|

|

|

|

|||||

|

|

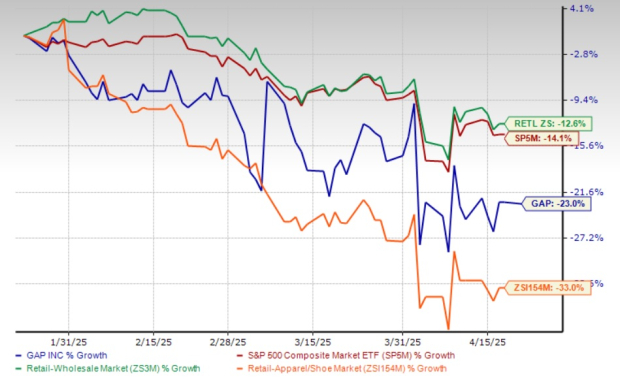

The Gap Inc. GAP has seen its shares decline 23% in the past three months. Most of this decline can be attributed to an uncertain macroeconomic environment, including inflationary pressures and other headwinds like mounting tariff woes. Despite the decline, the stock reflects outperformance compared with the industry’s decline of 33%. However, the GAP stock has underperformed the broader Retail-Wholesale sector and the S&P 500’s declines of 12.6% and 14.1%, respectively, in the same period.

Gap’s performance is notably stronger than its close competitors, including Boot Barn BOOT, American Eagle Outfitters Inc. AEO and Abercrombie & Fitch Company ANF, which declined 47.1%, 38.1% and 41.4%, respectively, in the past three months.

At the current share price of $19.09, the Gap stock’s price reflects a 12.4% premium to the company’s 52-week low of $16.99. Meanwhile, the stock’s price reflects a 37.6% discount from its 52-week high of $30.59.

While the GAP stock reflects a significant decline in recent months, investors continue to analyze whether the decline is a reaction to the ongoing market conditions. Let us find out.

We expect the GAP stock to return to a growth trajectory, given its strong execution, brand momentum and financial discipline, positioning it for sustained growth. As a longstanding force in the apparel industry, Gap maintains a significant market presence through its diverse brand portfolio, which includes Old Navy, Banana Republic and Athleta.

Although the rise of fast-fashion players and direct-to-consumer brands has disrupted the traditional retail landscape, Gap continues to hold its ground. The company is leveraging its rich brand legacy, broad store network and global reach to remain competitive. A strategic turnaround is now well underway, underscored by solid financial results and a series of targeted initiatives aimed at revitalizing its brand portfolio.

Gap has focused on enhancing supply-chain efficiency, implementing cost-saving strategies and driving digital transformation to improve operational agility and customer experience. At the same time, investments in product innovation, sustainability efforts and high-profile collaborations have helped attract younger consumers and reinforce the brand’s cultural relevance. International expansion and accelerated e-commerce adoption strengthen Gap’s long-term positioning.

For fiscal 2025, the company is projecting 1-2% sales growth, signaling confidence in its strategic roadmap despite ongoing macroeconomic challenges. Growth is expected to be led by Old Navy and Gap brands, with Banana Republic showing signs of stabilization and Athleta undergoing a measured recovery.

To support these initiatives, Gap plans to generate approximately $150 million in cost savings. A portion of these savings will be reinvested to fuel growth, while the remainder will help offset inflationary pressures. Despite persistent headwinds, including inflation and tariff uncertainty, management is preparing for a dynamic and resilient fiscal 2025.

On the tariff front, the company has proactively diversified its sourcing. In fiscal 2024, fewer than 10% of its products were sourced from China, with Canada and Mexico representing less than 1% combined. As a result, Gap expects only a limited impact on margins from recently imposed tariffs, reflecting prudent supply-chain management.

The Zacks Consensus Estimate for Gap’s fiscal 2025 earnings per share was unchanged in the last 30 days. The consensus estimate for fiscal 2026 EPS moved down by a penny in the last seven days.

For fiscal 2025, the Zacks Consensus Estimate for GAP’s sales and EPS implies 1.5% and 7.7% year-over-year growth, respectively. The consensus mark for fiscal 2026 sales and earnings indicates 2.1% and 6.9% year-over-year growth, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Gap’s current valuation suggests that the stock is available at a discounted price compared with the industry average. The GAP stock trades at a forward 12-month price-to-earnings (P/E) ratio of 7.94X, significantly lower than the Zacks Retail – Apparel and Shoes industry average of 13.64X and the S&P 500’s 19.08X.

Similarly, the forward 12-month price-to-sales ratio of 0.47X is substantially lower than the industry average of 1.27X and the S&P 500’s average of 4.46X.

At 7.94X P/E, Gap is trading notably below Boot Barn, which commands a higher valuation at 12.8X. However, other competitors American Eagle and Abercrombie are trading at lower forward 12-month P/E multiples of 7.02x and 6.53x, respectively. While Boot Barn enjoys a valuation premium over Gap, the latter still trades at a higher multiple than both American Eagle and Abercrombie, indicating a mixed positioning in the peer valuation landscape.

Although Gap is trading at a low valuation multiple compared with the industry, investors’ decisions on whether to lock in gains, hold or remain bullish on GAP depend on several factors.

Gap has firmly established itself as a leader in the retail apparel space, driven by powerful brand equity, digital innovation, a strong commitment to sustainability and an expanding global presence. Through a focus on product innovation, operational streamlining and a customer-first mindset, the company is well-positioned to adapt to the evolving retail environment while preserving its competitive edge.

As Gap advances its strategic roadmap, it remains well-poised to deliver consistent performance and enhance shareholder value. That said, persistent economic uncertainties and inflationary pressures call for a measured outlook. With its attractive low price-to-earnings ratio and recent share price pullback, the stock presents an attractive entry point for long-term investors. Backed by a Zacks Rank #1 (Strong Buy), Gap offers a timely opportunity for value-focused accumulation. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 16 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite