|

|

|

|

|||||

|

|

Masimo Corporation MASI is well-poised for growth in the coming quarters, courtesy of its strong underlying demand for innovative technology and research and development (R&D) efforts. The optimism, led by a solid third-quarter 2025 performance and a solid product portfolio, is expected to contribute further. However, concerns regarding overdependence on its Signal Extraction Technology (SET) unit and reimbursement headwinds persist.

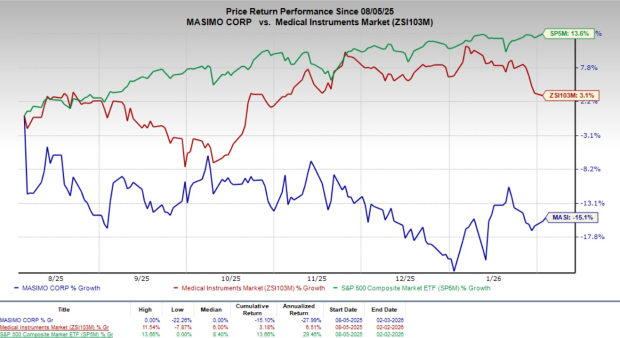

Over the past six months, this Zacks Rank #2 (Buy) company’s shares have lost 15.1% against the industry’s 3.1% growth and the S&P 500’s 13.6% rise.

The renowned global provider of non-invasive monitoring systems has a market capitalization of $7.44 billion. The company projects 5.9% earnings growth for 2026 and expects to maintain its strong performance going forward. Masimo’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.4%.

Let’s delve deeper.

Long-Term Growth Strategy and 2028 Financial Targets: Masimo outlined its long-term strategic vision and plans to drive sustainable growth, highlighting its strategy to strengthen its position as a global leader in patient monitoring, expand its multi-year innovation pipeline and execute a roadmap focused on revenue growth, improved margins and strong cash flow.

The company presented updated long-run financial targets through 2028, including revenue growth of 7%-10% on a compound annual basis, operating margins approaching 30%, adjusted earnings per share of approximately $8.00 and cumulative operating cash flow of about $1 billion from 2026 to 2028.

In addition, MASI’s revenues are projected to be $1.52 billion for full-year 2025, reflecting 9% growth on both a reported and constant-currency basis. Adjusted diluted earnings per share, inclusive of the impact from newly implemented tariffs, are expected to exceed $5.55, reaching the top end of the company’s guidance range. Shipments of noninvasive technology boards and instruments are anticipated to total approximately 270,000 units.

The company’s strong quarterly performance reflects continued effective execution of its strategic initiatives and the ongoing value proposition of its solutions. During 2025, Masimo generated a record level of incremental contract value, supported by both new customer additions and the expansion of agreements with existing hospital clients. This commercial traction positions the company for sustained performance and growth in the coming year to deliver long-term value for all stakeholders.

Intelligent Patient Monitoring: We remain optimistic about Masimo’s long-term growth prospects, driven by innovation and partnerships. The company highlighted three strategic growth waves — elevating commercial excellence, accelerating intelligent monitoring and innovating wearables. Masimo continues to gain traction in advanced monitoring categories such as capnography and hemodynamics.

In October, MASI announced results from an exploratory analysis for a unique feasibility study published in CHEST Critical Carein. In the study, researchers found that Masimo’s SET pulse oximetry was accurate in critically ill adult patients across all skin tones, including patients with low blood flow who needed vasopressors and detected zero occult hypoxemic events.

In September, the company reported results from a study published in the Journal of Patient Safety by researchers at Dartmouth-Hitchcock Medical Center demonstrating that continuous monitoring of general care floor patients using Masimo technologies can deliver meaningful cost savings. The study found surveillance monitoring to be cost-effective, improving operating margins by reducing patient rescues and transfers to higher-acuity care. Each avoided rescue and transfer generated around $5,500 and $10,700 in operating margin benefit per patient, respectively. The findings support surveillance monitoring as an accretive strategy for hospitals.

Strategic Alliances Offer Long-Term Growth: Masimo continues to collaborate with hospitals across multiple geographies, with its technologies being deployed to support improved clinical outcomes. In September, the company finalized the divestiture of its Sound United consumer audio business to HARMAN International, a wholly owned subsidiary of Samsung Electronics, for a cash consideration of $350 million. The transaction is intended to further streamline Masimo’s portfolio, reinforcing management’s focus on innovation and growth within its core professional healthcare business.

During the same month, Masimo announced the renewal and expansion of its long-term strategic partnership with Royal Philips. The expanded agreement is designed to further drive adoption of Masimo’s monitoring technologies, including SET pulse oximetry, across a broad portfolio of Philips patient monitors through 2026 and beyond. The collaboration will incorporate Masimo’s Radius PPG and other next-generation wearable solutions into Philips systems, expand sensor integration across bedside and central monitoring platforms, and support joint development, manufacturing and commercialization of next-generation AI-enabled monitoring technologies aimed at improving patient care at scale.

Tariff Pressure on Gross Margins: Masimo maintains a diversified manufacturing footprint across the United States, Mexico and Malaysia, with certain raw materials sourced from China and sub-assemblies imported from Malaysia and Mexico. As a result, tariffs are expected to increase input and finished goods costs. Management is taking proactive steps to offset the operating profit impact of tariffs by optimizing its supply chain and manufacturing processes, while also undertaking administrative efforts to secure available exemptions, including those provided under the United States-Mexico-Canada Agreement.

Longer-term initiatives are also underway to reduce tariff exposure, including evaluating alternative suppliers for China-sourced raw materials and cables. While management expressed confidence in its ability to continue improving margins through operational optimization, tariffs are clearly identified as an ongoing external pressure.

Capital Equipment Growth Remains Volatile: While capital equipment and other revenues increased sharply in the third quarter of 2025, backed by favorable prior-year comparisons and shipment timing, management made clear that capital equipment revenues are timing-driven and volatile. When viewed on a multi-year basis, capital equipment growth has historically been in the low- to mid-single-digit range, which is indicative of the underlying trend. Capital performance can fluctuate based on contract award timing, shipment schedules and customer purchasing patterns, leading to uneven quarterly results.

Looking ahead, management indicated that capital revenues are expected to be softer in fourth-quarter 2025, with overall growth anticipated to be driven by accelerating consumables shipments, partially offset by lower capital comparisons. As Masimo enters 2026, capital equipment revenues are therefore expected to remain less predictable and more cyclical than consumables, with growth driven by the timing of large contracts rather than steady demand expansion.

Masimo Corporation price | Masimo Corporation Quote

MASI has been witnessing a positive estimate revision trend for 2026. In the past 60 days, the Zacks Consensus Estimate for its earnings per share (EPS) has moved north 0.5% to $5.77.

The Zacks Consensus Estimate for the company’s first-quarter revenues is pegged at $396.7 million, implying a 6.7% improvement from the year-ago quarter’s reported number.

Other top-ranked stocks in the broader medical space are Intuitive Surgical ISRG, Veracyte VCYT and AngioDynamics ANGO.

Intuitive Surgical, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term earnings growth rate of 15.7%. ISRG’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 13.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuitive Surgical’s shares have gained 0.4% compared with the industry's 3.2% growth in the past six months.

Veracyte, presently flaunting a Zacks Rank #1, has an estimated earnings recession rate of 3% for 2026. VCYT’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 45.1%.

Veracyte’s shares have surged 50.9% in the past six months compared with the industry’s 3.1% growth.

AngioDynamics, flaunting a Zacks Rank #1 at present, has delivered an average earnings surprise of 82.1% in the trailing four quarters.

ANGO’s shares have gained 22.7% in the past six months compared with the industry’s 3.1% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 7 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite