|

|

|

|

|||||

|

|

Dexcom DXCM recently announced an upcoming nationwide rollout of an AI-driven upgrade to its Stelo platform aimed at improving users’ understanding of glucose health and supporting long-term wellness goals. The new features expand the previously launched AI-driven Smart Food Logging feature in Stelo by integrating a nutrition database containing over one million food entries, providing detailed macro- and nutrient-level breakdowns for logged meals.

The database supports multiple meal-logging methods, including text search, barcode scanning and photo capture, enabling a more streamlined glucose tracking experience. Users will gain access to the upgraded Smart Food Logging functionality and refreshed Daily Insights tools through the latest iOS and Android app updates scheduled for release in the coming weeks.

Per management, the Smart Food Logging feature was initially introduced to simplify meal tracking and highlight glucose impacts. In response to user feedback, the company has further refined the features within Stelo, introducing enhancements designed to simplify nutrition tracking. The updated functionality is expected to reduce tracking barriers, enabling users to make more informed dietary choices and pursue their health objectives with greater confidence.

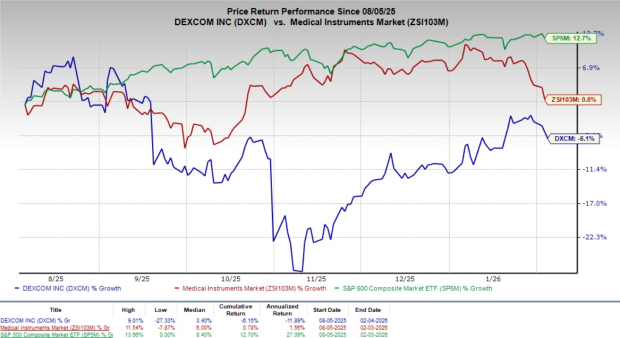

Following the announcement, shares of DXCM lost 1.1% at yesterday’s closing. Over the past six months, shares of the company have declined 6.1% against the industry’s 0.8% growth and the S&P 500’s 12.7% rise.

In the long run, the expanded Stelo offerings reinforce Dexcom’s competitive positioning in the rapidly evolving personal and preventive health market by deepening user engagement with AI-enabled nutrition analytics and personalized metabolic insights. By broadening the utility of the Stelo platform beyond glucose sensing to integrated lifestyle guidance, Dexcom enhances its value proposition for both existing and new customers, supporting sustained adoption and digital ecosystem stickiness.

DXCM currently has a market capitalization of $27.94 billion.

Stelo will introduce a redesigned Daily Insights feature that will include a card-based interface that delivers up to three personalized recommendations derived from prior-day glucose, activity, nutrition and sleep data, with each card highlighting key metrics and contextual interpretation. In addition, a fourth card will incorporate behavioral science-driven prompts designed to encourage user reflection and action on metabolic health trends. The feature leverages AI to preserve day-to-day contextual continuity, enabling adaptive, personalized guidance that evolves in line with individual behavioral patterns and progress.

Dexcom stated that improved awareness of macronutrient composition, particularly carbohydrates, proteins and fats, plays a critical role in glucose management. Company-reported data indicate that, after 30 days of Stelo usage, the majority of users reported favorable changes in dietary behaviors, physical activity and weight-management habits, indicating that enhanced insights into food-related glucose responses may support more effective metabolic health management.

Stelo ambassador Mike Golic Sr. noted that managing type 2 diabetes has required greater attention to personal health and lifestyle choices. Prior to using Stelo, assessing the glucose impact of different foods involved considerable uncertainty, whereas the platform now provides clearer, data-driven insights. The latest Smart Food Logging enhancements are expected to further streamline health management and help individuals take a proactive approach to metabolic health rather than relying on reactive adjustments.

Going by the data provided by Precedence Research, the glucose biosensors market was valued at $10.71 billion in 2025 and is expected to witness a CAGR of 8.9% through 2034. Factors like the increasing number of diabetes patients, the rising investments in technological advancements, favorable government policies for diabetes-controlling measures and the growing diabetes awareness campaign in the rural areas are driving the market’s growth.

Dexcom launched the Dexcom G7 15-Day Continuous Glucose Monitoring (CGM) system in the United States, targeting adults with diabetes, in December last year. The sensor provides real-time glucose readings for up to 15.5 days, representing the company’s longest wear duration, and will initially be distributed via durable medical equipment providers before broader retail availability. The system meets Medicare therapeutic CGM criteria, delivers 8.0% MARD accuracy, and includes a waterproof design, direct Apple Watch connectivity, logging and data-sharing capabilities, and launch-time integration with the iLet Bionic Pancreas and Omnipod 5 platforms.

In November 2025, the company obtained FDA clearance for Dexcom Smart Basal, a CGM-integrated basal insulin dosing optimization tool designed for adults with type 2 diabetes using long-acting glargine U-100 insulin. Leveraging Dexcom G7 15-Day CGM data alongside logged insulin doses, the system provides personalized daily basal insulin recommendations by analyzing comprehensive glucose trends rather than isolated fasting readings and incorporates dose adjustments following hypoglycemic events. Smart Basal is expected to be integrated into the Dexcom G7 15-Day app shortly after its United States launch, with prescribing and configuration managed through the Dexcom Clarity platform.

DexCom, Inc. price | DexCom, Inc. Quote

Currently, DXCM carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Veracyte VCYT, AtriCure ATRC and Boston Scientific BSX.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.3% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

AtriCure, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 adjusted loss of 1 cent per share, surpassing the Zacks Consensus Estimate by 90.9%. Revenues of $134.3 million beat the Zacks Consensus Estimate by 2.1%.

ATRC has an estimated earnings growth rate of 91.7% for 2026 compared with the industry’s 17.5% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 67.1%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion beat the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.3% rise. The company’s earnings beat estimates in the trailing four quarters, the average surprise being 7.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 13 hours | |

| 14 hours | |

| 15 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite