|

|

|

|

|||||

|

|

McKesson Corporation MCK is scheduled to report third-quarter fiscal 2026 results on Feb. 4, after market close.

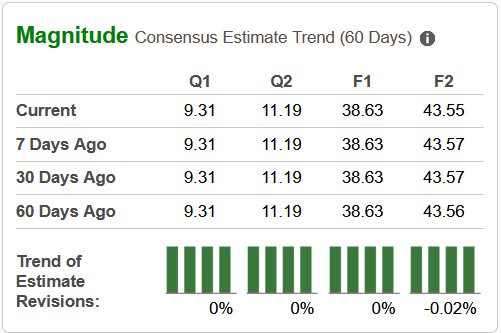

The Zacks Consensus Estimate for sales is pegged at $105.54 billion, implying 10.8% year-over-year growth. The bottom line is projected to grow 15.9% to $9.31, per the Zacks Consensus Estimate.

The EPS estimates have remained stable over the past 30 days.

The company delivered an earnings surprise of 10.54% in the last reported quarter. Its earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 3.49%.

McKesson Corporation price-eps-surprise | McKesson Corporation Quote

Our proven model does not conclusively predict an earnings beat for McKesson this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here, as you will see below.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate is 0.00% for MCK. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: The company carries a Zacks Rank #3 at present.

McKesson is expected to report a solid third-quarter performance, supported by sustained momentum across its diversified healthcare portfolio, with particular strength in specialty distribution, oncology services and prescription technology solutions. While revenue growth is likely to have remained robust, driven by higher prescription volumes and the continued expansion of GLP-1 medications, investors will closely watch margin performance and the extent to which mix and cost discipline offset pockets of demand softness in select end markets.

Operating profit is likely to have outpaced revenue growth, aided by a favorable business mix, operating leverage and ongoing efficiency initiatives, including automation and technology-driven cost optimization. Adjusted EPS is expected to have benefited from strong core execution and lower interest expense, partially offset by a higher tax rate of 23-25%.

Segment-wise, the North American Pharmaceutical business is expected to have delivered steady growth, supported by increased prescription volumes from retail national account customers and continued specialty product momentum. GLP-1 medications likely remained a key growth driver, with sequential and year-over-year volume expansion contributing meaningfully to revenues. Operating profit growth is likely to have been driven by continued strong demand for specialty products in health systems, as well as new product launches and operating expense efficiencies.

The Oncology and Multispecialty segment is expected to have been a standout performer for the quarter. Strong organic growth in provider and specialty distribution volumes, combined with contributions from recent acquisitions such as PRISM Vision and Core Ventures, likely drove revenue and operating profit growth.

Continued expansion of the U.S. Oncology Network, higher patient acuity, and increased adoption of complex and specialty therapies are expected to have supported robust quarterly performance. While the addition of PRISM and Core Ventures is likely to have driven significant operating profit growth, underlying organic growth trends also appear solid, reflecting McKesson’s expanding footprint in community-based oncology and multispecialty care.

In Prescription Technology Solutions, revenue growth is expected to have been driven by higher prescription volumes and rising demand for access and affordability solutions, particularly prior-authorization services tied to GLP-1 therapies. Favorable mix toward technology-enabled services likely supported operating margin expansion, although management has signaled that investment spending could increase in the back half of fiscal 2026, potentially affecting near-term profit growth.

The Medical-Surgical Solutions is likely to have reflected a modest drag on overall growth, with softer illness-season demand for vaccines and testing products and lower volumes in ambulatory and extended care settings. While cost optimization initiatives should have supported profitability, revenue growth in this segment is expected to have remained muted.

Shares of McKesson have gained 19.1% in the past six months compared with the industry’s 15.7% growth. The S&P 500 Index has increased 12.4% in the same time frame.

Strong momentum in higher-growth platforms and ongoing efficiency gains provide earnings stability, but near-term variability from investment spending, mix shifts, and nonrecurring items limits visibility for incremental upside. With guidance already incorporating much of the recent strength, we advise investors to stay on the sidelines until clearer third-quarter signals emerge. However, existing investors can continue to hold the stock.

Here are some medical product stocks worth considering as these have the right combination of elements to post an earnings beat this reporting cycle.

Masimo MASI has an Earnings ESP of +8.04% and a Zacks Rank #2 at present. The company is set to release fourth-quarter 2025 results on Feb. 26.

MASI’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 12.39%. According to the Zacks Consensus Estimate, MASI’s fourth-quarter EPS is expected to decline 20.6% from the year-ago reported figure.

Cardinal Health CAH has an Earnings ESP of +0.46% and a Zacks Rank of 2 at present. The company is set to release second-quarter fiscal 2026 results on Feb. 05.

CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 9.36%. According to the Zacks Consensus Estimate, CAH’s fiscal second-quarter EPS is expected to improve 22.8% from the year-ago reported figure.

DexCom DXCM has an Earnings ESP of +4.75% and a Zacks Rank of 3 at present. The company is slated to release fourth-quarter 2025 results on Feb. 12.

DXCM’s earnings surpassed estimates in two of the trailing four quarters and missed twice, the average surprise being 0.17%. According to the Zacks Consensus Estimate, DXCM’s fourth-quarter EPS is expected to gain 44.4% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 5 hours | |

| 8 hours | |

| 9 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite