|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Becton, Dickinson and Company BDX, popularly known as BD, recently announced the successful completion of a joint feasibility study evaluating the recycling of polystyrene Petri dishes into high-quality manufacturing feedstock, conducted in collaboration with Envetec Sustainable Technologies. Findings from the pilot study indicate that following effective disinfection and processing, several polymers, including polystyrene, polyester (PET), polypropylene and polyethylene, can be reintroduced into the manufacturing supply chain. These materials are widely used in medical devices, including across BD’s product portfolio.

Per management, single-use plastic devices made from high-quality plastics remain essential to modern healthcare given their safety, usability and scalability advantages. However, their long-term environmental impact remains a concern. This pilot project, led by BD’s Sustainable Medical Technologies Institute, is an important step toward developing circular economy solutions for widely used healthcare products made from plastics, such as blood collection tubes, syringes and packaging materials.

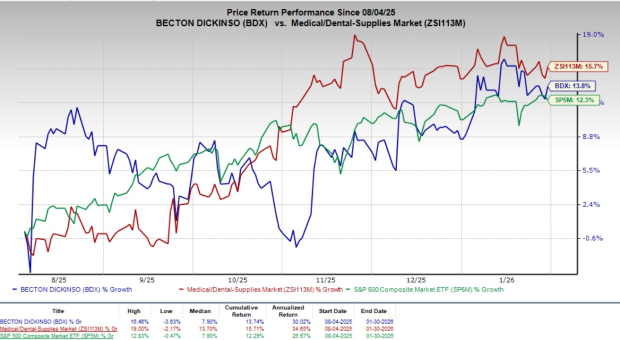

Shares of BDX gained 1.2% since the announcement on Thursday. Over the past six months, shares of the company have climbed 13.8% compared with the industry’s 15.7% growth and the S&P 500’s 12.3% rise.

In the long run, the initiative reinforces BD’s sustainability narrative and positions the company to benefit from increasing customer and regulatory focus on environmental stewardship in health care. The successful pilot demonstrates that widely used laboratory plastics can be safely recycled and reintroduced into the manufacturing process without compromising quality.

While the pilot is not expected to have a near-term revenue impact, it supports BD’s strategic objective of reducing reliance on virgin plastics, lowering waste-management costs over time and mitigating supply chain risks linked to raw material availability. Overall, this initiative positions BD as an innovator in sustainable healthcare solutions, which could strengthen competitive advantage and create long-term value for investors.

BDX currently has a market capitalization of $57.97 billion.

As part of the study, unused BD BBL prepared plated media were processed using Envetec’s GENERATIONS technology, a low-energy chemical disinfection process that converts regulated waste into clean, recyclable polymer flakes. These flakes were then processed into polystyrene pellets and used to create new Petri dish prototypes. Testing confirmed that the recycled material met required performance standards and could be successfully molded. Envetec’s GENERATIONS technology is currently being implemented across health care, biopharma and life science settings in the United States and Europe.

Malcolm Bell, CEO of Envetec Sustainable Technologies, stated that the pilot study represents an initial phase in a wider initiative to validate the recovery and recycling of multiple plastic product types across healthcare supply chains. Establishing a proof of concept for the safe treatment and reintegration of regulated plastics into productive use supports the development of sustainable solutions aimed at reducing landfill dependency and retaining material value within the circular economy.

The collaboration underscores BD’s proactive approach to addressing the environmental footprint of single-use medical devices while maintaining safety, scalability and performance standards. For Envetec, collaboration with a large medtech player like BD could accelerate adoption by creating end-to-end recycling pathways for polystyrene Petri dishes, PET tubes, medical tubing and polypropylene syringes across healthcare supply chains.

Going by data provided by Precedence Research, the sustainable laboratory plasticware market is anticipated to be valued at $970.97 million in 2026 and is expected to witness a CAGR of 19.2% through 2035. Factors like the increasing demand for recyclable, biodegradable and reusable laboratory products; rising preference for bio-based and low-carbon plastic materials; increasing partnerships between labware manufacturers and sustainability-focused research institutions; and rising demand for certified sustainable products to meet regulatory and compliance standards are driving the market’s growth.

BD has announced an expanded collaboration with Ypsomed to develop a 5.5 mL BD Neopak XtraFlow Glass Prefillable Syringe. The partnership, which previously delivered the 2.25 mL Neopak XtraFlow syringe integrated with Ypsomed’s YpsoMate 2.25 autoinjector, demonstrated improved flow performance and faster injection across a range of drug viscosities. The new 5.5 mL syringe is designed for compatibility with the YpsoMate 5.5 autoinjector and targets rising demand for large-volume subcutaneous self-injection solutions.

The company has announced the global commercial launch of BD Research Cloud 7.0, advancing its AI-focused life sciences strategy. The updated platform enhances BD’s flow cytometry offering by incorporating greater automation and data intelligence to support improved research efficiency and data quality. A key feature of the release is BD Horizon Panel Maker, an AI-enabled tool developed to streamline and optimize experimental panel design, particularly for applications in immunology and oncology research.

Becton, Dickinson and Company price | Becton, Dickinson and Company Quote

Currently, BDX carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Veracyte VCYT, Cardinal Health CAH and The Cooper Companies COO.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.5% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

Cardinal Health, currently carrying a Zacks Rank #2 (Buy), reported a first-quarter fiscal 2026 adjusted EPS of $2.55, which surpassed the Zacks Consensus Estimate by 15.4%. Revenues of $64.0 billion beat the Zacks Consensus Estimate by 8.4%.

CAH has an estimated long-term earnings growth rate of 14.7% compared with the industry’s 9.5% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 9.4%.

The Cooper Companies, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of $1.15, which surpassed the Zacks Consensus Estimate by 3.6%. Revenues of $1.06 billion beat the Zacks Consensus Estimate by 0.5%.

COO has an estimated long-term earnings growth rate of 7.8% compared with the industry’s 9.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 2.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite