|

|

|

|

|||||

|

|

The global cannabis market is rapidly evolving, with President Trump’s decision to federally reschedule marijuana in the United States representing one of the most consequential regulatory shifts in decades. According to Mordor Intelligence, the cannabis market is projected to witness a 14% CAGR through 2031, rising from an estimated $45 billion in 2026. Prominent players, such as Tilray Brands TLRY and Canopy Growth Corporation CGC, are increasingly drawing investor attention for their potential long-term gains.

Tilray is a lifestyle consumer products company operating at the intersection of cannabis, beverages, wellness and entertainment. Canopy Growth produces, distributes, and sells a diverse range of cannabis and cannabis-related products for adult-use and medical purposes. Let’s take a closer look at both companies to see which one looks like a better investment right now.

Tilray is the top cannabis producer in Canada by revenue and the fourth-largest craft beer brewer in the United States. It also leads in branded hemp wellness products across North America. A disciplined approach to product mix, margin management and premium pricing has supported the company’s re-entry into the high-growth categories, such as vapes and infused pre-rolls. In the fiscal 2026 second quarter, Tilray advanced its innovation pipeline with the launch of Redecan Amped Live Resin Liquid Diamond vapes.

International cannabis revenues increased 36% year over year and 51% sequentially, marking one of the company’s strongest international quarters. Tilray is also expanding its European cannabis footprint, leveraging scale, speed to market, data-driven decision-making and Canadian operation expertise. Meanwhile, the Distribution business also posted a record quarter, with revenues up 26% year over year, led by competitive pricing, portfolio optimization and increased medical device sales.

Tilray's Beverage expansion began in December 2020 with the acquisition of SweetWater and has since scaled significantly, including through Craft Acquisition I from ABI in October 2023 and Craft Acquisition II from Molson Coors in September 2024. To support brand growth and establish a path to profitability, the company implemented Project 420, delivering $27 million in annualized cost savings in the first half of fiscal 2026 and staying on track toward the $33 million-target.

In Wellness, the company is focused on value-added innovation, including high-protein, superseeds, better-for-you breakfast products and better-for-you snacking, while continuing to benefit from the ongoing momentum of HiBall clean energy drinks.

Financially, the company ended the second quarter of fiscal 2026 with cash and marketable securities of approximately $292 million and reduced debt by roughly $4 million, leading to a strong net cash position exceeding debt by almost $30 million.

The company’s second-quarter fiscal 2026 was among its strongest to date, driven by a disciplined focus on fundamentals. The adult-use cannabis business is showing renewed momentum following actions taken earlier this year to tighten the product portfolio, streamline execution with boards and retailers, and refine the sales model. Canopy Growth is building on this momentum with Claybourne innovation, new genetics across the core flower portfolio and PRJ brands, and plans to reach a broader consumer group in the coming quarters.

In the Canadian medical cannabis business, the company’s execution of medical strategy — offering the right products at the right price, consistently in stock and for the right patient segments — is translating into revenue gains. Spectrum Therapeutics has expanded several of its core offerings to enhance value and patient experience. Internationally, Canopy Growth remains committed to the European market and has mobilized efforts to improve supply chain execution, including daily management oversight of logistics, product road maps and licensing. Meanwhile, the newly launched VEAZY Vaporizer by Storz & Bickel is already generating strong customer interest and early sales momentum.

Operationally, Canopy Growth delivered over $21 million in annualized savings through its expense reduction initiative launched earlier in fiscal 2026, surpassing the $20 million target ahead of schedule. The company is also edging closer to achieving positive adjusted EBITDA, supported by margin expansion and disciplined cost management.

The quarter also ended with a significantly deleveraged balance sheet. Canopy Growth reported $298 million of cash and cash equivalents as of Sept. 30, 2025, which exceeded debt balances by $70 million.

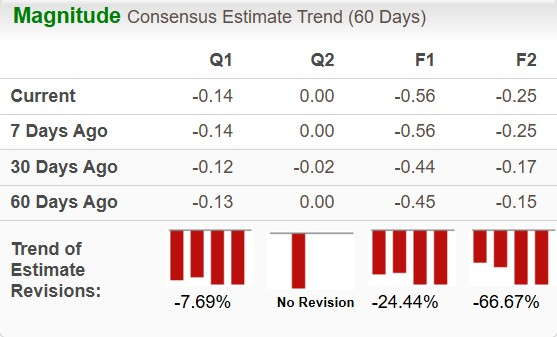

Presently, the Zacks Consensus Estimate for Tilray Brands’ fiscal 2026 loss per share stands at 56 cents compared to 10 cents in the year-ago quarter. Estimates have shown a mixed trend in the past 60 days.

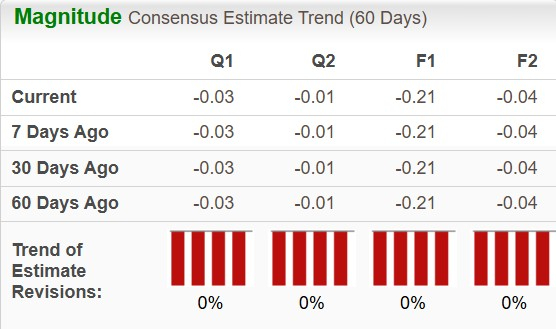

The Zacks Consensus Estimate for Canopy Growth’s fiscal 2026 loss currently stands at 21 cents per share, reflecting a 92.9% improvement from the year-over-year figure. The estimate has remained stable in the last 60 days.

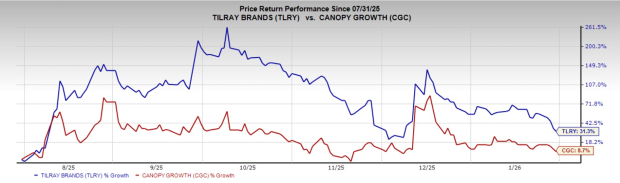

Over the past six months, Tilray Brands shares have climbed 31.3%, while Canopy Growth is up 8.7%.

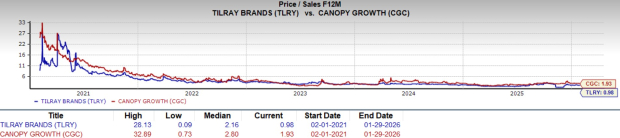

Tilray Brands trades at a forward, five-year Price/Sales (P/S) of 0.98X, below its own median of 2.16X. Canopy Growth trades at 1.93X, also at a discount to its own median of 2.80X.

Both Tilray Brands and Canopy Growth are advancing strategically in the highly fragmented cannabis space. Tilray’s financials highlight strength in the international cannabis business while capitalizing on the beverage and wellness products, alongside liquidity and balance sheet strength.

On the other hand, ongoing momentum in the Canadian adult-use cannabis business, rigorous cost-saving initiatives and a healthier balance sheet favor Canopy Growth. While TLRY and CGC carry a Zacks Rank #3 (Hold) each at present, Tilray’s recent price performance and attractive valuation relatively give it an edge. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite