|

|

|

|

|||||

|

|

Rigetti Computing is one of the foremost pure-play quantum computing stocks.

Because Rigetti is so small and quantum computing is so new, the company is likely to struggle in the coming years.

IBM is a much larger, established company with a major quantum computing presence and a dividend to boot.

Quantum computing could very well be the next big thing in the tech world. With its immense computing capacity, this emerging technology could completely revolutionize entire industries.

One of the companies at the forefront of this computing revolution is quantum processing unit (QPU) maker Rigetti Computing (NASDAQ: RGTI). The market seems to agree: The company's stock has soared 137.1% over the last five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

But believing in Rigetti's technology isn't necessarily the same as believing in its stock. Here's why I think investors should forget Rigetti (at least for now) and consider an established AI giant that's a much safer play instead.

Image source: Getty Images.

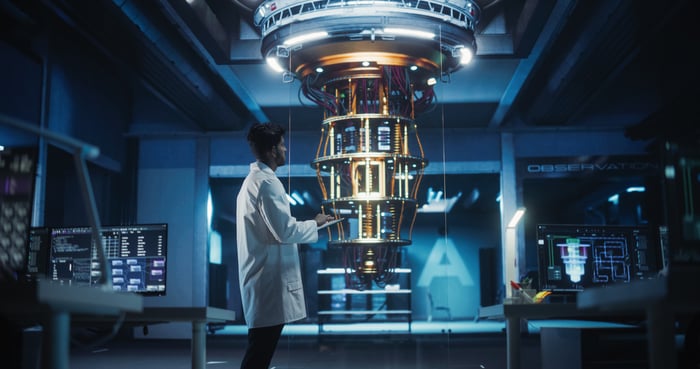

If you think quantum computing sounds futuristic, high-tech, and incredibly complicated, you're not far off. It is high-tech, involving particle physics, supercooling, and huge, expensive machinery. And it is pretty complicated. But it's not some dream that's far into the future: There are hundreds of working prototype quantum computers in existence today.

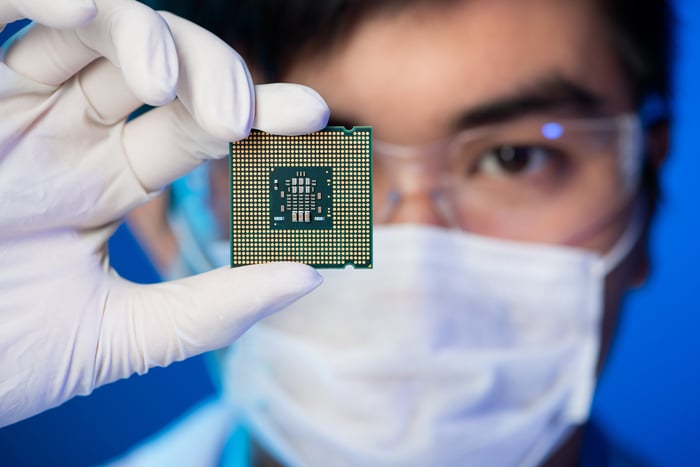

Basically, instead of storing data as binary bits, which can represent either a 0 or a 1, quantum computers use subatomic particles called qubits, which can represent a range of possible options between 0 and 1. If that's hard to wrap your brain around, don't worry: The important thing you need to know is that quantum computers are incredibly fast.

In 2025, for example, the Willow quantum chip from Alphabet's Google performed a computation in less than five minutes that would have taken the world's most powerful supercomputer trillions of years to complete.

Image source: Getty Images.

So why aren't we all using quantum computers at our desks instead of our poky old PCs? Well, right now, quantum computers are incredibly large, expensive, and error-prone. That means the customer base for Rigetti's QPUs is limited to government research labs, universities, and a few other high-tech clients.

Rigetti's financials reflect this limited demand. Its trailing-12-month (TTM) revenue was just $7.5 million, although it just received an $8.4 million purchase order for a 108-qubit quantum computer from India's Centre for Development of Advanced Computing. Despite the limited demand for its products, though, the company has had to make hefty outlays for research & development (R&D), resulting in a TTM net loss of $351 million.

Right now, although Rigetti's 108-qubit system is one of the fastest on the market, its two-qubit gate fidelity -- a measure of accuracy -- is only 99%. That might sound very accurate, but when we're talking about billions of computations per second, even a 1% error rate can add up quickly. The logic gates on your conventional PC or laptop operate with near-100% accuracy.

Image source: Getty Images.

As Tom Petty once sang, "The waiting is the hardest part." That's especially true for very small companies like Rigetti.

It has only about $450 million of cash on its balance sheet. And yet, it's incurring hundreds of millions of dollars in expenses every year. The company has been funding its operations by issuing new shares. Its share count has nearly tripled over the last five years, and it's likely it will continue to grow.

That will dilute the value of existing investors' shares. And with Rigetti's current market cap already at a very optimistic $7.2 billion (higher than, for example, ADT, Mattel, or CarMax), it's very richly valued.

Investors would probably be better off waiting to invest in Rigetti until a larger market for its quantum chips emerges.

Image source: Getty Images.

If you're looking for a top quantum computing stock to buy today, you might want to instead consider International Business Machines (NYSE: IBM).

IBM isn't a pure play on quantum, but that's probably a good thing given how volatile the industry is right now. Instead, it's a research and innovation powerhouse that occupies an important space in many crucial tech industries, including cloud computing and artificial intelligence (AI). In 2025, IBM received 912 patents for generative AI, the third-highest of any company.

That's not to say that IBM isn't a major player in the quantum space. More than 210 clients -- including Boeing, Wells Fargo, the Oak Ridge National Laboratory, and the University of Southern California -- use IBM's quantum computing services.

In 2021, IBM launched a partnership with defense contractor RTX, formerly known as Raytheon Technologies, to develop quantum technologies, including cryptographic technologies that protect vulnerable systems from the kinds of decryption made possible by the power of AI and quantum computing.

For a large company, IBM's stock has been somewhat volatile over the last year as the market has weighed its position in these emerging industries. But its 69.6% gain in net income over the last five years, coupled with a dividend currently yielding 2.3%, makes it a much better bet than Rigetti for long-term investor success.

Before you buy stock in Rigetti Computing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rigetti Computing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $456,457!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,174,057!*

Now, it’s worth noting Stock Advisor’s total average return is 950% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 29, 2026.

Wells Fargo is an advertising partner of Motley Fool Money. John Bromels has positions in Alphabet and CarMax. The Motley Fool has positions in and recommends Alphabet, Boeing, CarMax, International Business Machines, and RTX. The Motley Fool has a disclosure policy.

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite