|

|

|

|

|||||

|

|

Coeur Mining, Inc. CDE and Hecla Mining Company HL have been in focus as the broader gold and silver markets show strong momentum, with precious metals prices drawing investor interest into early 2026. Rising gold and silver prices have bolstered sector sentiment, underpinning operational performance and exploration confidence across both companies.

The combination of strong precious metal trends and ongoing project development for both CDE and HL makes them leveraged plays on the current commodity backdrop.

Let’s dive deep and closely compare the fundamentals of these two miners to determine which one is a better investment now.

Coeur has delivered a strong operational performance driven by strategic expansion, robust production growth and disciplined cost management, positioning it as a leading North American precious metals producer. Coeur reported record quarterly production and financial results, including $555 million in revenue and 111,364 ounces of gold plus 4.8 million ounces of silver in the third quarter of 2025, with realized metal prices rising 15% for silver and 4% for gold, contributing to significant margin expansion and strong free cash flow generation.

A key driver of Coeur’s growth is its acquisition and integration of the Las Chispas mine in Sonora, Mexico. This high-grade, low-cost underground operation has now been fully integrated and delivered 1.6 million ounces of silver and approximately 16.5 thousand ounces of gold in the third quarter of 2025.

Coeur’s flagship assets, like Rochester in Nevada, produced roughly 1.6 million ounces of silver and 14.8 thousand ounces of gold in the quarter. Palmarejo in Mexico, which added 1.5 million ounces of silver and 24.8 thousand ounces of gold, is expected to help deliver a total 2025 production of 392,500–438,000 ounces of gold and 17.1–19.2 million ounces of silver.

At the end of September 2025, CDE’s cash and cash equivalents were around $266 million, higher than $77 million a year ago. The debt to capital was 10.5%. Free cash flow in the third quarter was about $189 million.

Hecla Mining delivered record third-quarter 2025 revenues of $409.5 million, 67% higher than the year-ago quarter. It also witnessed strong production metrics, reflecting higher metal prices and solid operational execution.

Hecla Mining produced about 4.6 million ounces of silver in the quarter. Silver contributed nearly 48% of mine-site revenues, while gold accounted for roughly 37%, led by Greens Creek and Casa Berardi. Greens Creek was the largest contributor, delivering 2.3 million ounces of silver and 15,584 ounces of gold, followed by Lucky Friday with 1.3 million ounces of silver, Keno Hill with 898,000 ounces of silver and Casa Berardi adding 25,100 ounces of gold, reflecting consistent performance across all operating mines.

Hecla Mining also benefited from strong realized metal prices in the third quarter, achieving a realized silver price near $42.58 per ounce and a realized gold price of about $3,509 per ounce, reflecting robust pricing and by-product credits. Gold prices remained supportive of margin expansion.

It recently accelerated its growth pipeline with clearly defined projects, timelines and capital commitments. In November 2025, HL received formal regulatory approval for the Polaris Exploration Project in Nevada’s historic Aurora district, clearing the way for exploration drilling to begin in early 2026 at a prospective high-grade gold-silver system near existing infrastructure.

During 2025, the company deployed an approximately $28 million exploration budget, advancing high-grade drilling at Midas in Nevada, expanding mineralization at Keno Hill’s Bermingham zone, and continuing near-mine exploration at Greens Creek to support reserve growth. Hecla Mining plans to increase exploration and pre-development spending to about $55 million in 2026, underscoring a strong focus on resource expansion, mine-life extension and long-term production growth.

At the end of September 2025, HL’s cash and cash equivalents were around $134 million, higher than $22 million a year ago. The debt to capital was 9.9%. Free cash flow in the third quarter was about $91 million.

CDE stock is up 308.8% in the past year, and HL is up 398.9%.

CDE is currently trading at a forward 12-month sales multiple of 6.14X, whereas HL is trading at a forward 12-month sales multiple of 12.58X.

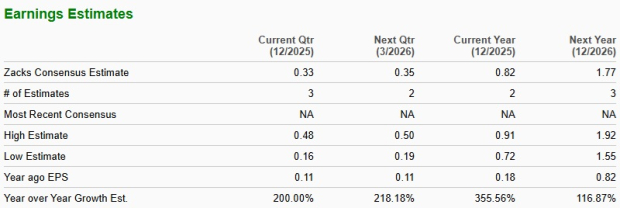

The Zacks Consensus Estimate for CDE’s fiscal 2025 sales implies year-over-year growth of 96%. The same for EPS suggests a 356% year-over-year rise.

EPS estimates for fiscal 2025 have been trending lower over the past 60 days.

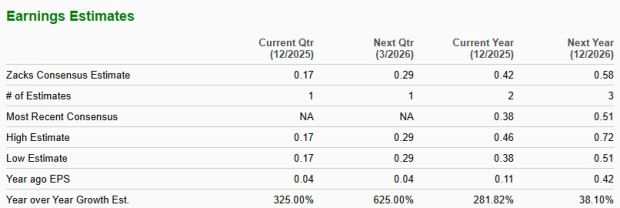

The consensus estimate for HL’s fiscal 2025 sales and EPS implies a year-over-year rise of 42.1% and 282%, respectively.

EPS estimates for 2025 have been trending northward over the past 60 days.

Coeur stands out as the more compelling investment, while Hecla Mining remains an attractive buy. CDE delivered a strong third-quarter 2025 performance, generating $555 million in revenue, 111,364 ounces of gold and 4.8 million ounces of silver, supported by $189 million in free cash flow. Its growth was driven by the successful integration of the high-grade, low-cost Las Chispas mine, alongside consistent production from Rochester and Palmarejo, enhancing both margin expansion and production visibility. Hecla Mining also posted solid results, generating $409.5 million in revenues, 4.6 million ounces of silver and significant gold output from Greens Creek, Casa Berardi, Lucky Friday and Keno Hill, with $91 million in free cash flow, reflecting strong operational execution across its portfolio.

CDE’s higher cash with a conservative debt-to-capital ratio and a lower valuation compared to HL gives it an edge.

Coeur’s combination of production scale and margin efficiency positions it as the preferred stock, with Hecla Mining serving as a complementary buy for investors seeking diversified precious-metal exposure.

CDE sports a Zacks Rank of #1 (Strong Buy), while HL carries a Zacks Rank of #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 10 hours | |

| 12 hours | |

| Mar-08 | |

| Mar-05 | |

| Mar-04 | |

| Mar-03 | |

| Mar-03 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-23 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite