison, the industry has returned 20.8%, as seen in the chart below.

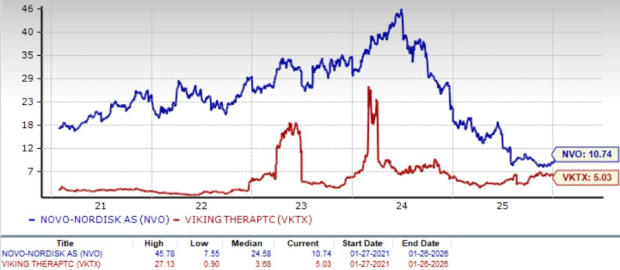

From a valuation standpoint, Novo Nordisk is more expensive than Viking Therapeutics, going by the price/book (P/B) ratio. NVO’s shares currently trade at 10.74 times trailing book value, higher than 5.03 for VKTX.

Both Novo Nordisk and Viking Therapeutics currently carry a Zacks Rank #4 (Sell) at present, which makes a clear winner difficult to determine. However, from the point of view of a safer bet, Novo Nordisk is undoubtedly the way to go.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Despite the risks surrounding both stocks, Novo Nordisk offers a relatively more resilient investment case. Unlike development-stage peers, NVO has a well-established revenue base supported by its marketed GLP-1 portfolio. While competitive pressures and execution challenges weighed on results in 2025, the company has multiple catalysts that could support a recovery. The recent approval and early uptake of oral Wegovy meaningfully expand patient access and could help revive sales momentum in 2026. Combined with broader distribution partnerships across U.S. pharmacies, telehealth providers, and digital platforms, Novo Nordisk is better-positioned to convert demand into sustainable revenues, making it a more suitable option for long-term investors.

In contrast, Viking Therapeutics remains a higher-risk bet. The company lacks an approved product and consistent revenues, leaving its valuation heavily dependent on clinical outcomes. Mixed mid-stage data for oral VK2735, particularly higher discontinuation rates, have raised concerns that now hinge on upcoming FDA discussions. Meanwhile, pivotal data from the injectable version are not expected until 2027, extending the timeline of uncertainty. Given the binary nature of clinical development and intense competition in obesity treatments, VKTX appears less suitable for both short- and medium-term investors, while Novo Nordisk offers a comparatively safer long-term profile.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| 16 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite