|

|

|

|

|||||

|

|

Advancements in artificial intelligence (AI) within the medical technology industry are playing a significant role in improving patient lives by enabling innovative care delivery, reducing healthcare costs and enhancing overall patient outcomes. According to analysis by Porsche Consulting, generative AI is rapidly transforming medical technology industry from a conceptual promise into practical application.

AI is accelerating every stage of research and development, from generative design and virtual testing to clinical trials and regulatory documentation. Simultaneously, the Food and Drug Administration (FDA) actively encourages the development of innovative, safe, and effective medical devices, including those that incorporate artificial intelligence.

Backed by the strong prospects of AI, companies like Tempus AI TEM and Doximity DOCS are likely to be on investors’ radars.

While AI offers substantial benefits in healthcare, it also introduces several challenges and potential drawbacks. According to a HITRUST report, one major concern is data privacy and security, as AI systems rely on generating and processing vast amounts of sensitive patient information. Additionally, emerging regulatory and legal challenges require medical technology companies to navigate complex and evolving frameworks. Finally, the limited trust in AI-generated recommendations poses severe resistance to adoption among healthcare professionals and the public.

In the past year, shares of Tempus have surged 27.2%, outperforming Doximity’s 32.8% decline.

Image Source: Zacks Investment Research

Tempus is developing and deploying a suite of advanced AI algorithms and diagnostic software that run on its multimodal data. In line with this, Tempus entered into a collaboration with Northwestern University’s Abrams Center to harness AI for rapid discovery and innovation in Alzheimer’s disease research.

The collaboration leverages Tempus’ AI-powered data analytics platform, Lens, to analyze and restructure the center’s genomic data repository. Also, the company secured two FDA 510(k) clearances — one for the updated Tempus Pixel cardiac imaging platform and another for its ECG-Low EF software, which uses AI to help identify patients with potentially low ejection fraction.

Most recently, Tempus acquired Paige, an AI company specializing in digital pathology, bringing a proprietary dataset of almost 7 million clinically annotated, de-identified pathology slides to accelerate Tempus’ efforts.

In the third quarter of 2025, Tempus achieved positive adjusted EBITDA for the first time, reaching $1.5 million. Gross profit rose to $209.9 million, reflecting a 98.4% year-over-year increase. This milestone marks a key inflection point in the company’s financial performance, demonstrating improved operating leverage and cost discipline. This achievement strengthened its ability to self-fund growth and pursue long-term opportunities in precision medicine and AI-driven healthcare.

AI is a central pillar of Doximity’s strategy and growth. The company highlighted that AI is deeply embedded across its platform, powering clinical workflows, content discovery, and customer optimization. Its early integration of generative AI through Doximity GPT has accelerated product stickiness and physician utility. Its AI tools, such as document summarization, clinical query generation, and smart faxing, have seen 5x year-over-year growth in usage. As regulatory frameworks for AI in healthcare mature, Doximity’s physician-first, HIPAA-compliant approach positions it to gain share. Meanwhile, pharma clients are increasingly embedding these tools into their campaigns, reinforcing the company’s value as a data-rich omnichannel platform.

Recently, Doximity acquired Pathway Medical Inc., a Montreal-based startup specializing in medical AI and evidence-based clinical reference. Pathway’s model outperforms others in clinical accuracy, recently scoring a record 96% on the U.S. Medical Licensing Examination (USMLE) benchmark.

Doximity delivers standout profitability metrics uncommon in healthcare tech. In fiscal 2025, the company reported a 55% adjusted EBITDA margin and a 39% net income margin, with $267M in free cash flow. With a largely fixed cost structure and high incremental margins, it is capital-efficient and highly cash-generative. This gives the company flexibility to invest in R&D, repurchase shares, and maintain resilience during macro softness.

For 2025, TEM’s loss per share is projected at 64 cents, reflecting a 59.5% improvement from 2024.

Image Source: Zacks Investment Research

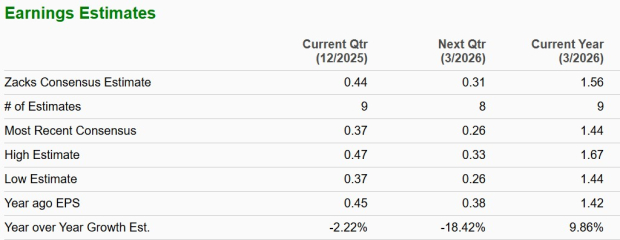

For fiscal 2026, earnings per share (EPS) for DOCS are projected to be $1.56, suggesting a 9.9% improvement from fiscal 2025.

Image Source: Zacks Investment Research

Tempus is trading at a forward 12-month price-to-sales (P/S) ratio of 7.24, below its median of 7.98 over the past year. Meanwhile, Doximity’s forward 12-month P/S ratio is 10.38, below its median of 17.58. However, DOCS is trading at a premium to TEM.

Image Source: Zacks Investment Research

While both Tempus AI and Doximity are positioned to benefit from advancements in the medical technology industry driven by AI, DOCS, a Zacks Rank #2 (Buy) stock, appears better positioned at this stage from a valuation and EPS estimate perspective.

Doximity’s deep AI integration, strategic acquisition, and exceptional profitability position it as a highly resilient and cash-generative healthcare technology leader.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Tempus, which carries a Zacks Rank #4 (Sell), has demonstrated expanding AI capabilities, meaningful regulatory progress, and a recent profitability milestone that together underscore its growing scale and long-term potential in precision medicine. However, Tempus appears more attractive to investors with a long-term outlook.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 15 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite