|

|

|

|

|||||

|

|

We expect investors to focus on Viking Therapeutics’ VKTX progress with the development of its lead candidate, VK2735, a dual agonist of the glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide receptors, when it reports fourth-quarter and full-year 2025 results next month.

VK2735 is being studied for treating obesity. Since the company lacks a marketed drug in its portfolio, no revenues are expected to be recorded in the upcoming quarter. The Zacks Consensus Estimate for fourth-quarter earnings is pegged at a loss of 89 cents per share.

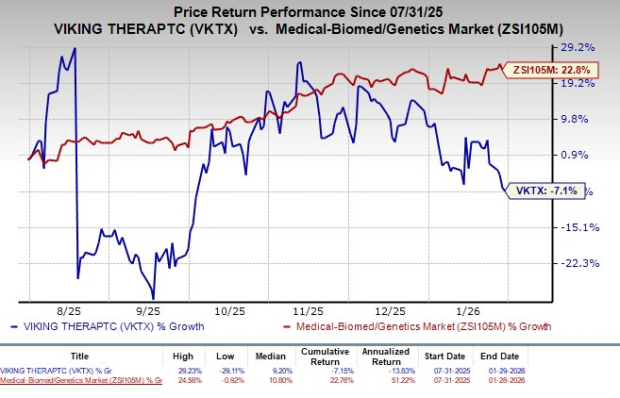

In the past six months, shares of Viking Therapeutics have lost 7.1% against the industry’s rise of 22.8%.

Let’s see how things might have shaped up before the announcement.

Viking Therapeutics is developing VK2735 in multiple late-stage studies as oral and subcutaneous (“SC”) formulations for the treatment of obesity. The company’s pipeline also includes VK2809, which is in mid-stage study for non-alcoholic steatohepatitis (“NASH”), and VK0214, which is in an early-stage study for X-linked adrenoleukodystrophy (X-ALD).

VKTX is conducting two late-stage studies — VANQUISH-1 and VANQUISH-2 — which are evaluating the SC version of VK2735 over a 78-week treatment period. Initiated last year, the VANQUISH-1 study is evaluating the drug in obese adults with at least one weight-related co-morbid condition, while the VANQUISH-2 study is focused on obese or overweight adults with type II diabetes.

Viking Therapeutics completed enrollment in the VANQUISH-1 study in November 2025. The company is on track to complete enrollment of nearly 1,100 patients in the VANQUISH-2 study later in 2026. Further updates on the studies are expected during the upcoming earnings call.

Eli Lilly and Novo Nordisk NVO dominate the obesity space with their respective GLP-1 injections, Zepbound and Wegovy. Novo Nordisk launched its oral Wegovy pill earlier this month, while an FDA decision for Lilly’s oral obesity pill is due in the first half of 2026. This is likely to have brought more competitive pressure to Viking Therapeutics, given its limited resources.

Beyond obesity, Viking Therapeutics' NASH and X-ALD programs have delivered encouraging early results. We expect management to provide more updates on its NASH and X-ALD studies at the upcoming investor call.

Activities related to the development of its pipeline candidates are likely to have escalated Viking Therapeutics' operating expenses in the to-be reported quarter.

Viking Therapeutics has a dismal history of earnings surprises. The company’s earnings missed estimates in each of the trailing four quarters, delivering an average negative surprise of 21.66%. In the last reported quarter, VKTX’s earnings missed estimates by 15.71%.

Viking Therapeutics, Inc. price-eps-surprise | Viking Therapeutics, Inc. Quote

Our proven model does not conclusively predict an earnings beat for Viking Therapeutics this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Viking Therapeutics has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate currently stand at a loss of 89 cents per share.

Zacks Rank: Viking Therapeutics currently carries a Zacks Rank #4 (Sell).

Here are some drug/biotech stocks that have the right combination of elements to beat on earnings this time around:

Castle Biosciences CSTL has an Earnings ESP of +80.95% and a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Castle Biosciences have rallied 158.5% in the past six months. CSTL’s earnings beat estimates in three of the trailing four quarters, while missing the same on the remaining occasion. Castle Biosciences delivered an average surprise of 66.11%.

Moderna MRNA has an Earnings ESP of +4.86% and a Zacks Rank #3 at present.

Shares of Moderna have rallied 58.5% in the past six months. MRNA’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 31.45%. Moderna is scheduled to report fourth-quarter results on Feb. 13.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 min | |

| 14 min | |

| 40 min | |

| 1 hour | |

| 1 hour |

Novo Nordisk Dives As Next-Gen Obesity Drug Lags Eli Lilly's Kingpin

NVO -16.12% VKTX +10.94%

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours |

Stock Market Today: Dow Dives As EU Makes Trump Tariff Move; Novo Plunges On This (Live Coverage)

NVO -16.12%

Investor's Business Daily

|

| 2 hours | |

| 2 hours |

Novo Nordisk Shares Plunge After Obesity Drug Fails to Beat Zepbound

NVO -16.12%

The Wall Street Journal

|

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite