|

|

|

|

|||||

|

|

Freeport-McMoRan Inc. FCX is slated to report first-quarter 2025 results before the opening bell on April 24. While higher unit costs are likely to have impacted FCX’s performance, it is expected to have benefited from higher realized copper prices.

The Zacks Consensus Estimate for first-quarter earnings has been revised downward in the past 60 days. The consensus estimate for earnings is pegged at 24 cents per share, suggesting a 25% year-over-year decline. The Zacks Consensus Estimate for revenues currently stands at $5.31 billion, indicating a 16% decline on a year-over-year basis.

FCX beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed once. It has a trailing four-quarter earnings surprise of 15.2% on average.

Our proven model does not conclusively predict an earnings beat for FCX this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

FCX has an Earnings ESP of 0.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

(Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Freeport’s first-quarter results are expected to have been aided by higher copper prices. Copper saw a strong rebound in the first quarter after slumping nearly 12% to around $4 per pound in the fourth quarter of 2024. Prices surged to a new record high of $5.24 per pound in late March 2025 as buyers stocked up the commodity amid concerns that President Trump could impose tariffs on copper, leading to a disruption in the global supply chain.

Prices of copper were up nearly 25% in the first quarter, closing at around $5 per pound. Our estimate for first-quarter average realized price for copper for FCX currently stands at $4.40 per pound, which indicates a year-over-year rise of 11.7%.

Higher unit costs are likely to have affected the company’s performance in the March quarter. Freeport’s consolidated unit net cash costs per pound of copper for fourth-quarter 2024 were 9% higher than the prior-year level. The company, last month, said that it now estimates consolidated unit net cash costs for the first quarter to be roughly 5% higher than the January 2025 guidance of $2.05 per pound of copper, mainly due to the timing of gold shipments, which has led to lower by-product credits. Its first-quarter gold sales volumes were impacted by the timing of shipments in Indonesia. FCX expects gold sales to be about 100,000 ounces lower than the January forecast of 225,000 ounces.

FCX’s shares have lost 31.3% in a year, underperforming the Zacks Mining - Non Ferrous industry’s 29.8% decline and the S&P 500’s increase of 4.6%. Its peers, Southern Copper Corporation SCCO, BHP Group Limited BHP and Rio Tinto Group RIO have lost 20.2%, 20.1% and 12.3%, respectively, over the same period.

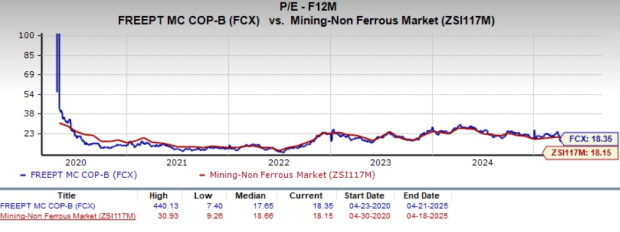

From a valuation standpoint, Freeport is currently trading at a forward 12-month earnings multiple of 18.35X, a roughly 1.1% premium to the peer group average of 18.15X.

Freeport is well-placed with high-quality copper assets and remains focused on strong execution and advancing its organic growth opportunities. It is expected to gain from progress in exploration activities that will boost production capacity. FCX also has a strong liquidity position and generates substantial cash flows, which allow it to finance its growth projects, pay down debt and drive shareholder value. Backed by strong financial health, the company's dividend is perceived to be safe and reliable. The strength in copper prices should also support its profitability and drive cash flow generation.

Freeport faces headwinds from higher costs, which may eat into its margins. FCX is grappling with higher unit net cash costs in North America. Higher labor and mining costs are leading to increased unit costs in the region.

FCX is poised to gain from progress in expansion activities that will boost production capacity. Robust financial health allows FCX to invest in growth projects and drive shareholder value. Despite these positives, declining earnings estimates and high production costs warrant caution. Holding onto the FCX stock will be prudent for investors who already own it, awaiting more clarity on the company’s prospects following its forthcoming earnings release.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 47 min | |

| 6 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 15 hours | |

| 18 hours | |

| 19 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite