|

|

|

|

|||||

|

|

QT Imaging Holdings, Inc. QTIH recently announced a collaboration with Olea Medical aimed at enhancing visualization, quantitative analytics and multimodality integration across its cloud imaging platform. Olea Medical brings established quantitative analytics and multimodality capabilities spanning magnetic resonance (MR), computed tomography (CT) and ultrasound (US) imaging.

Under the collaboration, Olea Medical’s advanced visualization, quantitative analytics and AI-ready imaging capabilities will be integrated into QT Imaging’s cloud-based SaaS platform. The integration is expected to enhance clinical interpretation, support research workflows and enable advanced quantitative imaging analysis. This initiative builds on QT Imaging’s existing cloud infrastructure and will be deployed through the InteleShare platform, which serves as the enterprise PACS and cloud backbone for the company’s clinical and research implementations.

Per management, the collaboration with Olea Medical enhances QT Imaging’s cloud platform by expanding its clinical visualization and analytical functionality. Combined with the enterprise-scale delivery infrastructure being implemented, the collaboration enhances QT Imaging’s ability to deliver secure, high-performance cloud-based imaging with advanced analytics, supporting both clinical care and research use cases.

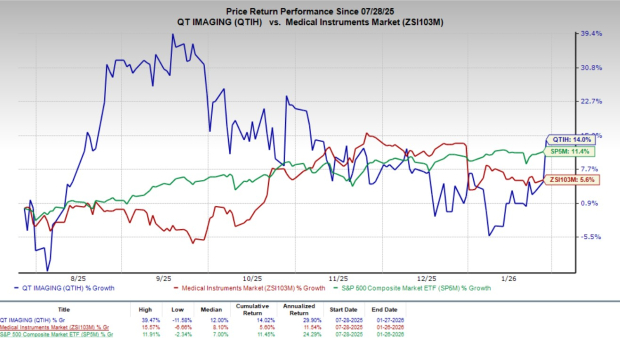

Following the announcement, shares of QTIH gained 8.3% at yesterday’s closing. Over the past six months, shares of the company have climbed 14% compared with the industry’s 5.6% growth and the S&P 500’s 11.4% rise.

In the long run, by combining innovative acoustic imaging with Olea Medical’s trusted, clinically validated software, QT Imaging strengthens its value proposition to providers and researchers, positioning the company to participate in the evolution of data-driven, quantitative breast imaging. The partnership supports broader multimodality integration, enabling QT Imaging to position its solution more competitively within existing breast imaging workflows. The collaboration strengthens the company’s plan to offer a single, cloud-based imaging platform that connects its new acoustic imaging technology with standard radiology tools and advanced analytics by leveraging a trusted, established imaging software partner.

QTIH currently has a market capitalization of $71.55 million.

QT Imaging enables clinical interpretation of its imaging data within its existing infrastructure by integrating Olea Medical’s validated visualization and quantitative analytics technologies. The combined platform supports a scalable, multimodality breast imaging workflow, bringing together mammography, digital breast tomosynthesis, ultrasound, MR imaging and QT imaging studies across the continuum of breast care. Advanced quantitative analytics, segmentation and volumetric analysis are expected to enhance lesion characterization, improve diagnostic confidence and increase clinical efficiency. Secure, network-enabled access further supports multi-institutional collaboration, centralized research operations and standardized execution of clinical trials.

The collaboration is aligned with QT Imaging’s strategic roadmap to drive broader adoption of its Breast Acoustic CT technology while enabling future AI- and machine learning-based analytics through its cloud infrastructure. The company will offer the QT Imaging Olea Vision software, a customizable 3D and 4D DICOM viewer with user-defined hanging protocols. The software allows smooth navigation across DICOM series, advanced 3D viewing and image manipulation capabilities and incorporates subtraction tools to enhance diagnostic assessment.

Dr. Faycal Djeridane, Founder and CEO of Olea Medical, stated that the collaboration with QT Imaging extends Olea Medical’s advanced visualization and quantitative imaging capabilities into next-generation breast imaging solutions, reflecting a shared focus on clinically relevant innovation, multimodality integration and quantitative imaging. Overall, this collaboration supports QT Imaging’s goal of delivering patient-centered imaging solutions while expanding its addressable market across clinical care and research settings and positions the company for long-term growth, broader clinical acceptance and increased competitiveness in the medical imaging landscape.

Going by data provided by Precedence Research, the artificial intelligence in the breast imaging market is anticipated to be valued at $666.9 million in 2026 and is expected to witness a CAGR of 15.9% through 2035. Factors like high breast cancer incidence and prevalence rate, a favorable framework for reimbursement for breast cancer diagnosis, increased breast cancer awareness and early detection, growing health insurance and an increasing aging population are driving the market’s growth.

QT Imaging announced a distribution agreement with Al Naghi Medical Co. for its QTI Breast Acoustic CT scanners and QTI Cloud Platform in the United Arab Emirates. The agreement provides for minimum committed orders totaling 43 scanners between 2026 and 2028, representing more than $24 million in anticipated revenues and marking a meaningful expansion of the company’s international footprint. The partnership leverages NMC’s established regional distribution capabilities and positions QT Imaging to address a market with a high incidence of breast cancer. This agreement supports QT Imaging’s commercialization strategy while advancing the adoption of its cloud-enabled imaging and analytics platform in a key growth market.

QT Imaging Holdings, Inc. price | QT Imaging Holdings, Inc. Quote

Currently, QTIH carries a Zacks Rank #3 (Hold).

Some top-ranked stocks from the broader medical space are Veracyte VCYT, AtriCure ATRC and Boston Scientific BSX.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.7% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

AtriCure, currently sporting a Zacks Rank #1, reported a third-quarter 2025 adjusted loss of 1 cent per share, narrower than the Zacks Consensus Estimate by 90.9%. Revenues of $134.3 million beat the Zacks Consensus Estimate by 2.1%.

ATRC has an estimated earnings growth rate of 91.7% for 2026 compared with the industry’s 16.9% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 67.1%.

Boston Scientific, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion beat the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.1% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite