|

|

|

|

|||||

|

|

In recent times, investors have been increasingly drawn to companies operating in the molecular diagnostics space, a rapidly growing segment within the broader in-vitro diagnostics (IVD) market. According to Roots Analysis, the IVD market is projected to witness a 6.2% compound annual growth rate through 2035. Two prominent companies with a strong foothold in this space are Hologic HOLX and Myriad Genetics MYGN. Hologic’s molecular diagnostics offerings specialize in women’s health and acute respiratory infections, while Myriad Genetics develops molecular tests that help assess disease risks, monitor progression and guide treatment decisions across oncology, women's health and pharmacogenomics.

With the market set to grow from rising infectious disease cases, increasing demand for point-of-care diagnostics devices and rapid diagnostics testing, which among these two offers a better investment opportunity right now? Let’s dive into the details.

Marlborough, MA-based Hologic’s Diagnostics division is led by Molecular Diagnostics, which grew 11% year over year in the first quarter of fiscal 2025, excluding COVID-19-related sales. The company’s highly automated Panther platform — now installed in more than 3,300 locations globally — runs more than 20 FDA-approved assays. Hologic is also expanding the global reach of the Panther Fusion sidecar to meet the demand for high-throughput molecular diagnostic respiratory testing.

Sexually transmitted infections (STIs) testing is the largest category in Hologic’s global molecular diagnostics business and continues to lead the U.S. market. At present, the Molecular Diagnostics business is powered by the Aptima BV, CV/TV assay, Hologic’s second-largest assay globally, which posted a strong double-digit rate in the first quarter of fiscal 2025. Biotheranostics continues to post accretive revenue growth from the ongoing adoption and expanding coverage of the Breast Cancer Index test.

Beyond Diagnostics, Hologic operates through Breast Health, GYN Surgical and Skeletal Health units. The company’s strategy of building multiple durable growth drivers into its franchises has delivered strong performances while adding more drivers through internal innovation and business development. Recent tuck-in deals like Endomagnetics (2024) and Gynesonics (2025) have unlocked high-growth adjacent markets. Hologic is going directly into more geographies and businesses with its market-leading innovations, acting on its vast international opportunity.

The company’s operational performance in the fiscal first quarter has been strong, with the adjusted gross margin improving 80 basis points (bps) and the operating margin up by 90 bps. With $1.97 billion in cash and cash equivalents and $47 million in short-term debt as of the first quarter-end, the liquidity aspect looks strong as well. However, divisional softness, broader macroeconomic struggles and a strong U.S. dollar led the company to lower its fiscal 2025 revenue outlook by $100 million from its initial projections.

Based in Salt Lake City, UT, Myriad Genetics continued its growth streak with an 11% revenue jump in 2024. The company’s flagshiphereditary cancer test, MyRisk with RiskScore, delivered 24% effective revenue growth from steady volume and average selling price growth. Its Precise Tumor therapy selection test is gaining traction, and the company is expanding its global reach through biopharma partnerships for companion diagnostics like BRACAnalysis CDx and MyChoice CDx.

Earlier in 2025, Myriad Genetics secured an exclusive license for PATHOMIQ’s AI technology platform in the United States, bolstering its prostate cancer portfolio with post-surgical treatment testing solutions alongside Prolaris.

Throughout last year, the company made several strides in women’s health, including a partnership with jscreen and cancerCARE to expand access to prenatal and virus testing. Myriad Genetics launched the new Universal Plus Panel for its Foresight Carrier Screen and also unveiled the Prequel Prenatal Screen. Within Pharmacogenomics, GeneSight revenues increased 23% in 2024. The company looks forward to bringing Precise Liquid, FirstGene, Precise MRD, as well as MyRisk gene expansion in the coming quarters.

Furthermore, Myriad Genetics reorganized its international operations to better align resources to its domestic opportunities, aiming to accelerate profitable business growth across its portfolio. As part of this strategy, the company divested its EndoPredict business in Europe in August 2024, reducing annual run-rate revenues of $11 million.Operationally, the gross margin increased 300 bps in the fourth quarter of 2024, thanks to better average revenue per test and overall lab efficiencies. Myriad Genetics closed 2024 with cash and cash equivalents of $102 million and no short-term debt, reflecting sound liquidity.

For 2025, the company projects annual revenue growth between 9% and 11% over 2024. However, UnitedHealthcare’s medical policy for pharmacogenetic testing, which excludes Genesight coverage, presents an estimated $55 million revenue headwind. Ongoing economic and political instabilities also pose risks of rising operational costs.

In the past six months, Hologic shares have dropped 29.8% in value. Meanwhile, Myriad Genetics has seen a much steeper decline, with shares falling 66.8%.

In terms of forward five-year price-to-sales (P/S), Hologic stock is trading at 3.04X, lower than its median of 4.33X. Myriad Genetics has a five-year P/S of 0.78X, matching its five-year low. When compared to the broader Medical sector average of 2.5X, MYGN appears to be appealing, although it has a Value score of C at present. Hologic, meanwhile, carries a Value Score of B.

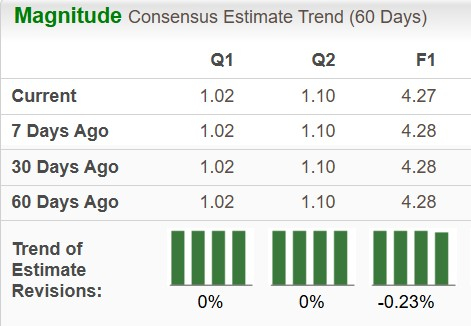

The Zacks Consensus Estimate for Hologic’s current fiscal 2025 earnings per share (EPS) implies growth of 4.7%. Estimates have dropped by 1 cent in the past seven days. The consensus mark for 2025 sales indicates a 1.3% uptick to $4.08 billion. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

The Zacks Consensus Estimate for Myriad Genetics’ 2025 EPS stands at 8 cents, suggesting a 42.9% decline. Over the past 60 days, estimates have dipped from 9 cents to 5 cents and again rose to 8 cents in the last seven days. The consensus mark for 2025 sales indicates a 1.2% increase to $847.5 million.

Hologic’s business is well-diversified, with Molecular Diagnostics being the strongest revenue growth driver. Even with short-term challenges, its robust international expansion opportunity, operational discipline and financial stability position it well for success in the longer term. Hologic stock has fared comparatively better in the past six months and also trades below its own five-year median, making it look attractive.

Meanwhile, Myriad Genetics, focusing fully on molecular diagnostics, also benefits from a strong product portfolio and financial health. Also, trading attractively relative to both its median and the sector, the company’s future trajectory looks promising, backed by an innovative pipeline and efforts to drive profitable growth.

That said, it’s tough to favor one stock over another at this point. Both HOLX and MYGN carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-13 | |

| Feb-12 | |

| Feb-10 | |

| Feb-10 | |

| Feb-06 | |

| Feb-04 | |

| Feb-03 | |

| Feb-02 | |

| Feb-02 | |

| Jan-30 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite