|

|

|

|

|||||

|

|

Biogen BIIB will report fourth-quarter and full-year 2025 results on Feb. 6, before market open. In the last reported quarter, the company's earnings beat expectations by 23.65%. The Zacks Consensus Estimate for fourth-quarter sales and earnings is pegged at $2.21 billion and $1.60 per share, respectively.

In the fourth quarter, lower sales of Biogen’s multiple sclerosis (“MS”) drugs are likely to have been offset by sequential revenue growth from new products.

Sales of Biogen’s MS drugs like Tecfidera and Tysabri are likely to have declined due to generic competition for Tecfidera globally, biosimilar competition for Tysabri in Europe and rising competitive pressure in the MS market.

The Zacks Consensus Estimate for fourth-quarter sales of Tecfidera is pegged at $120.0 million. The Zacks Consensus Estimate for Tysabri is $362.0 million.

Sales of another MS drug, Vumerity, are expected to have risen due to higher demand. The Zacks Consensus Estimate for Vumerity is $183.0 million.

Biogen’s U.S. MS sales were better than expected in the first three quarters of 2025, driven by demand for Vumerity, as well as favorable gross-to-net adjustments and favorable inventory timing in the United States. However, the MS revenue decline is expected to have been steeper in the fourth quarter due to increased competitive pressure on the ex-U.S MS business, particularly accelerating generic competition for Tecfidera in Europe. As regards Tecfidera in Europe, Biogen expects the sequential impact in the fourth quarter to be roughly double the erosion seen in the third quarter.

Sales of Biogen’s spinal muscular atrophy drug, Spinraza, are likely to have declined due to lower demand. The Zacks Consensus Estimate for Spinraza is $380.0 million.

Sales of Biogen’s newly launched drug Skyclarys for Friedreich’s ataxia are likely to have continued to improve sequentially, backed by continued demand growth and geographic expansion outside the United States. However, some Medicare discount dynamics are likely to have tempered sequential growth in the United States.

Sales of another new drug, Zurzuvae, are likely to have continued to rise on a sequential basis, backed by strong patient demand and an expanding new prescriber base. Zurzuvae was approved in the EU in September, which should have contributed to sales growth.

Biogen has a collaboration with Supernus Pharmaceuticals SUPN for Zurzuvae. Biogen and Supernus Pharmaceuticals equally share profits and losses for the commercialization of Zurzuvae in the United States. In outside U.S. markets, Biogen records product sales (excluding Japan, Taiwan and South Korea) and pays royalties to Supernus.

Alzheimer’s collaboration revenues are expected to have risen in the quarter. Alzheimer’s collaboration revenues include Biogen’s 50% share of net product revenues and cost of sales (including royalties) from Alzheimer’s drug Leqembi (lecanemab), which has been developed in collaboration with Eisai.

Leqembi sales in the United States improved sequentially in the past four quarters, with the positive trend expected to have continued in the fourth quarter. Leqembi sales are recorded by Eisai. In ex-U.S. markets, Leqembi sales declined in the third quarter due to a one-time shipment of about $35 million to China recorded in the second quarter. Biogen expects minimal revenues in China in the fourth quarter due to the inventory build.

A less frequent maintenance intravenous dosing version of Leqembi was approved by the FDA in January 2025, while a subcutaneous autoinjector for maintenance dosing called Leqembi Iqlik was approved in August and launched in October. Investors will look for updates on their commercial performance on the conference call. The FDA has accepted and granted priority review to Biogen and Eisai’s sBLA seeking approval of Leqembi Iqlik as a subcutaneous autoinjector for initiation dosing. The FDA decision on the sBLA is expected on May 24.

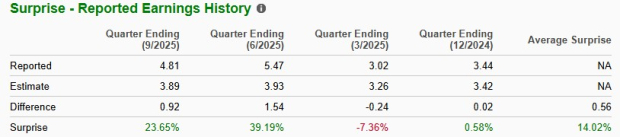

The company’s earnings beat estimates in three of the last four quarters while missing in one. The company has a four-quarter earnings surprise of 14.02%, on average.

Biogen’s stock has risen 25.9% in the past year compared with an increase of 15.2% for the industry.

Our proven model does not conclusively predict an earnings beat for Biogen this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Earnings ESP: Biogen’s Earnings ESP is -2.49%. The Zacks Consensus Estimate is pegged at $1.60 per share, while the Most Accurate Estimate is pegged lower at $1.56 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Biogen has a Zacks Rank #3.

Here are some drug/biotech stocks that have the right combination of elements to beat on earnings this time around:

Jazz Pharmaceuticals JAZZ has an Earnings ESP of +3.29% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Jazz Pharmaceuticals’ stock has risen 37.5% in the past year. JAZZ’s earnings performance has been mixed over the trailing four quarters. The company beat earnings estimates in two of the last four reported quarters while missing in two, delivering a negative earnings surprise of 10.48%, on average.

Moderna MRNA has an Earnings ESP of +4.86% and a Zacks Rank #3 at present.

Shares of Moderna have risen 24.3% in the past year. Moderna beat on earnings in each of the trailing four quarters, delivering an average surprise of 31.45%. Moderna is scheduled to report fourth-quarter results on Feb. 13.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 8 hours | |

| 8 hours | |

| 11 hours | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite