|

|

|

|

|||||

|

|

The S&P 500 is pushing to fresh record highs after spending much of the past three months moving sideways, with technology and AI stocks once again leading the advance. As risk appetite improves, investors are rotating back toward higher-beta exposures tied directly to the AI infrastructure buildout.

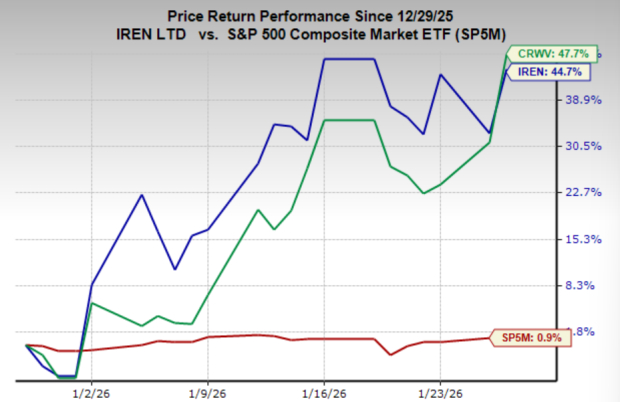

Iren Limited (IREN) and CoreWeave Inc. (CRWV) stand out as two of the most leveraged ways to express that theme. Both stocks are rebounding this week after sharp drawdowns during the market’s consolidation phase, when speculative corners of the market fell out of favor. While they sit farther out on the risk curve, IREN and CoreWeave have emerged as two of the fastest-growing and most closely watched pure-play AI infrastructure names.

Momentum has been reinforced by a major development at CoreWeave. The company recently secured a $2 billion capital injection from Nvidia (NVDA), deepening an existing partnership aimed at accelerating its expansion. CoreWeave plans to scale its AI data-center footprint to roughly 5 gigawatts by 2030, a level that would place it among the largest AI infrastructure operators globally. While some observers have characterized the investment as “circular financing,” Nvidia’s management has pushed back, noting its existing equity stake and the relatively small size of the investment compared to CoreWeave’s long-term capital plans.

IREN, by contrast, is pursuing rapid expansion without external equity injections, leveraging its renewable-energy-powered data centers to scale AI and high-performance computing capacity. With aggressive growth targets and renewed upside momentum in both names, investors are left with a clear question: which, if either of these AI infrastructure plays offers the more compelling risk-reward from here?

Following news that Nvidia would increase its investment in CoreWeave, shares of Iren Limited initially sold off as investors worried that CoreWeave’s scale could overwhelm smaller competitors. That concern proved short-lived. Within 24 hours, buyers returned decisively, pushing IREN shares nearly 9% higher and back toward a key breakout level.

Fundamentally, IREN’s growth profile remains exceptional. The company is expected to grow revenue by roughly 120% this year and another 151% next year, driven by sustained demand for AI and high-performance computing capacity. IREN has already secured a $9.7 billion contract with Microsoft and is rapidly developing five AI clusters across North America. Its flagship Sweetwater 1 asset, a 1.4-gigawatt site scheduled for completion by April, anchors a broader 3-gigawatt power portfolio already secured. If fully leased, management estimates these assets could support $4–$5 billion in annual revenue.

Crucially, power availability has become one of the most binding constraints in AI infrastructure, and IREN’s secured capacity meaningfully de-risks its expansion plans. Technically, the stock has recently broken out from a well-defined base and is consolidating in a bullish continuation pattern. A decisive move higher would likely confirm renewed momentum and reinforce IREN’s position.

While IREN offers a compelling growth story, CoreWeave remains the undisputed leader in the “neocloud,” or outsourced AI data-center market. The gap in current scale is meaningful. By the end of this year, Iren Limited is expected to have roughly 140,000 GPUs deployed, while CoreWeave already operates more than 250,000 GPUs across 30+ data centers, giving it a substantial head start in capacity.

CoreWeave also boasts a powerful growth trend, with revenue projected to grow by more than 125% next year, while total sales are expected to be nearly five times larger than IREN’s. Recent strategic investments and long-term partnerships may further reinforce CoreWeave’s position as a preferred provider of high-performance AI infrastructure as well.

The technical picture mirrors IREN’s. CoreWeave shares have recently broken out from a well-defined base and are now trading sharply higher with strong upside momentum. With accelerating revenue growth, expanding capacity, and clear leadership in the neocloud segment, the breakout suggests investors are once again pricing in CoreWeave’s dominant role in the next phase of the AI infrastructure buildout.

CoreWeave and IREN represent two different expressions of the same powerful AI infrastructure trend. CoreWeave is clearly dominant in scale, with a market cap of $38 billion. IREN, by contrast, is smaller at roughly $14 billion in market value but offers a more power-secured, capital-efficient growth profile that could translate into outsized upside if execution remains on track.

Valuation offers some more insight but does little to settle the debate. IREN trades at roughly 5x sales, while CoreWeave trades closer to 3.3x. With demand for AI compute appearing effectively unconstrained, both companies are positioned to grow rapidly. Ultimately, the choice comes down to investor preference.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite