|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

As of mid-October 2025, pure-play stocks IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. had soared by as much as 6,200% on a trailing 12-month basis.

Although quantum computers offer intriguing real-world use cases, this technology is years away from solving practical problems more cost-effectively than classical computers.

Furthermore, the barrier to entry in quantum computing appears to be far lower than most investors realize.

In terms of global addressable opportunity, nothing tops the long-term potential for artificial intelligence (AI). But in 2025, AI took a back seat to an even more hyped technology: quantum computing.

In mid-October, trailing 12-month returns for pure-play quantum computing stocks IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), D-Wave Quantum (NYSE: QBTS), and Quantum Computing Inc. (NASDAQ: QUBT) reached as much as 6,200%! These are life-altering gains that resulted from investors taking a chance on a potentially game-changing technology.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

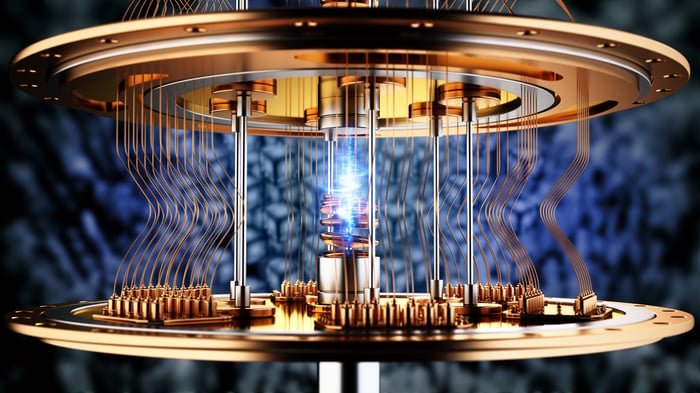

Image source: Getty Images.

When an industry sees many of its most popular stocks skyrocket by four-digit percentages in a year or less, it's not uncommon for the fear of missing out (commonly known as FOMO) to set in. With Wall Street's major stock indexes recently hitting new highs, investors are hoping for an encore performance for quantum computing stocks in 2026.

Unfortunately, three unpleasant truths make a fairy tale ending for quantum computing investors highly unlikely in the new year.

With quantum computing, specialized computers perform rapid, simultaneous calculations to solve complex problems that classical computers can't tackle.

The lure of these next-generation computers is their speed and accuracy. Examples of their usefulness include speeding up the learning process for AI algorithms, improving weather modeling/forecasting, and running molecular interaction simulations to refine the drug development process. Online publication The Quantum Insider believes this technology can create $1 trillion in global economic value by 2035.

Quantum Computing 1 Year Returns 🤯$RGTI +6,217% $QBTS +3,912%$QUBT +2,798%$IONQ +670% pic.twitter.com/tzSN5ZqVjj

-- Connor Bates (@ConnorJBates_) October 13, 2025

Although it's easy to become enamored with pie-in-the-sky addressable markets, the unpleasant truth about next-big-thing technologies is that they all take time to mature and evolve -- and quantum computing is unlikely to be the exception.

At the moment, IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. are still in the very early stages of commercializing their quantum computers. While IonQ and Rigetti have landed a few big fish -- quantum-cloud services from Amazon and Microsoft are allowing clients access to IonQ's and Rigetti's quantum computers -- this is an industry and technology that's years away from mainstream relevance.

Most Wall Street analysts believe it'll be several years before quantum computers can solve practical problems more cost-effectively than classical computers. This suggests the parabolic ascent for quantum computing stocks will give way to numerous potholes and speed bumps as this technology matures.

Image source: Getty Images.

In addition to quantum computing needing time to evolve as a technology, pure-play quantum computing companies will have to demonstrate to investors that their operating model is viable and sustainable, which is easier said than done.

As is often the case with early stage companies, access to traditional financial services is limited or nonexistent. In other words, businesses that aren't profitable and lack operating model validation struggle to access loans and lines of credit from financial institutions.

In order for IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. to facilitate their ongoing research and keep the proverbial lights on, all four companies have turned to share-based dilution to raise capital.

On the one hand, investors shouldn't blame the management teams at any of these companies for selling stock and/or warrants. Following breakneck gains in 2025, the red carpet was rolled out for these highfliers to raise capital. Last year, aggregate at-the-market or private share offerings totaled:

Collectively, pure-play quantum computing stocks raised $4.15 billion in 2025. At the same time, share-based dilution weighed on existing shareholders and threatens to do so in the future.

For instance, IonQ's capital raise included seven-year warrants to purchase another 43.01 million shares of the company's stock at $155 per share. Warrants can act as a share price ceiling for public companies, as they increase the outstanding share count when exercised.

With all four pure-play stocks still years away from any chance at recurring profits, dilution is effectively their only solution.

The third unpleasant truth that investors of IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. will have to face in 2026 is that the barrier to entry for this industry is almost certainly lower than they realize.

Without question, IonQ, Rigetti, and, to some extent, D-Wave are enjoying their first-mover advantage. All three have been able to secure some early stage revenue and land a couple of noteworthy contracts or collaborations. However, maintaining their first-mover advantage is another story with a potentially unhappy ending.

As most investors are likely aware, the "Magnificent Seven" are Wall Street's most influential companies. These are industry-leading businesses with well-defined competitive advantages that are nothing short of cash cows. Most importantly, they all often want their piece of the pie when it comes to a technological innovation.

For instance, we've observed all members of the Magnificent Seven spend billions, if not tens of billions, annually on AI data center infrastructure. Even if AI isn't going to be a major contributor to growth in 2026, these seven market leaders have the capital on their balance sheet and operating cash flow to make aggressive investments for their future.

With the above being said, Alphabet and Microsoft have been investing in a quantum computing future. Alphabet introduced the world to its quantum processing unit (QPU) Willow in December 2024, while Microsoft debuted its Majorana 1 QPU in February 2025. Members of the Magnificent Seven have the luxury of making investments in quantum computing thanks to their foundational operating segments. Early stage quantum computing stocks simply can't compete.

The notoriously low barrier to entry for quantum computing suggests this first-mover advantage for IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. could disappear in 2026, or shortly thereafter.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $462,174!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,099!*

Now, it’s worth noting Stock Advisor’s total average return is 946% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 28, 2026.

Sean Williams has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, IonQ, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Quantum Computing Stocks: Infleqtion Pops In First Day As Public Company

QBTS -6.25% RGTI IONQ

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite