|

|

|

|

|||||

|

|

Workforce solutions provider ManpowerGroup (NYSE:MAN) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.1% year on year to $4.71 billion. Its GAAP profit of $0.64 per share was 22.2% below analysts’ consensus estimates.

Is now the time to buy ManpowerGroup? Find out by accessing our full research report, it’s free.

Jonas Prising, ManpowerGroup Chair & CEO, said "We are pleased with our solid fourth quarter results, which reflect improving stabilization in market trends and continued execution of our go-to market and cost optimization strategy. Throughout 2025, we delivered sequential progress in both revenue and profitability, as adjusted, exiting the year with strengthening trends. France and Northern Europe improved, alongside market-leading performance in Italy. In North America, Manpower and Talent Solutions TAPFIN MSP continued to perform well, while Experis stabilized and RPO and permanent recruitment faced continued headwinds. Looking ahead, assuming current trends hold, we see opportunity to capitalize on improving market demand as we progress technology initiatives to diversify our capabilities and win market share. We will remain agile and continue to execute against our disciplined transformation to drive productivity gains and operating leverage."

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup (NYSE:MAN) connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

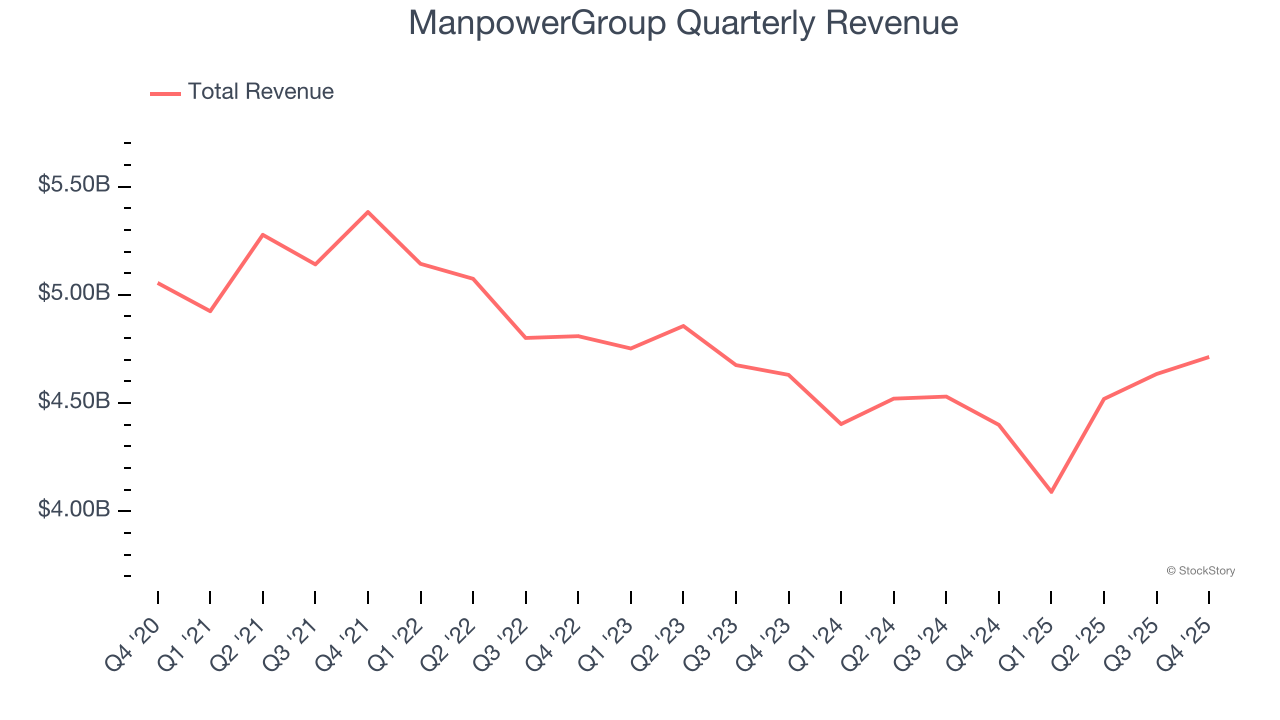

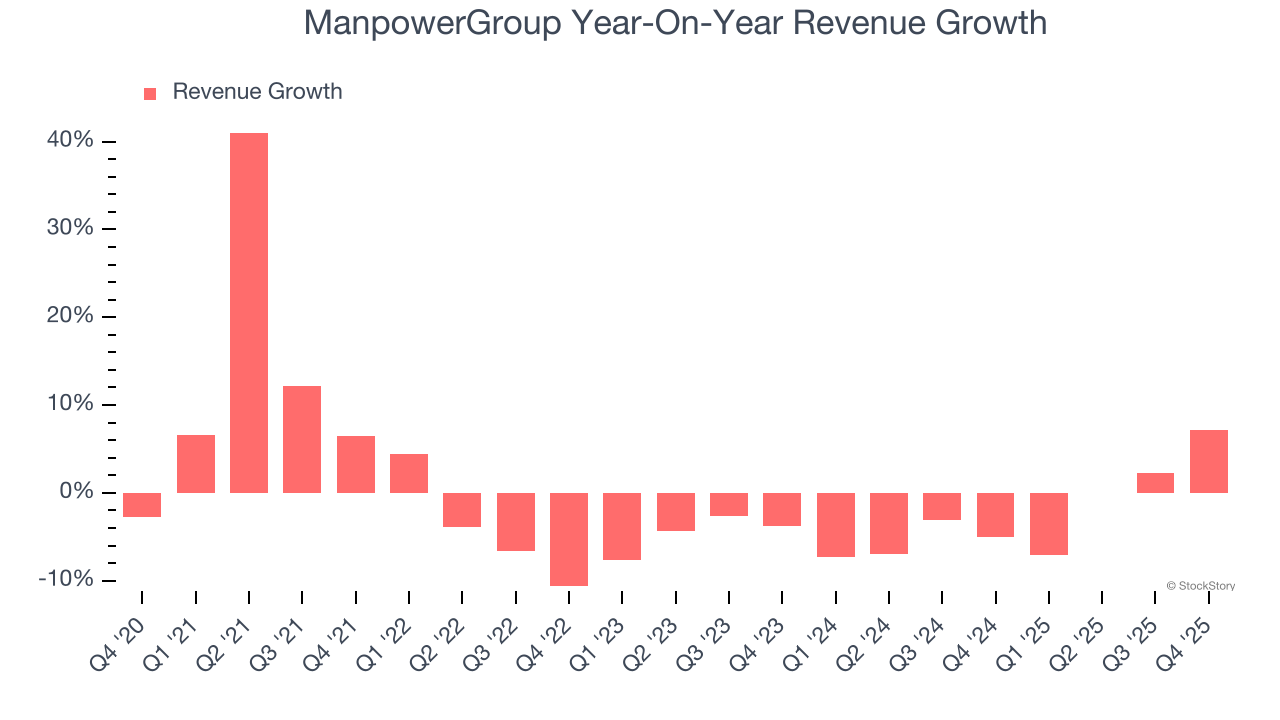

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $17.96 billion in revenue over the past 12 months, ManpowerGroup is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. To expand meaningfully, ManpowerGroup likely needs to tweak its prices, innovate with new offerings, or enter new markets.

As you can see below, ManpowerGroup struggled to increase demand as its $17.96 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. ManpowerGroup’s recent performance shows its demand remained suppressed as its revenue has declined by 2.6% annually over the last two years.

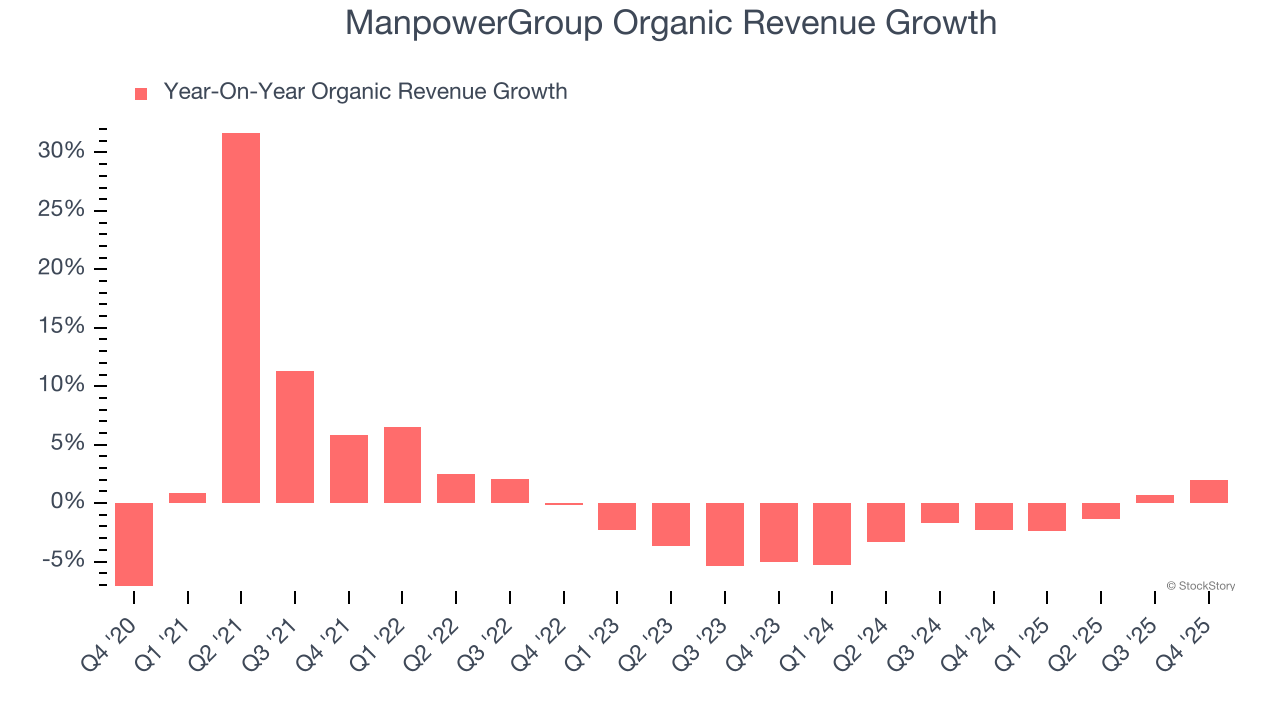

ManpowerGroup also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, ManpowerGroup’s organic revenue averaged 1.7% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, ManpowerGroup reported year-on-year revenue growth of 7.1%, and its $4.71 billion of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

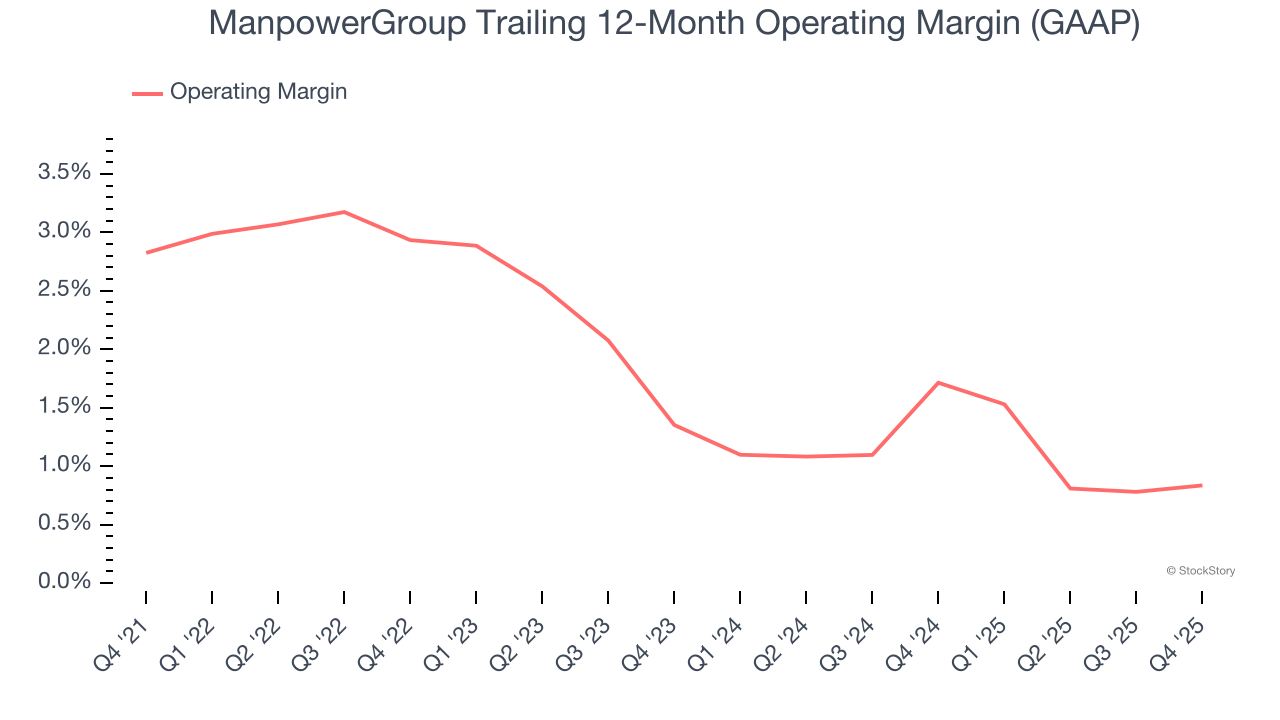

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

ManpowerGroup was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for a business services business.

Analyzing the trend in its profitability, ManpowerGroup’s operating margin decreased by 2 percentage points over the last five years. ManpowerGroup’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, ManpowerGroup generated an operating margin profit margin of 1.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

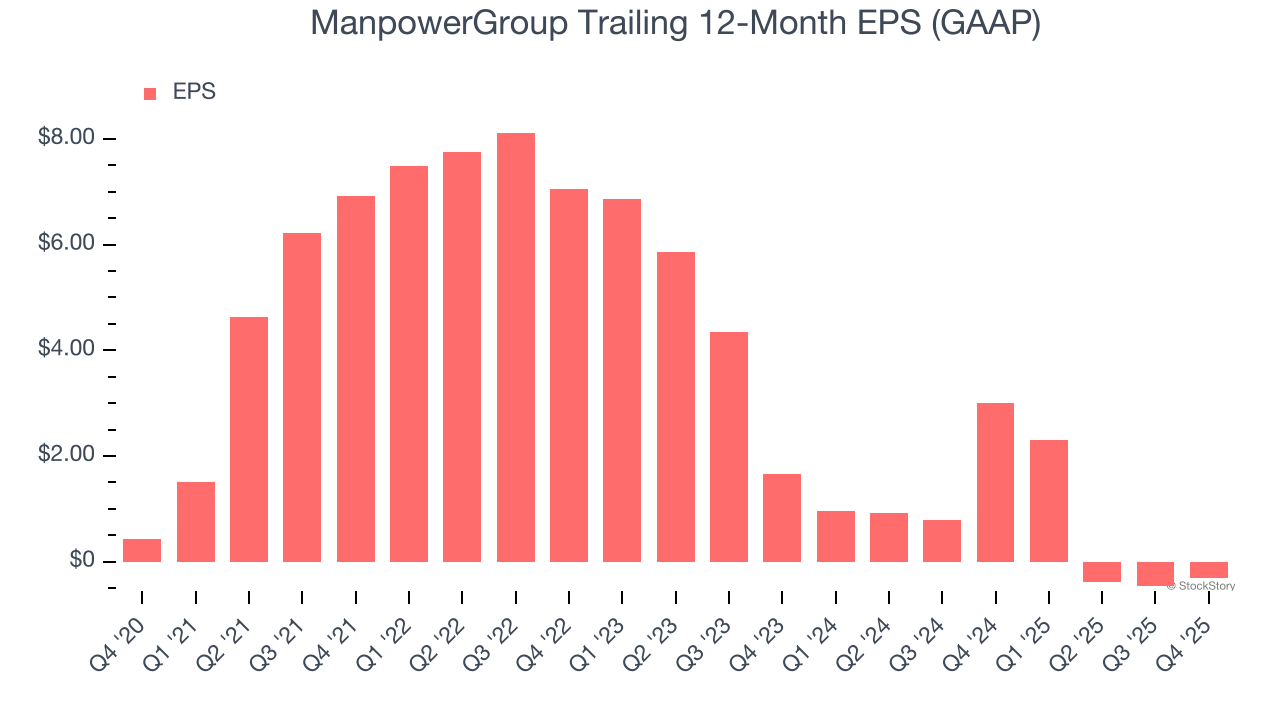

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for ManpowerGroup, its EPS declined by 22% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Diving into the nuances of ManpowerGroup’s earnings can give us a better understanding of its performance. As we mentioned earlier, ManpowerGroup’s operating margin was flat this quarter but declined by 2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For ManpowerGroup, its two-year annual EPS declines of 47.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, ManpowerGroup reported EPS of $0.64, up from $0.47 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast ManpowerGroup’s full-year EPS of negative $0.30 will flip to positive $3.56.

We enjoyed seeing ManpowerGroup beat analysts’ organic revenue expectations this quarter, leading to a revenue beat. Management also called out "improving market demand". On the other hand, its EPS missed. Overall, this was a mixedquarter. Still, the stock traded up 10.2% to $31.90 immediately after reporting.

Is ManpowerGroup an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).

| Feb-26 | |

| Feb-23 | |

| Feb-17 | |

| Feb-05 | |

| Feb-04 | |

| Feb-03 | |

| Feb-02 | |

| Jan-31 | |

| Jan-30 | |

| Jan-30 | |

| Jan-30 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite