|

|

|

|

|||||

|

|

MP Materials MP and Lynas Rare Earths Limited LYSDY are two leading players in the global rare earth supply chain, crucial to the production of high-performance magnets used in EVs, defense and high-tech applications.

Rare earth stocks have recently come under renewed investor attention amid the U.S.-China tensions, as China accounts for roughly 70% of global rare earth mining and 90% of processing capacity. Both companies are expected to play key roles in the West’s efforts to secure critical mineral independence and reduce reliance on Chinese supply.

Las Vegas, NV-based MP Materials is the only fully integrated rare earth producer in the United States. It has capabilities covering the entire supply chain, from mining and processing to advanced metallization and magnet manufacturing. MP has a market capitalization of $11.8 billion. Perth, Australia-based Lynas, valued at around $11.5 billion, engages in the exploration, development, mining, extraction and processing of rare earth minerals in Australia and Malaysia.

For investors looking to tap into the long-term growth of the rare earth sector, the key question is which stock one should put their bets on - MP or LYSDY. To make an informed decision, let us analyze their fundamentals, growth potential and key challenges.

MP has established itself as the nation’s only fully integrated rare-earth producer, spanning the supply chain from mining and processing to advanced magnet production.

In July 2025, MP Materials announced a landmark long-term agreement to supply Apple AAPL with rare earth magnets manufactured in the United States, entirely from recycled materials. Also, in July, MP Materials entered into an agreement with the United States Department of War (DoW) to accelerate a domestic rare earth magnet supply chain.

Backed by DoW’s investments, MP will construct the second domestic magnet manufacturing facility (the 10X Facility), which will take total U.S. rare earth magnet manufacturing capacity to 10,000 metric tons and cater to both the defense and commercial sectors. MP also expects to extend the lifespan of Mountain Pass through further exploration and enhanced processing.

MP Materials’ third-quarter 2025 revenues were down 15% year over year to $56.6 million. The company produced a record 721 metric tons of NdPr, marking a 51% year-over-year surge as a result of ramping production of separated products. Rare earth oxides (REO) production was, however, down 4% to 13,254 metric tons, still its second-best quarterly performance.

The Materials segment’s revenues declined 50% year over year to $31.6 million as a 61% increase in NdPr oxide and metal revenues (due to higher sales volumes and prices) was offset by the absence of rare earth concentrates in the quarter. The Magnetics segment generated revenues of $21.9 million in the third quarter. Initial commercial magnet production remains on track for year-end.

Lower revenues, combined with higher selling, general and administrative expenses and increased spending on advanced projects, resulted in a third-quarter loss of 10 cents per share. This was narrower than the 12-cent loss reported in the same quarter last year.

MP’s strategy of producing and selling more separated products at Mountain Pass and the ramp-up of output of magnetic precursor products are expected to have led to higher costs in its 2025 performance and likely result in a full-year loss. The company, however, expects to report profits in the fourth quarter of 2025 and in 2026. With the DoW’s Price Protection Agreement commencing on Oct. 1, 2025, it will provide revenue stability and offset margin pressure.

Lynas has built a reputation as an environmentally responsible producer of rare earth materials, serving global manufacturing supply chains across East Asia, Europe and North America. The company ensures traceability from mine to finished product through its fully integrated and secure supply chain. At the core of its operations is its high-grade, long-life Mt Weld mine in Western Australia.

Concentrates sourced from Mt Weld are processed at its Rare Earths Processing Facility in Kalgoorlie, Western Australia and the Lynas Malaysia advanced materials plant in Kuantan, Malaysia. Lynas has an expenditure-based contract with the U.S. DoD for the construction of a Heavy Rare Earths processing facility at Seadrift, TX.

Lynas achieved a milestone in 2025 with the production of Dysprosium Oxide (Dy) and Terbium Oxide (Tb) on the new production line at Lynas Malaysia. It marked the first commercial production of separated Heavy Rare Earths (HRE) for Lynas, and also the first production outside China in decades.

The Lynas 2025 growth initiative (launched in 2019), designed to deliver increased capacity, enhanced efficiency and improved sustainability across its global operations, has essentially been completed. This included the production of separated HRE at Lynas Malaysia and the completion of the construction phase of the Mt Weld expansion project. The company also ramped up the Kalgoorlie Rare Earths Processing Facility and Mixed Rare Earth Carbonate (MREC) reception facilities in Malaysia and finalized projects in Solvent Extraction and Product Finishing to deliver 10.5 kt p.a. of nameplate finished NdPr capacity.

With the conclusion of major capital projects, Lynas is now embarking on its “Towards 2030” strategy. Its two focal points are optimizing performance from the Lynas 2025 capital investments and expanding its resource and scale, boosting downstream capacity and expanding in the metal and magnet supply chain.

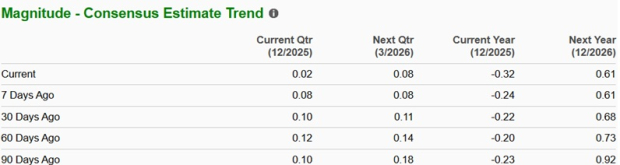

The Zacks Consensus Estimate for MP Materials’ fiscal 2025 earnings is pegged at a loss of 32 cents per share, narrower than the loss of 44 cents in fiscal 2024. The estimate for fiscal 2026 for MP Materials is pegged at earnings of 61 cents per share.

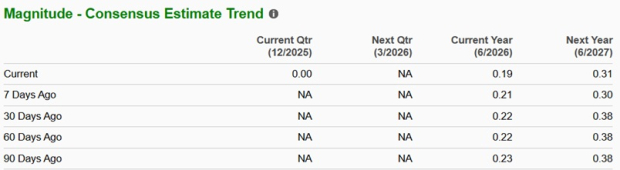

The Zacks Consensus Estimate for Lynas’ fiscal 2026 earnings (ending June 2026) is 19 cents per share, indicating a substantial increase from earnings of one cent in fiscal 2025. The fiscal 2027 estimate of 31 cents indicates 66% year-over-year growth.

Both the estimates for MP Materials’ fiscal 2025 and fiscal 2026 have been revised downward over the past 60 days. Lynas’ fiscal 2026 and fiscal 2027 estimates have also moved down in the past 60 days. This is shown in the charts below.

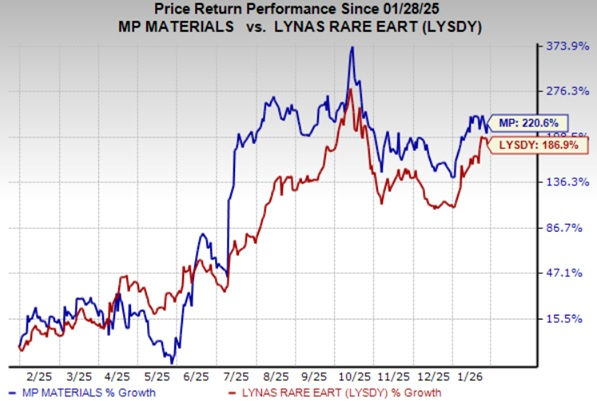

In the past year, MP Materials stock has gained 220.6% compared with Lynas’ 186.9% gain.

MP Materials is currently trading at a forward 12-month price-to-sales ratio of 24.56X, a significant premium to the industry’s 1.35X. Lynas is also trading higher than the industry, but at a lower forward 12-month price-to-sales ratio of 13.95X.

MP and LYSDY stocks offer long-term strategic potential in the promising rare earth space. MP has been reporting upbeat production numbers and making investments in boosting production capacity, but elevated costs will continue to pressure earnings, with the current year likely ending in a loss. Meanwhile, Lynas appears better positioned, supported by strong growth projections. Lynas has outperformed MP in terms of share price gains and offers a cheaper valuation. Overall, Lynas represents the more compelling buy for investors seeking exposure to rare earths.

Lynas currently carries a Zacks Rank #2 (Buy) while MP Materials has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Apple To Hold Product Event On March 4. Cheaper iPhone Seen But No AI Siri

AAPL

Investor's Business Daily

|

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite