|

|

|

|

|||||

|

|

Novo Nordisk NVO is scheduled to report its fourth-quarter 2025 results before the opening bell on Feb. 4, 2026. The Zacks Consensus Estimate for quarterly revenues in the to-be-reported quarter is pegged at $11.96 billion, while the same for earnings is pinned at 89 cents per share.

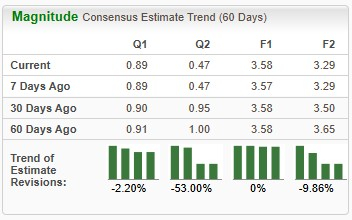

In the past 60 days, the Zacks Consensus Estimate for Novo Nordisk’s 2025 earnings per share (EPS) has remained constant at $3.58. During the same time frame, the company’s 2026 EPS forecast has dropped from $3.65 to $3.29.

Novo Nordisk’s performance has been mixed over the trailing four quarters, with earnings beating estimates in three quarters and matching the mark on the remaining occasion. On average, Novo Nordisk registered an earnings surprise of 11.60% in the trailing four quarters. In the last reported quarter, the company reported an earnings surprise of 32.47%.

Novo Nordisk has an Earnings ESP of +0.09% and a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) have a good chance of delivering an earnings beat, which is not the case for NVO. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Novo Nordisk operates under two segments — Diabetes and Obesity Care and Rare disease.

Novo Nordisk’s fourth-quarter revenues are expected to have been driven by the sale of its diabetes and obesity treatments, particularly semaglutide-based (GLP-1) drugs — Wegovy, Ozempic, and Rybelsus. Wegovy is the largest contributor to the company’s top line. Its label has also been expanded for reducing major cardiovascular events, easing HFpEF symptoms and relieving osteoarthritis-related knee pain in obesity. The drug has also received accelerated approval for noncirrhotic metabolic dysfunction-associated steatohepatitis. NVO is currently seeking regulatory approval for a higher dose Wegovy (7.2mg) with greater efficacy in the United States and the EU.

Ozempic is also the only GLP-1 therapy approved to reduce kidney disease progression and cardiovascular death in patients with type II diabetes (T2D) and chronic kidney disease. The drug is expected to have contributed meaningfully to the top line, along with Rybelsus oral pill, which is approved for T2D and cardiovascular risk reduction. NVO is also pursuing a label expansion of Ozempic in treating peripheral artery disease in the United States and the EU.

Ozempic and Rybelsus sales, along with insulin product sales growth, are also likely to have contributed meaningfully to the top line. Additionally, the Rare Disease segment is expected to have generated incremental revenues for the company.

However, given Novo Nordisk’s July and November guidance cuts amid ongoing headwinds in its GLP-1 franchise, sales of Ozempic and Wegovy are expected to have remained under pressure in the fourth quarter of 2025. The company continues to face slower-than-expected U.S. momentum for both drugs, as unregulated compounded semaglutide products persist in the market despite regulatory crackdowns. Although sales of Ozempic and Wegovy are likely to have posted year-over-year growth, the pace of the growth has probably slowed. This is mainly due to Wegovy’s uptake remaining below expectations amid limited market expansion and rising competition, while Ozempic’s momentum moderated due to intensified rivalry in the U.S. diabetes market.

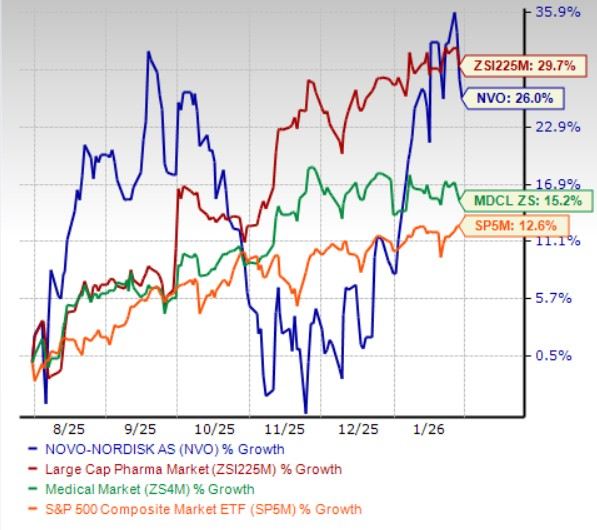

In the past six months, Novo Nordisk shares have gained 26% compared with the industry’s 29.7% growth. The company has, however, outperformed the sector and the S&P 500 during the same time frame, as seen in the chart below.

Novo Nordisk is trading at a discount to the industry, as seen in the chart below. Going by the price/earnings ratio, the company’s shares currently trade at 17.91 forward earnings, which is marginally lower than 18.18 for the industry. The stock is trading much below its five-year mean of 29.25.

Novo Nordiskhas achieved tremendous commercial success with Wegovy and Ozempic since their launch. However, the company’s growth trajectory has suffered in the past year.

NVO revised its 2025 sales and profit outlook twice, reflecting slower-than-expected uptake for Wegovy and Ozempic, due to intensifying competition from arch-rival Eli Lilly LLY, the presence of compounded semaglutide alternatives in its largest obesity market, the United States and foreign exchange headwinds. To turn things around, Novo Nordisk underwent a major structural shift, appointing a new CEO and making significant changes to its board of directors. CEO Mike Doustdar announced a major restructuring program in September 2025 to streamline operations and reinvest in its core diabetes and obesity businesses.

Eli Lilly markets its tirzepatide injections as Mounjaro for T2D and Zepbound for obesity. Despite being on the market for just over three years, both drugs have become LLY’s key top-line drivers. In the first nine months of 2025, the drugs generated combined sales of $24.8 billion, accounting for 54% of Eli Lilly’s total revenues. Following strong third-quarter 2025 results, LLY raised its 2025 full-year revenue and EPS guidance.

Novo Nordisk is also facing mounting U.S. pricing pressure and has introduced early self-pay price cuts for Wegovy and Ozempic in 2025 to revive demand, expand access, and counter intensifying competition, particularly from Eli Lilly. While the strategy aims to regain market share across diabetes and obesity, investors remain cautious as aggressive discounting risks margin compression and adds uncertainty to NVO’s long-term GLP-1 economics, competitive position, and medium-term growth outlook.

Competition in the obesity treatment market is also intensifying as the space has garnered much of the spotlight over the past year due to the sizeable and still underpenetrated market opportunity. Roche RHHBY recently reported strong phase II data for its once-weekly dual GLP-1/GIP RA, CT-388, showing robust and sustained weight loss with a favorable safety profile in obese/overweight adults. Roche is currently gearing up to initiate two phase III obesity studies to evaluate the candidate during this quarter. Smaller biotech firms, like Viking Therapeutics VKTX, are also advancing GLP-1–based therapies to challenge the incumbents. Viking Therapeutics is developing its dual GIP/GLP-1 RA, VK2735, both as oral and subcutaneous formulations for the treatment of obesity.

However, Novo Nordisk secured the long-awaited FDA approval for its oral Wegovy pill to treat obesity and reduce cardiovascular risk in late December, followed by its commercial launch in early January. This marked a major milestone, making Wegovy the first GLP-1 RA available in an oral form for weight management. Compared to injectable formulations, the pill offers a far more convenient administration option. By beating Eli Lilly to the oral GLP-1 market, NVO enjoys the first-mover advantage, which is expected to boost Wegovy sales in 2026. Eli Lilly has also filed a regulatory application seeking the approval of its oral GLP-1 pill, orforglipron, for obesity, which is currently under review by the FDA.

NVO is also making steady progress across its pipeline. The company is advancing new candidates for T2D and obesity, while also working to expand the approved uses of Wegovy, Ozempic and Rybelsus to drive further growth. Efforts to develop next-generation obesity drugs could help diversify its portfolio. Beyond metabolic diseases, NVO is also building out its rare disease segment, with the submission of a regulatory filing for Mim8 in hemophilia A in the United States and recent approvals of a broader label for its Alhemo injection for hemophilia A or B, further strengthening its position in the hemophilia space.

Amid ongoing challenges, we believe investors might want to reduce their exposure to Novo Nordisk, regardless of how its fourth-quarter results turn out. NVO struggled through 2025 despite resolving U.S. supply constraints, cutting its growth guidance twice amid intensifying competition from Eli Lilly, foreign-exchange headwinds, and widespread use of compounded semaglutide in the United States. The company is also facing mounting pricing pressure and has introduced early self-pay discounts for Wegovy and Ozempic, raising concerns around margin compression and long-term GLP-1 economics. A major management reshuffle and restructuring program raises operational risk for the company. The increasing competitive landscape also contributes to the skepticism around the stock. Analysts also continue to trim earnings estimates, leaving valuations at risk of further downside.

Although the approval and launch of oral Wegovy gives Novo Nordisk a competitive edge over Eli Lilly, which is still awaiting FDA review for its oral GLP-1 candidate, it is not yet enough to bet on the stock. NVO’s Ozempic and Wegovy were available in the U.S. market long before LLY’s Mounjaro and Zepbound. However, through superior efficacy and better commercial executions, Eli Lilly was able to eat away at Novo Nordisk’s market share in the diabetes and obesity care market. If history repeats itself, LLY’s orforglipron will once again be able to outshine NVO’s oral Wegovy, despite a delayed launch, and render NVO’s early-mover advantage useless. While the long-term potential in obesity and rare diseases remains, heightened volatility, legal and regulatory challenges, and a crowded GLP-1 development landscape suggest that the near-term risk/reward profile is skewed to the downside. These factors may prompt risk-averse investors to consider exiting their position or limiting exposure until clearer visibility emerges.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 11 hours | |

| 11 hours | |

| 14 hours | |

| 14 hours | |

| 16 hours | |

| 21 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite