|

|

|

|

|||||

|

|

For all the benefits that consumers are enjoying with tools like ChatGPT and Gemini, institutions aren't necessarily seeing a comparable degree of benefit with AI offerings aimed at them.

There is one company, however, that's built a powerful artificial intelligence platform.

This company's stock may seem overvalued right now, but it's likely to more than grow into its projected fiscal results.

There's no denying it. The world could use a good artificial intelligence (AI)-powered voice-based customer service agent solution. Too many of the voice-activated tools so far still turn self-service phone calls into a disservice, require users to repeat themselves too often to their smart speaker, or just simply botch too many restaurant drive-thru orders. SoundHound AI's (NASDAQ: SOUN) superior platform may be the one to get us over this usability hump.

From an investor's standpoint, though, SoundHound AI stock may not be your best long-term bet in artificial intelligence. It's got potential to be sure. But it's occasionally struggled to win and keep customers. There's arguably a more proven option within the AI space. That's Palantir Technologies (NASDAQ: PLTR), which -- based on its past growth (particularly with government agencies) -- seems to have years' worth of new business already waiting to be won.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

It's one of those companies most people have heard of but may not actually understand.

In simplest terms, Palantir's platforms allow its users to do something constructive with a mountain of digital data that might otherwise go unutilized. You might be able to achieve something similar using database software or a spreadsheet. However, Palantir Technologies is truly artificial intelligence-powered, analyzing all data from every possible angle to uncover insights that just aren't accessible any other way. For example, aircraft manufacturer Airbus is using Palantir's technology to predict when a plane will need maintenance, while online publishing powerhouse Axel Springer is maximizing ad revenue and subscriptions, and even determining the types of content readers want to read, using a Palantir-powered platform.

Image source: Getty Images.

Where Palantir Technologies really shines, though, is on the government front, where more than half of its current revenue comes from. The Department of Defense, the Centers for Disease Control, the IRS, and the Department of Homeland Security are just some of its public-sector customers. Indeed, the CDC tapped Palantir to help it combat COVID-19, arguably forcing the company into the spotlight just as the broader artificial intelligence revolution was getting underway.

Credit Palantir's capability to turn massive amounts of digitally messy information into actionable insights, mostly. What it does is actually quite difficult to do, let alone do well. That's why it isn't hyperbole to say there's nothing else out there quite like it. Indeed, this company largely is the decision-intelligence industry.

Great. But, is PLTR stock actually a buy here and now?

For valuation-concerned investors, it's certainly a tough name to like at this time. Never even mind its sky-high forward-looking price-to-earnings ratio of 150 (profits aren't always a young growth company's chief concern anyway). What's seemingly even more outrageous about this ticker is its trailing price-to-sales ratio of just over 100, versus a marketwide average of just a little over 3.

This is arguably one of those cases where the growth story is so compelling and strong that investors can and should look past the stock's current valuation and focus on what's just a few years down the road.

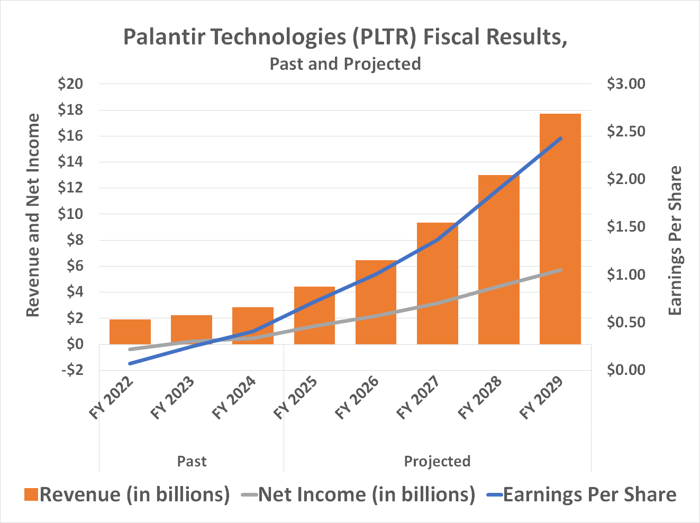

Its third-quarter numbers, released in November, are a brief glimpse into this likely future. Revenue improved 63% year over year, driving a 51% increase in operating income, and extending a pace that's also expected to continue through Palantir's fourth-quarter numbers in early February, and well beyond. And notice that the company's profit growth is expected to more than keep pace with revenue growth through at least 2029.

Data source: Morningstar. Chart by author.

This is an important nuance to draw out about the software business in general, too, and Palantir Technologies in particular. That is, while there's some customization for each customer, the company isn't reinventing the wheel for every user deployment. The same basic coding framework can be used over and over again, ultimately leading to lower net per-client developmental costs -- and therefore wider profit margins -- as Palantir brings in more and more paying customers.

And this is almost certainly going to happen in a big way, too.

Although corporations and even many government entities have only shown moderate interest thus far in AI tools like this one, they're starting to come around at a quicker pace. An outlook from Precedence Research suggests the global decision intelligence platform market is poised to grow at an average annualized pace of more than 15% through 2035.

Already being the biggest (and in some regards the only) name in the space, Palantir is best positioned to win the lion's share of this growth.

It's still not for the faint of heart. As is the case with most other tickers in the artificial intelligence arena, this one's likely to remain volatile. It's certainly not right as a foundational holding of a conservative, defensive-minded retirement portfolio.

Nevertheless, the growth potential here is massive. The stock's lethargic performance since August of last year is also more of an opportunity than a warning -- it's just waiting for the right bullish catalyst. After Thursday's sweeping rout of most artificial intelligence stocks, that could be its fourth-quarter earnings report, which may well be posted by the time you're reading this.

Even if its Q4 numbers don't light a fresh fire under its stock, though, this name's still an incredibly promising artificial intelligence play that would be at home in plenty of growth investors' portfolios.

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 2, 2026.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies and SoundHound AI. The Motley Fool has a disclosure policy.

| 2 hours | |

| 9 hours | |

| 13 hours | |

| 19 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite