|

|

|

|

|||||

|

|

Both The Goldman Sachs Group Inc. GS and Evercore Inc. EVR are leading U.S. investment banks, competing in mergers and acquisitions (M&A) advisory and dealmaking. Goldman represents the scale and diversification of a bulge-bracket bank, while Evercore offers the high-margin, focused model of a boutique advisory firm.

After a few years of subdued volumes and episodic dealmaking, 2025 marked a solid revival of global mergers and acquisitions (M&As) due to clarity on several macro issues and easing monetary policy. A strong U.S. economy, a more accommodating regulatory environment under Trump, clearer trade policies and the Federal Reserve’s rate cuts have improved the operating environment for the capital markets business. Against this, which IB stock — Goldman or Evercore Stanley — is a smarter bet for 2026? Let us decipher this.

Goldman is a dominant player in M&A, trading and capital markets. In 2025, the company’s IB revenues rose 21% year over year, supported by a rebound in global M&A activity and capital market issuance. Goldman’s IB division has capitalized on the resurgence in global dealmaking, advising on more than $1.6 trillion in announced M&A volumes in 2025.

Management remains confident in the outlook, projecting an even stronger M&A environment in 2026, provided macroeconomic conditions remain stable. The company has seen high levels of client engagement across its IB business, and expects the activity to accelerate in 2026. With the IB backlog at a four-year high and leadership position, the company is well-positioned to benefit in the upcoming period.

GS has embarked on a deliberate transformation to exit non-core consumer banking and double down on the divisions where it maintains a clear competitive advantage. Hence, the company is accelerating expansion in the asset and wealth management business. In January 2025, Goldman signed an agreement to transition the Apple Card program and associated accounts to JPMorgan.

In December, Goldman agreed to acquire Innovator Capital Management to expand active ETF capabilities, while GS acquired Industry Ventures in the same month to expand its exposure to the innovation economy and solidify its position in the global alternatives market. In September, Goldman expanded its alliance with T. Rowe Price to give individuals greater access to private markets, with the latest offerings set for launch in phases.

Goldman plans to ramp up its lending services to private equity and asset managers and expand internationally. The company's asset management unit intends to expand its private credit portfolio to $300 billion by 2029. Management expects to witness high-single-digit annual growth in private banking and lending revenues over time.

Evercore, though small in size, has established itself as a significant player in the IB space. The company generates most of its revenues from the Investment Banking and Equities business (which constituted 94.5% of total revenues as of Sept. 30, 2025). The metric witnessed a compound annual growth rate (CAGR) of 8.6% from 2017 to 2024, with a rising trend continuing in the first nine months of 2025.

The company is strengthening its IB business footprint by actively increasing staff. As of Sept. 30, 2025, the company employed 207 total Investment Banking & Equities senior managing directors. Going forward, the company’s efforts to boost its client base in advisory solutions, diversify revenue sources and expand geographically will likely support IB revenue growth.

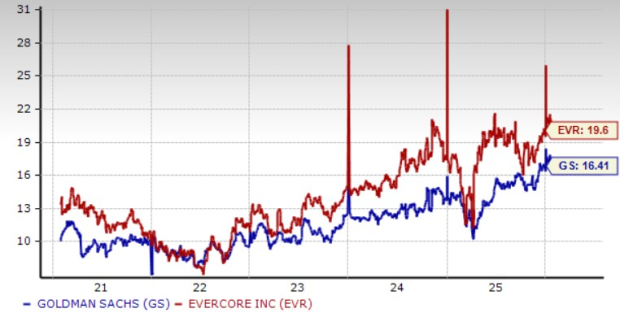

In the past year, shares of Goldman and Evercore have risen 45.1% and 25.5%, respectively, compared with the industry’s growth of 20.6%.

Price Performance

In terms of valuation, Goldman is currently trading at a 12-month forward price-to-earnings (P/E) of 16.4X, higher than its five-year median of 10.6X. The EVR stock, alternatively, is currently trading at a 12-month forward P/E of 19.6X, which is higher than its five-year median of 12.8X. Both stocks are trading at a premium compared with the industry average of 14.5X. However, GS is cheaper than EVR Stock..

Price-to-Earnings F12M

Both companies regularly pay out dividends. GS has a dividend yield of 1.7% while EVR has a dividend yield of 0.9%. Here also, Goldman holds an edge over Evercore.

Dividend Yield

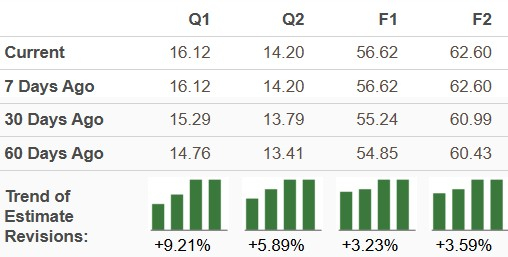

The Zacks Consensus Estimate for GS’s 2026 earnings indicates a year-over-year rise of 10.3%. Earnings estimates for 2026 have been revised upward over the past 60 days.

Estimate Revision Trend

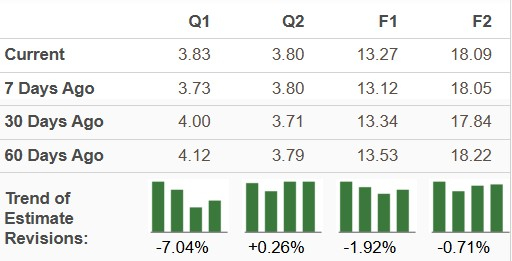

The Zacks Consensus Estimate for EVR’s 2026 earnings suggests a 36.3% year-over-year jump. Earnings estimates for 2026 have been revised downward over the past 60 days.

Estimate Revision Trend

While both Goldman and Evercore are well-positioned to benefit from a continued recovery in global M&A activity, Goldman emerges as the smarter bet for 2026.

Goldman offers a more balanced and resilient earnings profile, combining its leadership in M&A advisory with powerful engines in trading, asset and wealth management, and private credit. Its investment banking backlog is at a multi-year high, client engagement remains strong and management is guiding toward a more robust deal environment in 2026. Importantly, Goldman’s strategic exit from underperforming consumer businesses and its targeted expansion into higher-return areas.

From a valuation standpoint, GS looks more attractive. Despite its strong stock performance in 2025, Goldman still trades at a discount to the industry average, whereas Evercore commands a premium valuation. This gives GS a better risk-reward setup for investors seeking upside without overpaying for growth. Although Evercore’s earnings growth outlook appears higher on paper, recent downward revisions to estimates raise concerns about the sustainability of that growth, particularly given its heavy dependence on advisory revenues.

Evercore remains a high-quality boutique franchise with strong margins and operating leverage in a bullish M&A cycle. However, its narrower business mix makes it more vulnerable to swings in deal activity. In contrast, Goldman’s scale, diversification, capital strength and expanding private credit and wealth management platforms provide a more dependable pathway to long-term value creation.

At present, Goldman carries a Zacks Rank #2 (Buy) while Evercore carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 52 min | |

| 3 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 9 hours | |

| 10 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite