|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

U.S. stock markets started 2026 on a positive note after an astonishing rally in the last three years. In January, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — advanced 1.7%, 1.4% and 1%, respectively. Moreover, the small-cap benchmark — the Russell 2000 — climbed more than 5% last month.

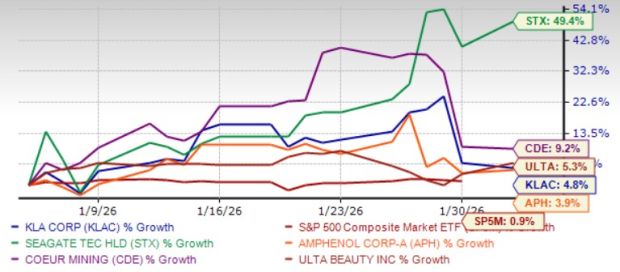

At this stage, it will be prudent to invest in stocks with a favorable Zacks Rank that have momentum in February. Five such stocks are: Amphenol Corp. APH, Seagate Technology Holdings plc STX, Ulta Beauty Inc. ULTA, Coeur Mining Inc. CDE and KLA Corp. KLAC. Each of our picks currently sports a Zacks Rank #1 (Strong Buy) and has a Zacks Momentum Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks in the past month.

Amphenol benefits from a diversified business model. Its strong portfolio of solutions, including high-technology interconnect products, is a key catalyst. The company is a dominant force in AI-powered data center interconnects, commanding an estimated 33% market share. APH’s advanced fiber-optic and high-density interconnect solutions are now essential for hyperscale data centers and 5G deployments.

Increased spending on both current and next-generation defense technologies bodes well for APH’s top-line growth. Apart from Defense, Amphenol’s prospects ride on strong demand for its solutions across Commercial Air, Industrial, and IT Datacom. Solid demand for high-speed and power interconnect products, which are critical components in next-generation IT systems, creates a long-term growth opportunity.

Rising AI workloads and cloud infrastructure upgrades are fueling demand for high-speed interconnects. This momentum is expected to support the Communications Solutions segment. Electrification in transportation and increasing electronic content in medical devices are driving the adoption of APH’s cable assemblies and sensor-based systems. These drivers are expected to support steady growth in the Interconnect and Sensor Systems segment.

Amphenol has an expected revenue and earnings growth rate of 24.1% and 30.2%, respectively, for the current year. The Zacks Consensus Estimate for the current year’s earnings has improved 1.2% in the last seven days.

Seagate Technology has been witnessing strong execution amid intensified cloud and AI demand. Management highlighted that modern data centers increasingly need solutions that balance performance with cost efficiency, a trend that strongly favors Seagate’s roadmap. STX’s areal-density-driven strategy aligns well with the long-term growth of AI-generated data, suggesting sustained demand beyond short-term cycles.

STX’s high-capacity nearline production is largely booked through 2026, with long-term contracts providing strong demand visibility through 2027. Advancing aerial density remains a major strength for STX and a key driver of progress across the entire hard drive industry.

STX’s aerial density roadmap ensures a lasting TCO advantage for hard drives over alternative technologies. Customers recognize the value of higher-capacity HAMR drives as the most efficient solution to meet growing AI-driven data storage demands.

In September 2025, STX announced an alliance with Acronis to provide MSPs and enterprises with secure, scalable storage for AI-driven data growth. Seagate and Acronis will offer Acronis Archival Storage, a secure, compliant, cost-efficient S3 solution using Seagate’s Lyve Cloud. Designed for MSPs and regulated sectors, it provides long-term data storage with enterprise-grade security, predictable costs and full compliance support.

Seagate Technology has an expected revenue and earnings growth rate of 24.6% and 52.6%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for the current year’s earnings has improved 6.5% over the last seven days.

Ulta Beauty’s fundamentals remain compelling, supported by a differentiated retail model that blends mass, prestige and luxury beauty, driving broad-based demand and consistent customer engagement.

ULTA’s powerful loyalty ecosystem and growing digital capabilities deepen relationships, encourage repeat purchases and enhance omnichannel convenience. Strong merchandising discipline, effective inventory management and a focus on operational execution underpin ULTA’s margin resilience even in a promotional environment.

Initiatives such as the marketplace platform expand assortment, while international expansion provides additional avenues for growth. Although near-term investments weigh on margins, these initiatives strengthen ULTA’s brand relevance and scalability, positioning it well to capture growth opportunities in the global beauty market.

Ulta Beauty has an expected revenue and earnings growth rate of 6.1% and 11.4%, respectively, for the current year (ending January 2027). The Zacks Consensus Estimate for the current year’s earnings has improved 0.01% over the last seven days.

Coeur Mining operates as a primary silver and gold producer with precious metals mines in the Americas. CDE’s principal properties include the Palmarejo silver-gold mine in Mexico, the San Bartolome silver mine in Bolivia, the Rochester silver-gold mine in Nevada and the Kensington gold mine in Alaska. CDE is also conducting ongoing exploration activities in Alaska, Argentina, Bolivia, Mexico, and Nevada.

Coeur Mining has an expected revenue and earnings growth rate of 30.2% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for the current-year earnings has improved 10.6% over the last 30 days.

KLA is benefiting from strong demand for leading-edge logic, high-bandwidth memory and advanced packaging, which is driving market share growth in the semiconductor industry. Accelerating investment in AI infrastructure bodes well for KLAC’s prospects.

KLAC’s robust portfolio and its leadership in process control systems are enabling customers to manage increasing design complexity. The services business also performed well, contributing significantly to revenue growth. KLAC is well-positioned to capitalize on AI advancements, with AI driving demand for higher-value wafer processing and more complex designs.

KLA has an expected revenue and earnings growth rate of 7.92% and 8.8%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for the current-year earnings has improved 1.2% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

This AI Stock Roars To Profit, Builds Bullish Base Ahead Of This Key Catalyst

APH

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite