|

|

|

|

|||||

|

|

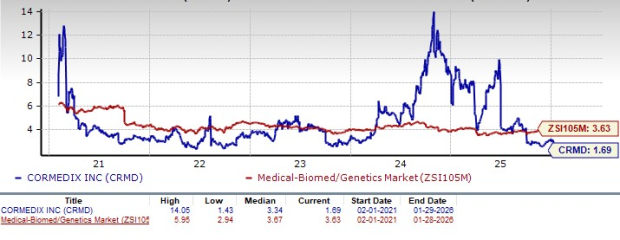

Shares of CorMedix CRMD have declined sharply over the past month, reflecting investor concerns following its bearish 2026 financial outlook. The guidance points to a more conservative growth trajectory for its lead product, DefenCath (taurolidine plus heparin), which has weighed on market sentiment. CorMedix stock has plunged 31% in the past month against the industry’s rise of 4.3%. CRMD’s shares have also underperformed the sector and the S&P 500 Index in this timeframe, as seen in the chart below.

CorMedix witnessed significant growth in 2025, backed by the strong uptake of DefenCath, which was approved by the FDA in 2023 as the first and only antimicrobial catheter lock solution in the United States. The product is indicated to reduce the incidence of catheter-related bloodstream infections in adult patients with kidney failure who receive chronic hemodialysis through a central venous catheter. DefenCath remains the company’s primary source of revenues. However, CorMedix’s most recent financial outlook suggests a more conservative pace of near-term adoption for DefenCath, which has tempered investor expectations that had anticipated higher sales levels relative to 2025.

Let’s dig deeper and understand CorMedix’s strengths and weaknesses to understand how to play the stock amid the recent share price drop.

DefenCath was launched in 2024 in both the hospital inpatient and outpatient hemodialysis settings.

In the first nine months of 2025, DefenCath recorded $167.6 million in net sales, reflecting strong uptake in its early commercial journey. Importantly, DefenCath holds a unique market position as the only FDA-approved therapy for a niche condition, supported by patent protection through 2033. CorMedix is also planning future potential label expansion of DefenCath into total parenteral nutrition to increase its customer base.

CorMedix recently reported preliminary unaudited 2025 pro forma net revenues of about $400 million, which were within its 2025 guidance ($390 million to $410 million).

Management introduced full-year 2026 revenue guidance of $300-$320 million, including $150-$170 million from DefenCath.

DefenCath sales are projected to be front-loaded in the first half of 2026, with only modest utilization gains largely offset by continued pricing pressure. Looking ahead, CorMedix forecasts 2027 DefenCath revenues of $100-$140 million, indicating expectations for higher net selling prices relative to 2026. Notably, the company’s DefenCath guidance for both 2026 and 2027 assumes flat usage among existing customers and does not factor in potential upside from new account wins, Medicare Advantage contracting, or reimbursement changes, underscoring a more conservative and slower-growth outlook than many investors had anticipated.

CorMedix took a significant step toward diversifying its revenues and reducing dependence on DefenCath with the $300 million acquisition of Melinta Therapeutics. The acquisition, which closed in August 2025, added seven approved therapies to CRMD’s portfolio, strengthening its presence in hospital acute care and infectious disease markets.

The acquisition of Melinta broadened CRMD’s revenue base while creating near-term growth opportunities, particularly with Rezzayo, which is currently approved for the treatment of candidemia and invasive candidiasis in adults.

Rezzayo is also in late-stage development for another indication, prophylaxis of invasive fungal infections. Top-line data from this study is expected in the second quarter of 2026.

The Melinta acquisition reinforces CorMedix’s long-term growth strategy, aimed at expanding its hospital-centric product offerings while creating a more durable and diversified commercial platform to support sustainable growth.

Though CorMedix rides on the success of DefenCath, its heavy reliance on the product for revenues remains a worry. Additionally, competition from major players like Pfizer PFE, Amphastar Pharmaceuticals AMPH, B. Braun, Baxter and Fresenius Kabi USA that already market heparin for multiple uses remains a concern.

DefenCath combines taurolidine, an antimicrobial agent, with heparin in a fixed-dose formulation, tailored for a specific subset of kidney failure patients. While CorMedix currently benefits from a first-mover advantage in the United States, the broader competitive landscape continues to present potential risks.

Pfizer, which sells Heparin Sodium Injection across multiple indications such as dialysis, surgery and thrombosis, could leverage its global scale and expertise to enter the CRBSI prevention market. Amphastar Pharmaceuticals, with end-to-end control over enoxaparin production, also has the efficiency and technical capabilities to pursue similar opportunities.

Given their stronger pipelines, larger manufacturing capabilities and greater financial resources, these companies could quickly become significant competitors if they decide to target CRBSI-related indications — a move that could challenge CorMedix’s market advantage and affect its long-term growth outlook.

Also, if either Pfizer or Amphastar Pharmaceuticals expands its anticoagulant portfolio into catheter-related infection prevention, CorMedix could encounter significant competitive pressure within the primary therapeutic space.

From a valuation standpoint, CorMedix is trading at a discount to the industry. Going by the price/book ratio, the company’s shares currently trade at 1.69 trailing 12-month book value per share, lower than 3.63 for the industry. The stock is also trading below its five-year mean of 3.34.

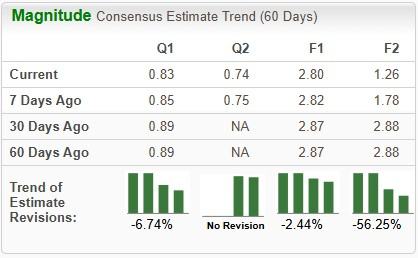

Estimates for CorMedix’s 2025 earnings have declined from $2.87 to $2.80 per share in the past 60 days, and the same for 2026 earnings has decreased from $2.88 to $1.26 over the same timeframe.

CorMedix, currently carrying a Zacks Rank #5 (Strong Sell), is poised to face some near-term uncertainty despite DefenCath’s solid launch. Also, the recent financial outlook has cast a doubt DefenCath's long-term growth and customer adoption as 2026 progresses.

Management’s conservative guidance for DefenCath, reflecting pricing pressure, front-loaded sales and limited utilization growth, has dampened investor enthusiasm. Also, the rising competitive pressure from established players having huge resources remains a worry.

From an investment perspective, CRMD currently lacks meaningful near-term catalysts to drive a sustained recovery in the stock. Ongoing downward revisions to earnings estimates continue to pressure valuation, leaving shares vulnerable to further downside. In this context, investors may be better served by reducing exposure or selling the stock outright.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite