|

|

|

|

|||||

|

|

Colgate-Palmolive Company CL has reported fourth-quarter 2025 results, wherein both top and bottom lines increased year over year and surpassed the Zacks Consensus Estimate. Results benefited from solid pricing, continued brand strength in oral care and pet nutrition, and resilient demand across key international markets, which supported modest net sales and organic sales growth for the full year.

On a Base Business basis (non-GAAP basis), earnings were 95 cents per share, up 4% from the prior-year period. The bottom line surpassed the Zacks Consensus Estimate of 91 cents.

Net sales of $5.230 billion rose 5.8% from the year-ago quarter and also surpassed the Zacks Consensus Estimate of $5.088 billion. On an organic basis, the company’s sales advanced 2.2%, which includes a 0.9% unfavorable impact of reduced private-label pet volume. Net sales included a positive currency effect of 3.1%.

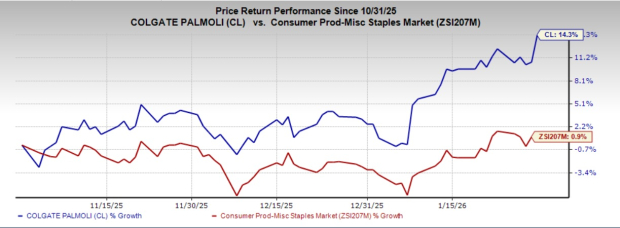

The Zacks Rank #4 (Sell) company's shares have gained 14.3% in the past three months as compared the industry’s growth of 0.9%.

Colgate's organic sales were driven by a 0.5% year-over-year drop in organic volume and a 2.7% improvement in pricing. Reported volume remained flat in the fourth quarter. We estimated organic sales growth of 1.4% for the quarter under review, with a 2.7% rise in pricing and a 1.3% decrease in volume.

In the earnings release, management highlighted that the company maintained its leadership in the toothpaste market, holding a 41.3% global market share year to date. In addition, Colgate continued to lead the manual toothbrush market with a 32.4% global market share year to date.

The base business gross profit of $3.15 billion increased 5.5% from the year-ago quarter. The company’s fourth-quarter base business gross profit margin contracted 10 basis points (bps) to 60.2%. We also expected the adjusted gross margin to contract 10 bps to 60.2%.

Adjusted selling, general and administrative (SG&A) expenses totaled $1.98 billion, up 4.5% from $1.89 billion in the prior-year quarter. We expected the adjusted SG&A expenses, as a percentage of salesto remain flat at 38.3%% for the fourth quarter.

The company’s adjusted operating profit of $1.11 billion increased 3% year over year. The adjusted operating profit margin contracted 50 bps year over year to 21.2%. We expected the adjusted operating margin to contract 10 bps to 21.6% for the fourth quarter.

Colgate-Palmolive Company price-consensus-eps-surprise-chart | Colgate-Palmolive Company Quote

North America’s net sales (19% of total sales) dipped 1.5% year over year on a reported basis and 1.8% on an organic basis. The sales decline was due to a decrease of 2.3% in volume, offset by a 0.5% rise in pricing. Foreign currency aided sales by 0.3%.

Latin America’s net sales (24% of the total sales) rose 12.8% year over year on a reported basis and 6.5% on an organic basis. Sales growth was driven 4.2% rise in pricing, a 2.3% increase in volume and a 6.3% positive currency effect.

Europe’s net sales (14% of the total sales) increased 9.8% year over year on a reported basis and 1.8% on an organic basis. Sales growth was driven by a 1% rise in pricing, a 0.8% increase in volume and a 8.1% positive currency effect.

The Asia Pacific segment’s net sales (14% of the total sales) declined 0.3% year over year, reflecting a 2.2% drop in volume and a 0.4% unfavorable currency impact, offset by a 2.3% rise in pricing. Regional organic sales increased 0.1% year over year.

Africa/Eurasia’s net sales (6% of the total sales) improved 15% year over year, driven by 9.1% growth in pricing, 4.7% favorable currency effect and a 1.1% increase in volume. Organic sales for the segment advanced 10.3%.

Hill’s Pet Nutrition’s net sales (23% of the total sales) improved 4.9% from the year-ago quarter on a reported basis and 1.5% on an organic basis. Results benefited from a 3% rise in pricing 1.6% favorable currency effect, and a a 0.3% rise in reported volume. Organic volume for the segment increased 1.5%.

Colgate ended fourth-quarter 2025 with cash and cash equivalents of $1.28 billion and a total debt of $7.9 billion. Net cash provided by operating activities was $4.2 billion for the 12 months ended Dec. 31, 2025. The free cash flow before dividends was $3.63 million during this time.

The company returned $2.9 billion in cash to its shareholders via dividends and share repurchases in the 12 months ended Dec. 31, 2025.

Colgate provided its sales guidance for 2026, anticipating net sales growth of 2-6%, including a low-single-digit tailwind from foreign exchange. Organic sales are projected to increase 1-4%, reflecting an approximately 20-basis-point headwind from the exit of the private-label pet food business.

On a GAAP basis, management expects gross margin expansion with higher advertising spend both in absolute dollars and as a percentage of sales for the year. Management forecasts double-digit growth in EPS for 2026.

On a non-GAAP (base business) basis, Colgate foresees gross profit margin expansion, with advertising investment expected to increase in both dollar terms and as a percentage of sales. The company also projects low to mid-single-digit growth in Base Business adjusted EPS for 2026.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural flaunts a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1.4% and 197.2%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 52.1%, on average.

Mama's Creations, Inc. MAMA manufactures and markets fresh deli-prepared foods in the United States. At present, MAMA sports a Zacks Rank of 1. Mama's Creations delivered a trailing four-quarter earnings surprise of 133.3%, on average.

The consensus estimate for Mama's Creations’ current fiscal-year sales and earnings implies growth of 39.9% and 44.4%, respectively, from the year-ago figures.

The Hershey Company HSY engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally. It holds a Zacks Rank #2 (Buy) at present. HSY delivered a trailing four-quarter earnings surprise of 15%, on average.

The Zacks Consensus Estimate for Hershey’s current fiscal-year sales implies growth of 3.6%, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 50 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours |

United Natural Foods Boosts Profit Outlook, Lowers Sales Guidance

UNFI -6.72%

The Wall Street Journal

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite