|

|

|

|

|||||

|

|

Shares of Ares Capital Corporation ARCC have lost 10.4% in the past six months compared with the industry’s decline of 11.6%. The stock has underperformed the S&P 500 Index’s 11.5% growth.

If we take into consideration its two close peers, Amalgamated Financial Corp. AMAL and Hercules Capital, Inc. HTGC, it appears that the ARCC stock has performed worse than both AMAL and HTGC. In the past six months, Amalgamated Financial has rallied 27.8%, while Hercules Capital stock has lost 2.2%.

The primary reason behind the decline in ARCC’s share price has been the interest rate cuts. Business development companies are sensitive to yield compression, which is the narrowing gap between what they earn on floating-rate loans and what they pay on borrowed funds.

Because the Federal Reserve has been reducing rates since last year, with expectations of more in the near term, the spread on ARCC’s investment portfolio has come under pressure, which weighed on investor sentiment.

Along with this, higher expenses and cautious forecasts for deal flow amid economic uncertainty have put downward pressure on the stock over the past half-year.

Now, the question arises whether you should add the ARCC stock to your portfolio now despite its price decline. In order to understand this, let us dig deeper into the company’s fundamentals and growth prospects.

Robust Originations: In 2024, Ares Capital originated $15.08 billion in gross investment commitments to new and existing portfolio companies. This is impressive compared with $6 billion of gross investment commitments in 2023 and $9.9 billion in 2022. Moreover, in the first nine months of 2025, the company originated $10 billion of gross investment commitments.

From Oct. 1, 2025, to Oct. 23, 2025, ARCC made investment commitments worth $735 million, of which $445 million were funded. Driven by the rise in demand for customized financing, the company is likely to continue witnessing a steady increase in investment commitments.

Additionally, the fair value of Ares Capital’s portfolio investments was $28.7 billion as of Sept. 30, 2025. The fair value of accruing debt and other income-producing securities was $25.9 billion. As of the same date, the net asset value was $20.01 per share.

Total Investment Income Strength: Ares Capital has been witnessing a steady rise in total investment income (its revenues). While the metric declined in 2020, it recorded a five-year (2019-2024) compound annual growth rate (CAGR) of 14.4%, with the uptrend continuing in the first nine months of 2025. The increase was primarily driven by a rise in demand for personalized financing solutions, which boosted investment income.

ARCC is expected to continue witnessing a rise in investment income in the quarters ahead, given the regulatory changes, resilient economic expansion and rising demand for customized financing.

The Zacks Consensus Estimate for ARCC’s 2025 and 2026 revenues is pegged at $3.06 billion and $3.20 billion, respectively, indicating year-over-year growth rates of 2.3% and 4.7%.

Impressive Capital Distributions: As of Sept. 30, 2025, Ares Capital had debt of $15.6 billion, while cash and cash equivalents (including restricted cash) were $1.3 billion. Nonetheless, the company has a revolving credit facility, allowing it to borrow up to $5.5 million as needed.

Given a decent balance sheet position, the company has been engaging in efficient capital distribution activities. ARCC distributes roughly 90% of its taxable income as dividends to maintain its status as a regulated investment company.

In October 2022, it announced a dividend hike of 11.6%, which followed a 2.4% hike in July, a 2.4% hike in February and a 2.5% hike in July 2021.

Also, the company has a share repurchase program in place. In February 2025, it extended its share repurchase authorization of $1 billion, which is set to expire on Feb. 15, 2026. As of Sept. 30, 2025, the entire authorization remained available. Given ARCC’s earnings strength, it is expected to be able to sustain efficient capital distribution plans and, hence, continue to enhance shareholder value.

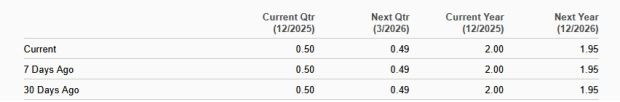

At present, analysts do not seem too optimistic regarding Ares Capital’s earnings growth prospects. Over the past month, the Zacks Consensus Estimate for its 2025 and 2026 earnings has been unchanged.

The estimated figures imply year-over-year declines of 14.2% and 2.2% for 2025 and 2026, respectively.

In a declining interest rate environment, Ares Capital remains well-positioned for growth, given the demand for customized financing and a diversified investment portfolio. A decent liquidity position is another tailwind for the company.

However, while the company’s expenses declined in 2020 and 2022, it saw a CAGR of 16.6% over the five years ended 2024. The upward trend continued in the first nine months of 2025. The rise was mainly due to higher interest and credit facility fees, and income-based fees. Overall costs are likely to remain elevated in the near term as the company continues to expand. While its expansion plans will lead to enhanced growth prospects, the bottom line might face some pressure.

In terms of valuation, Ares Capital’s price-to-book ratio (P/B) of 1.02X is higher than the industry's 0.87X. This shows that the stock is currently trading at a premium, which means that investors may pay a higher price than the company's expected earnings growth.

Thus, despite strength in fundamentals, investors should watch out for the above-mentioned concerns and monitor how Ares Capital navigates the current operating backdrop and generates solid investment income before investing in the stock right now. However, those who already own the stock can hold on to it for robust long-term gains.

Currently, ARCC carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-23 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite