|

|

|

|

|||||

|

|

The explosion of data from AI, cloud computing and digital transformation has driven demand for data storage stocks. But not all storage is created equal. Two very different companies — Seagate Technology Holdings plc STX and Pure Storage Inc. PSTG — represent opposing ends of the storage spectrum: traditional hard disk drives (HDDs) versus modern enterprise flash storage. STX leads in hard-disk storage, while Pure Storage specializes in all-flash storage arrays for enterprises, offering contrasting approaches.

Per a report from Fortune Business Insights, the global data storage market is projected to go from $298.5 billion in 2026 to $984.6 billion by 2034 at a CAGR of 16%. Meanwhile, a report from Mordor Intelligence estimates the HDD market to expand from $51.8 billion in 2026 to $69.7 billion by 2031 at a CAGR of 6%, while the enterprise flash storage market is projected to expand from $29.04 billion in 2025 at a 11.42% CAGR to $49.87 billion by 2030.

For diversified investors, owning both captures the full storage stack powering AI and cloud computing. If forced to choose, the decision ultimately comes down to value versus growth, and the future of data infrastructure and your time horizon. Let’s unwrap this in detail.

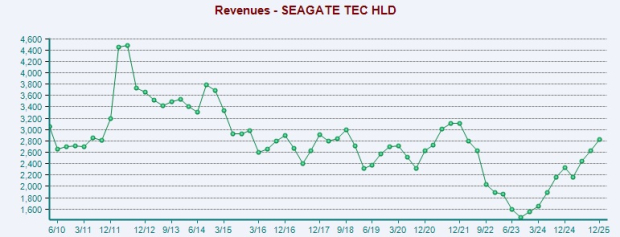

Seagate delivered record results in fiscal second quarter, driven by a successful HAMR ramp and strong data-center demand. With capacity fully booked through 2026, the company expects continued revenue and profit growth. Higher-capacity HAMR drives should boost margins and efficiency, strengthening long-term shareholder value. Revenues of $2.83 billion surpassed the guidance midpoint, up 22% year over year. The December quarter showed steady growth in high-capacity nearline drive demand across global cloud customers and continued improvement at the enterprise edge — momentum the company expects to sustain given its robust build-to-order pipeline.

Management highlighted that modern data centers increasingly need solutions that balance performance with cost efficiency, a trend that strongly favors Seagate’s roadmap. The company’s areal-density-driven strategy aligns well with the long-term growth of AI-generated data, suggesting sustained demand beyond short-term cycles. In the quarter, average nearline drive capacity increased 22% year over year to nearly 23 TB per drive, with even higher averages for cloud customers, underscoring strong adoption of higher-capacity products. Meanwhile, revenue per terabyte remained stable, reflecting disciplined pricing and positioning Seagate to benefit from strong secular demand and tight supply.

Seagate saw strong HAMR momentum in 2025, shipping Mozaic 3 HAMR drives to its first CSP and surpassing 1.5 million quarterly units by year-end. Mozaic 3 is now qualified with all major U.S. CSPs and is on track for global approval by early 2026, while next-gen Mozaic 4 is progressing toward broader CSP qualification and ramp-up. Demand remains very strong, with nearline capacity fully booked through 2026 and growing visibility into 2027 and beyond. Seagate is meeting this demand through higher areal density gains rather than increased unit volumes, supporting its long-term roadmap toward 10TB per disk.

Furthermore, its strong cash flow enables continued investment in innovation and growth, while also supporting consistent shareholder returns through dividends and share buybacks. During the fiscal second quarter, Seagate returned $154 million to shareholders, reduced dilution by retiring $500 million of notes, and expects higher free cash flow ahead. The company will maintain capital discipline while continuing the transition and ramp-up of HAMR technology, with 2026 capital spending expected to remain within its target range of 4%–6% of revenue.

However, Seagate faces headwinds from forex volatility, intense competition and ongoing macroeconomic and supply-chain uncertainty. Its high debt levels also increase financial risk and limit flexibility for buybacks, dividends and acquisitions, which could weigh on long-term growth. As of Jan. 2, 2026, cash and cash equivalents were $1.05 billion, while long-term debt (including the current portion) was $4.5 billion.

Pure Storage faces mounting headwinds from intensifying competition in flash storage, which could pressure pricing and hurt results if volumes fail to scale. Higher NAND costs versus disk alternatives threaten margins, while customers remain cautious amid rising software, SaaS and cloud expenses and uncertainty around AI spending. It operates in a fluctuating macroeconomic backdrop. Conditions are likely to deteriorate further before improving, given the current backdrop of macroeconomic uncertainty, margin pressure and ongoing investment needs.

Management anticipates that rising commodity costs and strong demand will create new pressure on global supply chains, similar to the disruptions seen in 2021–2022. This could result in longer lead times and higher component prices across the technology industry. The near-term outlook remains weak. While long-term investors may choose to stay put, most others have reason to be cautious about the stock at this stage. However, given its dynamic pricing environment, changes in commodity prices tend to impact revenue more than margins. As a result, higher commodity prices are expected to support top-line growth rather than significantly pressure gross margin.

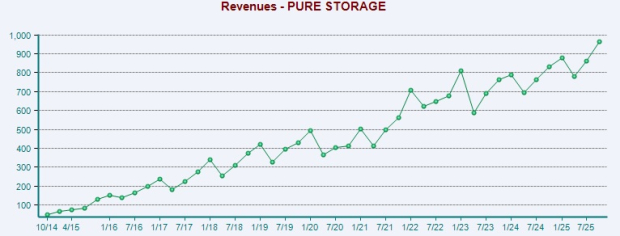

Nonetheless, robust enterprise demand, hyperscaler shipments and strong uptake of subscription and cloud-based offerings augur well. It posted $964.5 million in revenue in the fiscal third quarter, up 16% year over year. Growth was broad-based, with continued momentum in Evergreen//One and modern virtualization offerings like Cloud Block Store and Portworx. PSTG surpassed its full-year hyperscale shipment target early and continues to expand its Enterprise Data Cloud with new Azure-native offerings, FlashArray systems, AI capabilities and cyber-resilience partnerships.

Driven by business momentum, the company raised its fiscal 2026 outlook, projecting higher revenue and operating income growth. It now expects revenues of $3.63–$3.64 billion, up from $3.60–$3.63 billion, indicating 14.5–14.9% year-over-year growth. Non-GAAP operating income is also projected to be $629–$639 million, higher than the previous estimated range of $605–$625 million, implying 12.4–14.2% growth.

Rising demand for FlashBlade, including FlashBlade//E, is boosting Pure Storage as all-flash arrays gain preference for their cost efficiency, lower power use, smaller footprint and simpler management. PSTG’s addressable market is expanding with AI, hybrid cloud and cybersecurity demand. Backed by strong cash flow, record profits and a solid balance sheet, it plans higher R&D and go-to-market investment and authorized an additional $400 million share repurchase.

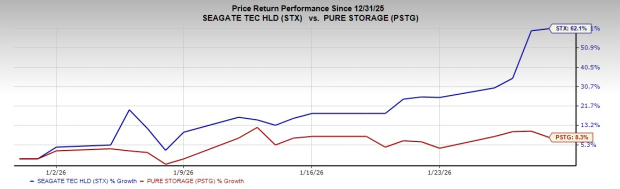

Over the past month, STX and PSTG have registered gains of 62.1% and 8.3%, respectively.

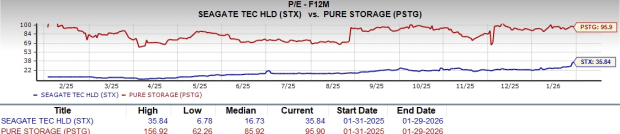

STX looks more attractive than PSTG from a valuation standpoint. Going by the price/earnings ratio, PSTG’s shares currently trade at 95.9X forward earnings, way more than 35.84X for STX.

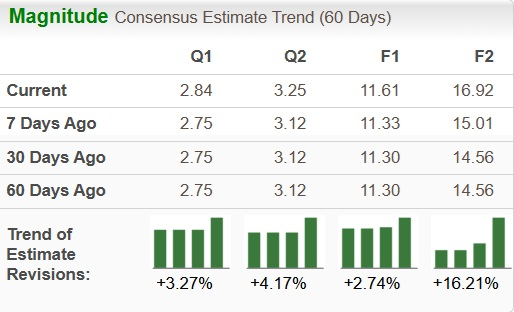

The Zacks Consensus Estimate for STX’s earnings for fiscal 2026 has been revised up 2.7% to $11.61 over the past 60 days.

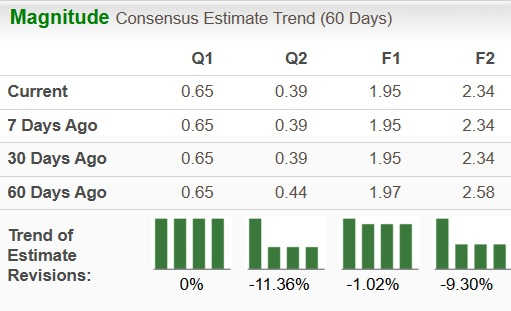

The Zacks Consensus Estimate for PSTG’s earnings for fiscal 2026 has been revised down 1% to $1.95 over the past 60 days.

HDD and flash technologies coexist, serving different economic needs. Both STX and PSTG benefit from AI-driven data growth and hyperscaler demand, strong enterprise and cloud customer exposure and are focused on improving profitability and cash flow discipline. Seagate dominates mass-capacity storage, primarily HDDs used in data centers, cloud archives and backup systems, while Pure Storage focuses on high-performance enterprise flash, replacing legacy disk arrays in mission-critical workloads.

However, PSTG’s higher valuation than legacy storage peers, intense competition, pricing pressure and higher exposure to NAND costs and margin sensitivity make it less appealing than STX at the moment. STX at present sports a Zacks Rank #1 (Strong Buy), while PSTG has a Zacks Rank #4 (Sell). Consequently, in terms of Zacks Rank and valuation, STX seems to be a better pick. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 11 hours | |

| 13 hours | |

| 14 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite