|

|

|

|

|||||

|

|

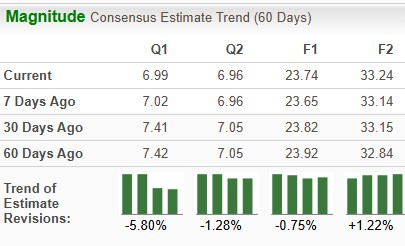

Eli Lilly and Company LLY will report its fourth-quarter and full-year 2025 earnings on Feb. 4, before market open. The Zacks Consensus Estimate for fourth-quarter sales and earnings is pegged at $17.87 billion and $6.99 per share, respectively. Earnings estimates for 2026 have risen from $33.15 per share to $33.24 per share over the past 30 days.

The healthcare bellwether’s performance has been mixed, with the company exceeding earnings expectations in three of the trailing four quarters while missing in one. It delivered a four-quarter earnings surprise of 7.44%, on average. In the last reported quarter, the company delivered a positive earnings surprise of 16.61%, as seen in the chart below.

Lilly has an Earnings ESP of -0.21% and a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1, #2 (Buy) or #3 have a good chance of delivering an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

In the fourth quarter, like the past few quarters, the key drivers of Lilly’s top-line growth are likely to have been its popular GLP-1 drugs, diabetes drug Mounjaro and obesity drug, Zepbound, driven by high demand trends, partially offset by lower pricing.

Launches of Mounjaro and Zepbound in new international markets and improved supply from ramped-up production in the United States have led to strong sales growth in the first three quarters of 2025. The positive trend is expected to have continued in the fourth quarter.

The Zacks Consensus Estimate for Mounjaro and Zepbound is pegged at $6.65 billion and $3.9 billion, respectively.

Last month, the FDA approved Lilly’s rival, Novo Nordisk’s NVO oral version of the obesity drug Wegovy (semaglutide). Wegovy pill is the first oral GLP-1 drug to be approved in the United States. NVO launched the Wegovy pill last month and has shown strong prescription trends, indicating robust initial demand. Though the new Wegovy pill is unlikely to have affected Zepbound’s sales in the fourth quarter, investors will look out for management’s comments on how they expect to deal with this new competition. Lilly has filed regulatory applications seeking approval for its own oral GLP-1 pill, orforglipron in obesity in December.

In the third quarter, Zepbound’s total U.S. prescriptions in the branded anti-obesity market declined sequentially due to disruption from the formulary changes made by CVS Caremark CVS. Effective July 1, CVS Caremark, a major pharmacy benefit manager, began excluding Zepbound from its preferred drug list while retaining NVO’s Wegovy. An update is expected on the fourth-quarter conference call.

Beyond Mounjaro and Zepbound, higher demand and volume growth for Lilly’s key growth drugs like Olumiant, Taltz and Verzenio are likely to have provided top-line support in the fourth quarter, driven by increased demand trends. However, sales of Emgality declined in the third quarter. It remains to be seen if the drug’s sales trend improved in the fourth quarter.

While volumes are expected to have increased for most drugs, lower realized prices (including U.S. Part D changes) are likely to have continued to hurt sales of most drugs, including Mounjaro and Zepbound.

Sales of Trulicity are likely to have been hurt by competitive dynamics, including patient switches to Mounjaro and lower realized prices.

The Zacks Consensus Estimate for Trulicity, Taltz, Verzenio, Jardiance, Olumiant and Emgality is $1.0 billion, $955.0 million, $1.62 billion, $776.0 million, $275.0 million and $220.0 million, respectively.

Newer products like Ebglyss, Jaypirca, Kisunla and Omvoh are likely to have contributed significantly to sales growth. Sales of most of these drugs have been improving sequentially for the past couple of quarters.

Sales of most established drugs like Forteo, Humalog and Humulin are likely to have declined in the quarter.

Higher marketing, selling and administrative expenses to support the launch of new products and indications are likely to have hurt operating profits in the quarter.

Nonetheless, a single quarter’s results are not so important for long-term investors. Let us delve deeper to understand whether to buy, sell or hold Lilly’s stock.

Lilly’s stock has risen 28% in the past year compared with the industry’s increase of 17.6%.

The stock is trading at a premium to the industry, as seen in the chart below.

Lilly’s success is primarily attributed to Mounjaro and Zepbound. Despite being on the market for only around three years, Mounjaro and Zepbound have become key top-line drivers for Lilly, with demand rising rapidly. Mounjaro and Zepbound account for around 50% of the company’s total revenues.

In addition to Mounjaro and Zepbound, Lilly has gained approvals for several other new drugs over the past couple of years, including Omvoh, Jaypirca, Ebglyss and Kisunla. These newly approved drugs are also contributing to Lilly’s revenue growth.

Lilly is investing broadly in obesity and has several new molecules currently in clinical development with a range of oral and injectable medications with different mechanisms of action. A key drug in its obesity pipeline is a once-daily oral GLP-1 small molecule called orforglipron. Lilly filed regulatory applications seeking approval for orforglipron in obesity in December, setting up the timeline for a potential launch this year. An oral pill like orforglipron has the potential to be a more convenient alternative to injectable treatments like Zepbound and NVO’s Wegovy.

Lilly’s another key obesity candidate, triple-acting incretin, retatrutide (which combines GLP-1, GIP and glucagon), delivered significant weight loss with substantial relief from osteoarthritis pain in a phase III study in patients with obesity and knee osteoarthritis pain. Lilly expects data readouts from three phase III studies on retatrutide for treating obesity in the second half of 2026.

The company is also working to diversify beyond GLP-1 drugs by expanding into cardiovascular, oncology, and neuroscience areas. In 2025, it announced several M&A deals.

Lilly has its share of problems. Prices of most of Lilly’s products are declining in the United States. Rising competition in the GLP-1 diabetes/obesity market is a key headwind.

The Wegovy pill gives NVO the first-to-market advantage and will initially bring in additional revenues and hurt Lilly’s market share. Though NVO has the lead in the oral obesity market, Lilly may be able to close the gap fast once orforglipron is approved by the FDA in 2026. Smaller biotechs like Structure Therapeutics and Viking Therapeutics are also developing oral GLP-1 drugs for treating obesity.

The exceptional growth from Mounjaro and Zepbound has made Lilly the largest drugmaker. Despite its expensive valuation, Lilly’s significant price appreciation, its product and pipeline portfolio in high-growth therapeutic areas like obesity, robust growth prospects and bullish analyst sentiment suggest that investors should retain this stock in their portfolio.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 hours | |

| 18 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite