|

|

|

|

|||||

|

|

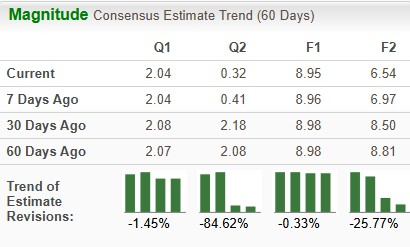

Merck MRK is set to report its fourth-quarter and full-year 2025 earnings on Feb. 3, before market open. The Zacks Consensus Estimate for fourth-quarter sales and earnings is pegged at $16.19 billion and $2.04 per share, respectively. Earnings estimates for 2026 have declined from $8.50 to $6.54 per share over the past 30 days. This is probably due to costs related to Merck’s various M&A deals, like the Verona acquisition, which closed in October, and the Cidara Therapeutics acquisition,which closed this month.

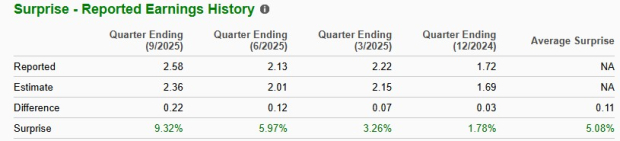

The healthcare bellwether’s performance has been solid, with the company exceeding earnings expectations in each of the trailing four quarters. It delivered a four-quarter earnings surprise of 5.08%, on average. In the last reported quarter, the company delivered an earnings surprise of 9.32%, as seen in the chart below.

Merck has an Earnings ESP of +0.33% and a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1, #2 (Buy) or #3 (Hold) have a good chance of delivering an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Merck’s top-line growth in the fourth quarter is expected to have been driven by higher sales of Keytruda and other oncology drugs, the Animal Health segment and new products, which may be partially offset by lower sales of Gardasil and other vaccines.

In oncology drugs, Keytruda sales are likely to have been driven by rapid uptake across earlier-stage indications globally, particularly early-stage non-small cell lung cancer. Continued strong momentum in metastatic indications is also likely to have boosted sales growth. The Zacks Consensus Estimate for Keytruda’s sales is $8.31 billion.

Higher alliance revenues from Lynparza, driven by increased demand, may have boosted oncology sales. Please note that Merck markets Lynparza in partnership with AstraZeneca AZN.

Merck has a global strategic collaboration with AstraZeneca to co-develop and co-commercialize Lynparza and Koselugo. AstraZeneca and Merck’s Lynparza is approved for four cancer types: ovarian, breast, prostate and pancreatic. Koselugo is approved for the treatment of neurofibromatosis Type 1 patients with symptomatic, inoperable plexiform neurofibromas.

Alliance revenues from Lenvima might have also boosted oncology sales.

Sales of the new drug Welireg are likely to have benefited from higher demand in the United States as well as early launch uptake in certain European markets.

With regard to the HPV vaccine, Gardasil, ex-U.S. sales are expected to have been hurt by lower demand in China and Japan. The Zacks Consensus Estimate for Gardasil is $1.04 billion.

Sales of some other Merck vaccines, like Proquad, M-M-R II, Varivax, Pneumovax 23 and Vaxneuvance, also declined in the third quarter, a trend likely to have continued in the fourth quarter. However, sales of the new vaccine, Capvaxive, are likely to have improved sequentially, driven by demand growth.

In the hospital specialty portfolio, generic competition in certain ex-U.S. markets is likely to have hurt sales of neuromuscular blockade medicine — Bridion injection. However, higher demand is expected to have benefited U.S. sales. The Zacks Consensus Estimate for Bridion is $457.0 million.

Sales of the diabetes franchise (Januvia/Janumet) are expected to have risen as higher net pricing in the United States might have offset lower demand in China and generic competition in most international markets.

New pulmonary arterial hypertension drug, Winrevair’s launch in the United States continues to outperform due to a steady increase in new prescription trends. However, in the third quarter, unfavorable timing of distributor purchases and lower pricing due to Medicare Part D redesign partially offset some of the gains. It remains to be seen if the trend continues in the fourth quarter. In outside U.S. markets, the company is progressing with launches and reimbursement.

The Zacks Consensus Estimate for Merck’s Pharmaceutical unit is $14.66 billion.

In the Animal Health franchise, while sales of livestock products are likely to have increased, those of companion animal products might have declined. The Zacks Consensus Estimate for the Animal Health unit is $1.48 billion.

EPS in the fourth quarter will include costs related to the Verona Pharma acquisition, which closed in October and some other one-time business development charges.

Nonetheless, a single quarter’s results are not important for long-term investors. Let's delve deeper to understand whether to buy, sell or hold Merck stock.

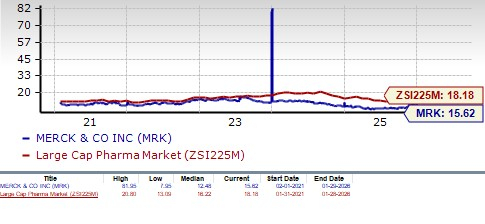

Merck shares have risen 9.4% in the past year compared with a return of 16.1% for the industry.

From a valuation standpoint, Merck appears attractive relative to the industry. Going by the price/earnings ratio, the company’s shares currently trade at 15.62 forward earnings, significantly lower than 18.18 for the industry. The stock is, however, trading above its five-year mean of 12.48. Another large drugmaker that is attractively valued is Pfizer PFE.

MRK Stock Valuation

Merck boasts more than six blockbuster drugs in its portfolio, with Keytruda being the key top-line driver. Keytruda has played an instrumental role in driving Merck’s steady revenue growth over the past few years.

MRK’s phase III pipeline has almost tripled since 2021, supported by in-house pipeline progress as well as the addition of candidates through M&A deals. This has positioned Merck to launch around 20 new vaccines and drugs over the next few years, with many having blockbuster potential. These include Merck’s new 21-valent pneumococcal conjugate vaccine, Capvaxive, and pulmonary arterial hypertension drug, Winrevair, which have the potential to generate significant revenues over the long term. Both products have witnessed a strong launch.

Merck has been on an acquisition spree in the past year, as it faces the looming patent expiration of Keytruda in 2028. Earlier this month, it closed the previously announced acquisition of Cidara Therapeutics for $9.2 billion. The acquisition added CDTX’s lead pipeline candidate, CD388, a first-in-class long-acting, strain-agnostic antiviral agent, currently being evaluated in late-stage studies for the prevention of seasonal influenza in individuals at higher risk of complications.

Last year, it also acquired Verona Pharma for around $10 billion, which added the latter’s lead drug Ohtuvayre, a novel, first-in-class maintenance treatment for chronic obstructive pulmonary disease, with multibillion-dollar commercial potential. Ohtuvayre's commercial launch is off to a solid start.

Though Keytruda may be Merck’s biggest strength and a solid reason to own the stock, it can also be argued that the company is excessively dependent on the drug, and it should look for ways to diversify its product lineup.

There are rising concerns about the firm’s ability to grow its non-oncology business ahead of the upcoming loss of exclusivity (LOE) of Keytruda in 2028.

Also, competitive pressure might increase for Keytruda in the near future from dual PD-1/VEGF inhibitors like Summit Therapeutics’ SMMT ivonescimab that inhibit both the PD-1 pathway and the VEGF pathway at once. They are designed to overcome the limitations of single-target therapies like Keytruda. Pfizer also recently acquired exclusive global ex-China rights to develop, manufacture and commercialize SSGJ-707, a dual PD-1 and VEGF inhibitor, from China’s 3SBio

Merck’s second-largest product, Gardasil, is also seeing grim sales in China and Japan. Merck is also seeing weakness in the diabetes franchise and the generic erosion of some drugs.

Merck has one of the world’s best-selling drugs in its portfolio, Keytruda, which is generating billions of dollars in revenues. Though Keytruda will lose patent exclusivity in 2028, its sales are expected to remain strong until then. Merck’s new products, Capvaxive and Winrevair, are witnessing strong launches and have the potential to generate significant revenues over the long term. Over the last couple of years, it has been acquiring new products like Ohtuvayre. The new products can be long-term growth drivers and help fill the potential revenue gap created by Keytruda’s upcoming LOE.

However, Merck faces several near-term challenges, including persistent challenges for Gardasil in China, potential competition for Keytruda and rising competitive and generic pressure on some of its drugs. All these factors have raised doubts about Merck’s ability to navigate the Keytruda LOE period successfully. Also, estimates have declined recently due to costs related to its various M&A deals. No matter how the fourth-quarter results play out, short-term investors may stay away from MRK stock for now as there seems to be limited upside from current levels. Declining earnings estimates temper the stock’s near-term gains.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 17 hours | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite