|

|

|

|

|||||

|

|

U.S. consumer sentiment took a sharp hit in January, signaling a tectonic shift in households' perceptions of the economy. Data from The Conference Board showed a steeper-than-expected drop in the consumer confidence index, reflecting growing concern about personal finances and the broader economic outlook. The index fell to 84.5 for the month, down from December’s upwardly revised reading of 94.2, marking the lowest level since 2014.

Persistent concerns about high living costs and limited affordability are eroding optimism, while rising geopolitical tensions continue to cloud the global backdrop. Moreover, aggressive trade policies have amplified business uncertainty. Together, these factors have dampened consumer confidence.

With sentiment now at a decade low, households may become more defensive, especially as the labor market shows signs of cooling and inflation remains high. A more cautious stance could lead to softer consumer spending, potentially tempering sales and earnings growth for consumer-facing sectors.

However, weakening consumer confidence does not justify a complete withdrawal from the retail sector. Industry players such as Dollar General Corporation DG, Walmart Inc. WMT, Dollar Tree, Inc. DLTR and The TJX Companies, Inc. TJX are better positioned to navigate a cautious consumer environment. As households trade down, prioritizing essentials and seeking greater value, these retailers — with scale advantages, pricing flexibility, loyal customer bases and resilient balance sheets — emerge as winners.

Dollar General continues to solidify its market-leading position through a combination of extreme value and unmatched convenience in rural America. The company’s bullish case is anchored by sustained market share gains across both consumable and non-consumable categories, driven by a broadening appeal to higher-income households and improved operational execution. Strategic real estate initiatives, particularly the large-scale "Project Elevate" and "Project Renovate" remodels, are delivering measurable sales lifts and enhanced customer satisfaction, while physical expansion continues to target a vast remaining runway of domestic and international opportunities. Furthermore, the rapid scaling of digital capabilities, including robust delivery partnerships and the high-margin DG Media Network, is successfully extending the company's reach and increasing transaction sizes.

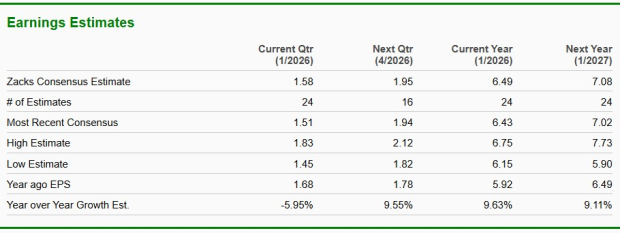

The Zacks Consensus Estimate for Dollar General’s current financial-year sales and EPS implies growth of 4.8% and 9.6%, respectively, from the year-ago reported figure. For the next fiscal year, the consensus estimate indicates a 4.1% rise in sales and 9.1% growth in earnings. DG, which sports a Zacks Rank #1 (Strong Buy), has a trailing four-quarter earnings surprise of 22.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Walmart continues to demonstrate strong market leadership by leveraging its massive scale and increasingly diversified business model. The company’s focus on high-growth, high-margin strategic initiatives, particularly in global advertising, membership services and marketplace expansion, is successfully shifting its profit mix. A robust omnichannel ecosystem has fueled consistent double-digit e-commerce growth, supported by significant advancements in fulfillment speed and store-integrated delivery. Broad-based market share gains across key categories and demographic groups underscore the enduring appeal of its value proposition in a dynamic economic environment. By combining disciplined operational execution with digital innovation, WMT is well-positioned to deliver sustained growth.

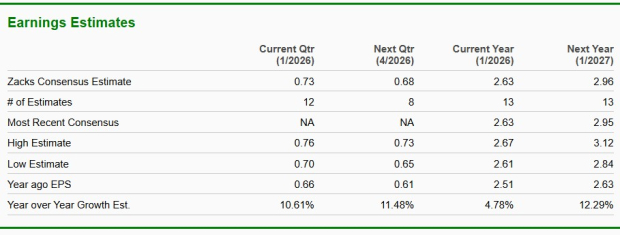

The Zacks Consensus Estimate for Walmart’s current financial-year sales and EPS implies growth of 4.5% and 4.8%, respectively, from the year-ago reported figure. For the next fiscal year, the consensus estimate indicates a 4.5% rise in sales and 12.3% growth in earnings. WMT, which carries a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 0.8%, on average.

Dollar Tree is sharpening its focus as a pure-play value retailer, following the strategic decision to move forward without the Family Dollar brand. The company’s expanding multi-price assortment has broadened consumer appeal, driven stronger discretionary engagement and enhanced merchandising flexibility while preserving its core value proposition. Operational discipline in merchandising, supply chain, cost management and store execution strengthens the company’s ability to scale efficiently. With growing appeal across income groups, a differentiated value proposition and a clear strategic roadmap with an optimal capital allocation framework, Dollar Tree is well-positioned to deliver sustained performance and long-term shareholder value.

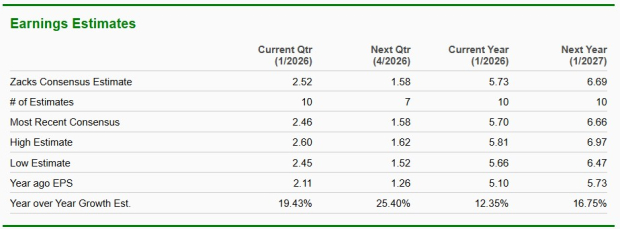

The Zacks Consensus Estimate for Dollar Tree’s current financial-year EPS implies growth of 12.4% from the year-ago reported figure. For the next fiscal year, the consensus estimate indicates a 6.5% rise in sales and 16.8% growth in earnings. This Zacks Rank #2 company has a trailing four-quarter earnings surprise of 29.1%, on average.

TJX's strong off-price business model is supported by a portfolio of well-known retail banners and a compelling value proposition that resonates across income levels and geographies. Through its extensive sourcing network, the company creates a "treasure hunt" shopping experience that drives consistent foot traffic. Management’s disciplined approach to inventory flow, ongoing store expansion and international growth, including planned entry into Spain, strengthens TJX’s ability to capture market share. Sustained investments in store execution, supply-chain efficiency and selective technology initiatives further reinforce competitive positioning. With multiple long-term growth levers and a proven ability to execute through varying economic cycles, TJX looks well-positioned for sustained gains.

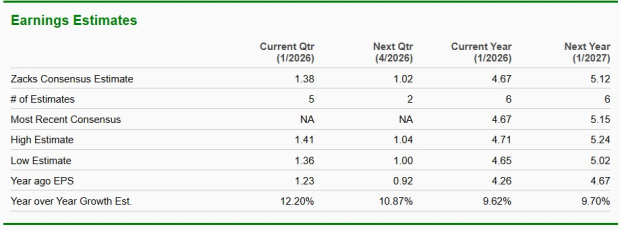

The Zacks Consensus Estimate for TJX Companies’ current financial-year sales and EPS implies growth of 6.5% and 9.6%, respectively, from the year-ago reported figure. For the next fiscal year, the consensus estimate indicates a 5.5% rise in sales and 9.7% growth in earnings. This Zacks Rank #2 company has a trailing four-quarter earnings surprise of 5.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| 8 hours | |

| 9 hours | |

| 13 hours | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite