|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

CDW Corporation CDW is scheduled to release fourth-quarter 2025 results before the market opens on Feb. 4, 2026.

The Zacks Consensus Estimate for revenues is pegged at $5.3 billion, indicating 1.6% growth from the prior-year quarter. The Vernon Hills-based company, known for offering a wide range of technology solutions to business, government, education and healthcare clients, has historically shown resilient top- and bottom-line performance even during volatile cycles.

The consensus estimate for earnings is pegged at $2.44 per share, up 0.4% in the past 60 days, but indicating a 1.6% decline from the year-ago quarter’s reported figure. Management expects a slight year-over-year and sequential decline in fourth-quarter non-GAAP EPS, pressured by ongoing weakness in government and education demand, possible funding gaps among healthcare customers and broader economic uncertainty.

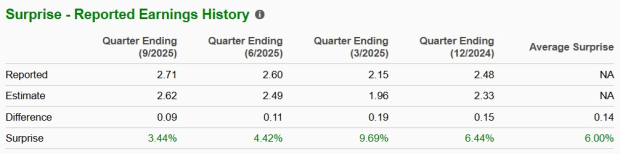

CDW’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with an average surprise of 6%.

In recent quarters, CDW’s performance has been mixed, hitting revenue and profitability growth in some periods while facing margin pressure and cautious customer spending in others. Continued momentum across services, cloud infrastructure, SaaS and ongoing investments in AI and customer-focused offerings are likely to have aided its performance in the fourth quarter amid macro challenges. Robust demand for notebooks/mobile devices, netcomm products, desktops, software and services, despite lower sales of data storage and servers, is likely to have buoyed its top line.

CDW expects low- to mid-single-digit year-over-year gross profit growth, with a sequential decline in line with seasonality. Fourth-quarter operating expenses should have dipped modestly quarter over quarter but include some reinvestment, driving higher non-GAAP SG&A as a percentage of gross profit versus both last year and the prior quarter. Management also expects strong seasonal fourth-quarter free cash flow to bring full-year 2025 free cash flow closer to its typical target level.

It plans to modestly raise its dividend to $2.52 annually in line with earnings, maintain a solid balance sheet at 2.5x net leverage and continue prioritizing M&A and share buybacks. Strong cash flow supports increased repurchases. In the third quarter, CDW exceeded its 2025 target of returning 50%–75% of adjusted free cash flow, having returned $747 million, or 112% of adjusted free cash flow to shareholders.

CDW’s growth reflects the strength of its diversified customer base across U.S., U.K. and Canadian operations, with each channel generating more than $1 billion annually. Momentum is driven by technology investment in small business, commercial and health care, supported by growth in cloud, devices and early AI workstation adoption. Government and public markets remain steady despite funding uncertainty, while international operations continue to execute well, highlighting CDW’s ability to deliver consistent performance across diverse end markets.

CDW Corporation price-eps-surprise | CDW Corporation Quote

For the fourth quarter, we expect revenues from Small Business, Government, Education and Healthcare to be $350.8 million, $653.5 million, $613.8 million and $609.3 million, respectively. Revenues from the Corporate sector are estimated to be $2.4 billion, up 1%.

The company continues investing in high-growth areas like cloud, cybersecurity and AI, including integrating Mission Cloud Services. Security demand remains strong, while software and services drive margin expansion, with services contributing 9% of third-quarter revenue and nearly a third of profit growth. Despite macro headwinds, CDW expects growth to resume, supported by rising data workloads, security needs, device refresh cycles and AI adoption.

However, uncertain macroeconomic conditions, trade wars and increasingly adverse geopolitical conditions are heightening uncertainty in the technology supply chain and affecting customers’ tech spending. The ongoing government shutdown threatens federal results and could spill over into health care and education. Recession risks, high inflation, geopolitical tensions and potential tariff changes continue to weigh heavily on the outlook for the quarter to be reported.

Our proven model does not predict an earnings beat for CDW this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

CDW currently has an Earnings ESP of +0.21% and a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Here are three stocks you may want to consider, as our model shows that these have the right elements to post an earnings beat in this reporting cycle.

Trimble Inc. TRMB, slated to release fourth-quarter 2025 results on Feb. 10, has an Earnings ESP of +1.91% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Trimble’s fourth-quarter 2025 earnings is pegged at 96 cents per share, suggesting a year-over-year rise of 7.9%. TRMB has a trailing four-quarter average surprise of 7.4%.

Hubbell Incorporated HUBB, slated to release fourth-quarter 2025 results on Feb. 3, has an Earnings ESP of +0.52% and a Zacks Rank of 3 at present. The Zacks Consensus Estimate for Hubbell’s fourth-quarter 2025 earnings is pegged at $4.70 per share, suggesting a year-over-year rise of 14.6%. HUBB has a trailing four-quarter average surprise of 3%.

Under Armour, Inc. UAA has an Earnings ESP of +68.75% and sports a Zacks Rank of 1 at present. The consensus estimate for Under Armour’s third-quarter fiscal 2025 earnings is pegged at a loss of 2 cents per share, implying a decline of 125% from the year-ago quarter’s actual. For Under Armour’s quarterly revenues, the consensus mark is pegged at $1.32 billion, which indicates a decrease of 5.9% from the year-ago quarter’s reported figure. UAA has a trailing four-quarter average surprise of 44.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite