|

|

|

|

|||||

|

|

Despite the prolonged government shutdown last year, shares of the Atlanta, GA-based Delta Air Lines DAL have performed impressively over the past six months, gaining in double digits (30.9% to be exact), and outperforming the Zacks Transportation - Airline industry and fellow airline operators American Airlines AAL and United Airlines UAL.

Given this impressive price performance and the fourth-quarter 2025 earnings beat by the airline heavyweight last month, the question that naturally arises is how investors should approach DAL stock now. Let us delve deeper and analyze Delta’s fundamentals to answer the question.

Deltareported fourth-quarter 2025 earnings (excluding 31 cents from non-recurring items) of $1.55 per share, which beat the Zacks Consensus Estimate of $1.53. Earnings decreased 16.22% on a year-over-year basis due to high labor costs.

Revenues in the December-end quarter were $16 billion, beating the Zacks Consensus Estimate of $15.63 billion and increasing 2.9% year over year. Adjusted operating revenues (excluding third-party refinery sales) increased 1.2% year over year to $14.6 billion. Revenue growth was impacted by about 2 points due to the government shutdown.

Passenger revenues, which accounted for 80.7% of total revenues, increased 1% year over year at $12.91 billion. Domestic passenger revenues were flat year over year, hurt by the government shutdown. International performance improved significantly sequentially, driven by the transatlantic and Pacific segments. Corporate sales improved across all sectors. Delta expects first-quarter 2026 adjusted earnings per share in the 50-90 cents band.

The earnings beat in the December quarter enabled Delta to maintain its excellent surprise record. DAL’s earnings have outpaced the Zacks Consensus Estimate in each of the past four quarters. The average beat is 7.9%.

Delta Air Lines, Inc. price-eps-surprise | Delta Air Lines, Inc. Quote

Highlighting efforts to modernize its fleet, Delta reached an agreement with The Boeing Company BA to acquire 30 787-10 widebody aircraft, with options to purchase an additional 30. Aircraft deliveries are expected to commence in 2031.

In addition to enhanced fuel efficiency, the new planes are expected to provide better operating economics and expand Delta’s long-haul capabilities. The order to Boeingrepresents the next phase of Delta’s international growth strategy, strengthening its global footprint and building on a solid foundation for overseas expansion supported by the airline’s industry-leading domestic network and joint-venture partnerships across all major regions. Delta also signed a separate agreement with GE Aerospace to provide maintenance services for the GEnx engines selected for the aircraft.

With international air travel demand gaining strength, Delta aims to operate more than 650 weekly flights to nearly 30 European destinations in the summer of 2026. As part of the largest transatlantic schedule, Delta has decided to introduce seven non-stop routes that offer direct options for exploring some of the most tourist-friendly destinations in Europe.

Flights across the Atlantic will be equipped with all customer-friendly features, including Delta’s partnership with YouTube, which provides customers with seamless, ad-free access to a curated selection of popular YouTube creators, podcasts and music playlists. The features and amenities are expected to elevate the flying experience of customers, which in turn should attract significant traffic and boost DAL’s passenger revenues.

Apart from the exciting summer schedule, Delta’s winter schedule is expected to attract significant traffic with service to popular destinations like Amsterdam, Paris, Marrakech, London-Heathrow, Dublin, Athens and Zürich.

Peers United Airlines and American Airlines have also announced plans to boost their network this year to meet the anticipated increased demand. Driven by its significant international network, United Airlines aims to offer nearly 3,000 weekly international round-trips in summer 2026. As part of its efforts to attract significant traffic, next summer, American Airlines aims to add new routes to tourist-friendly destinations, including Athens, Milan and Zürich, along with expanded summer service to Buenos Aires.

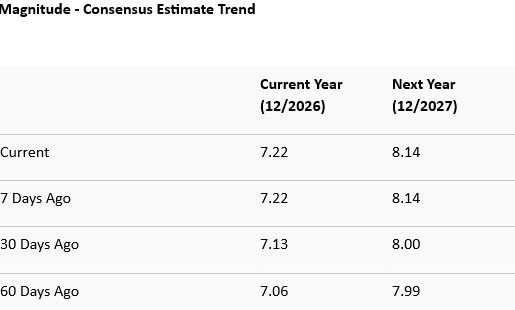

The Zacks Consensus Estimate for DAL’s 2026 and 2027 sales implies a year-over-year increase of 4.1% and 5.2%, respectively. The consensus mark for DAL’s 2026 EPS highlights a 24.1% year-over-year uptick. The 2027 EPS consensus mark indicates a 12.8% year-over-year increase. Moreover, the EPS estimates for 2026 and 2027 have been trending northward over the past 60 days.

The increase in expenses on the labor front represents a challenge for airlines, including DAL. At Delta, salaries and related costs have increased 8% year over year in 2025. Due to the spike in labor costs, DAL is burdened with rising non-fuel unit costs.

With U.S. airlines grappling with labor shortages in the post-COVID-19 high-demand scenario, the bargaining power of various labor groups has naturally increased. As a result, we have seen pay-hike deals being inked in the space. This is resulting in a spike in labor costs, limiting bottom-line growth in turn.

Moreover, the 2024 global IT outage cost Delta a significant amount and showcased the risks associated with technology dependence and potential for future disruptions. High inflation, tariff-related uncertainties, weather-related and geopolitical woes represent further concerns.

The company’s shareholder-friendly initiatives are noteworthy. Last year, DAL’s management announced a 25% hike in the quarterly dividend payout. This was the second dividend increase announced by Delta since its resumption of quarterly dividend payments following the COVID-induced hiatus. In June 2024, management announced a 50% hike in its quarterly dividend payout.

Moreover, DAL has other factors working in its favor, as mentioned in the write-up, like the improving air-travel demand scenario, fleet modernization efforts through the Boeing deal and the northbound estimate revisions. However, challenges like high non-fuel unit costs cannot be ignored.

Considering all factors, holding onto this Zacks Rank #3 (Hold) stock appears to be a prudent choice currently, while prospective investors might consider waiting for a more favorable entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 18 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite