|

|

|

|

|||||

|

|

Cencora, Inc. COR reported fiscal first-quarter 2026adjusted earnings per share (EPS) of $4.08, which beat the Zacks Consensus Estimate of $4.07 by 0.2%. The bottom line also improved 9.4% year over year.

GAAP EPS was $2.87, up 14.8% compared with the year-ago period’s figure.

Revenues totaled $85.93 billion, up 5.5% year over year. The top line was almost in line with the Zacks Consensus Estimate.

U.S. Healthcare Solutions

Revenues in this segment totaled $76.2 billion, up 5% on a year-over-year basis. This improvement was driven by overall market growth on increased unit volume, including improved sales of GLP-1 drugs and specialty products.

Segmental operating income totaled $831.3 million, up 21% year over year. Higher gross profit (as a result of increased product sales and the January 2025 acquisition of RCA) contributed to the upside, partly offset by increased operating expenses.

International Healthcare Solutions

This segment includes Alliance Healthcare, World Courier, Innomar and Profarma Specialty.

Revenues amounted to $7.6 billion, up 7.6% year over year. The top line increased 9.6% on a reported basis and 6.2% at constant currency (cc).

Operating income totaled $142.2 million, down 13.9% on a reported basis and 17% at cc. The decline was due to lower operating income at COR’s global specialty logistics and specialized consulting services businesses.

Cencora reported an adjusted gross profit of $3 billion, up 18.1% on a year-over-year basis. As a percentage of revenues, the adjusted gross margin was 3.48%, up 37 basis points (bps) year over year.

The company recorded an adjusted operating income of $1.1 billion, up 11.9% year over year. As a percentage of revenues, the adjusted operating margin was 1.24%, which expanded 8 bps from the year-ago quarter’s level.

Cencora, Inc. price-consensus-eps-surprise-chart | Cencora, Inc. Quote

COR exited the fiscal first quarter with cash and cash equivalents worth $1.75 billion compared with $4.36 billion in the previous quarter.

Net cash used in operating activities totaled $2.31 billion compared with $2.72 billion a year ago.

Cencora's board of directors declared a quarterly dividend of 60 cents per share. The new dividend is payable on March 2, 2026, to shareholders of record at the close of business on Feb. 13, 2026.

The company provided its outlook for fiscal 2026 earnings and revenues.

Adjusted EPS is estimated to be in the $17.45-$17.75 range. The Zacks Consensus Estimate for the same is pegged at $17.62.

Total revenues are now projected to rise 7%-9% compared with the previous guidance of 5%-7%. Sales at the U.S. Healthcare Solutions segment and the International Healthcare Solutions segment are now also anticipated to grow in the range of 7%-9%.

Adjusted operating income is now expected to improve in the range of 11.5%-13.5% compared with previous guidance of 8-10% for fiscal 2026.

Operating income for the U.S. Healthcare Solutions segment is now expected to improve 14-16%, while the same for the International Healthcare Solutions business is estimated to improve 5-8%, reportedly as well as at cc.

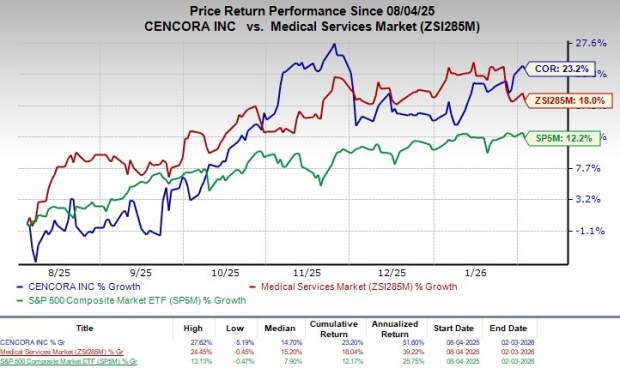

Cencora exited the fiscal first quarter on a mixed note, wherein earnings beat estimates, but revenues were in line. The company’s revenue guidance for fiscal 2026 was also above estimates. However, shares were down 5.3% in pre-market trading. In the last six-month period, COR’s shares have gained 23.2% compared with the industry’s growth of 18%. The S&P 500 Index was up 12.2% in the same time period.

Cencora delivered a solid start to fiscal 2026, supported by broad-based growth across its healthcare solutions platforms and sustained demand for specialty products, including GLP-1 therapies. Management highlighted the company’s continued role as a critical partner within the healthcare ecosystem, supported by disciplined execution and a focus on operational efficiency. While customer losses created some pressure on volumes, overall market growth and strong specialty demand helped offset these challenges.

Performance in the international business reflected healthy underlying demand, particularly within European distribution, though profitability was pressured by operating dynamics in that market. Strength in the global specialty logistics business provided a partial offset, highlighting the benefits of Cencora’s diversified international footprint. On a constant-currency basis, growth trends remained stable, reinforcing the resilience of the company’s core operations.

Strategically, Cencora remains focused on long-term value creation through targeted capital deployment. The RCA acquisition is contributing positively to operating performance and is expected to support incremental growth going forward. In addition, the company’s move to acquire the remaining equity interest in OneOncology strengthens its position in oncology-focused services and deepens relationships with physician practices. While higher operating expenses continue to weigh on margins, ongoing investments in scale, specialty capabilities, and integrated services position Cencora well for sustained growth over time.

COR carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space are Boston Scientific Corporation BSX, Phibro Animal Health PAHC and AtriCure ATRC. Each stock presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Boston Scientific shares have lost 12% in the past six months. Estimates for the company’s fourth-quarter 2025 EPS have remained constant at 78 cents in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.36%. In the last reported quarter, it posted an earnings surprise of 5.63%.

Estimates for Phibro Animal Health’s EPS for second-quarter fiscal 2026 have remained constant at 69 cents in the past 30 days. Shares of the company have risen 50.5% in the past six months compared with the industry’s 11.1% growth. PAHC’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 20.77%. In the last reported quarter, it delivered an earnings surprise of 23.73%.

AtriCure shares have risen 5.2% in the past six months. Estimates for the company’s fourth-quarter 2025 loss per share have remained stable at 4 cents in the past 30 days. ATRC’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 67.06%. In the last reported quarter, it posted an earnings surprise of 90.91%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite