|

|

|

|

|||||

|

|

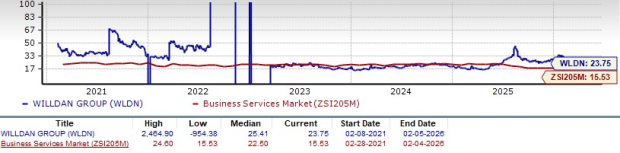

Willdan Group, Inc. WLDN has become one of the stronger performers in the Business Services space, but its valuation is now drawing closer scrutiny. With WLDN trading at about 23.75X forward 12-month earnings, well above the Zacks Business – Services industry average of 15.53X, investors are increasingly asking whether the premium reflects durable fundamentals or whether expectations are running ahead of near-term visibility. The answer lies in how Willdan’s growth drivers, execution and risks balance against that elevated multiple.

WLDN’s Valuation

Willdan’s shares have gained 20.6% over the past six months, sharply outperforming the broader industry, which declined meaningfully over the same period, and beating the S&P 500’s roughly 11% gain. As of Feb. 5, the stock was trading near $107.46, well below its 52-week high of $137 but far above its $30.43 low, underscoring the scale of the rerating investors have already assigned to the business.

WLDN's Price Performance

From a technical standpoint, the stock is trading below its 50-day moving average but above its 200-day moving average, suggesting some near-term consolidation after a strong run, while the longer-term trend remains intact.

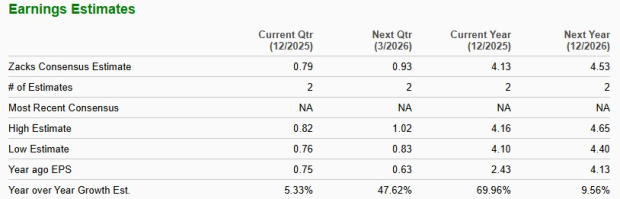

Meanwhile, earnings expectations have been stable. Over the past 60 days, the Zacks Consensus Estimate for 2026 earnings per share (EPS) has remained unchanged at $4.53, implying 9.6% growth year over year, while the same for revenue points to 4.8% growth. That stability supports the current multiple, but it also means valuation upside depends more on execution than estimate revisions.

Willdan’s recent financial performance helps explain why investors are willing to pay up. In the third quarter of fiscal 2025, the company delivered 15% contract revenue growth and 26% net revenue growth, driven by roughly 20% organic growth and 6% from acquisitions. Profitability expanded sharply, with adjusted EBITDA rising 53% and adjusted EPS increasing 66% year over year, reflecting both scale benefits and disciplined cost control.

Management raised 2025 targets following the third quarter, calling for net revenue of $360–$365 million, adjusted EBITDA of $77–$78 million, and adjusted EPS of $4.10–$4.20, assuming no additional acquisitions. These targets underscore confidence in the visibility of current contracts and backlog.

Willdan’s positioning at the intersection of energy infrastructure, electrification and grid modernization is a central pillar of the bull case. Roughly 85% of revenue comes from energy-related services, with utilities, state and local governments, and commercial customers providing a diversified demand base. Utility programs, many of which run three to five years, offer recurring revenue funded by ratepayer mechanisms, while government projects benefit from municipal bonds and user-fee structures that have remained resilient.

A key long-term catalyst is accelerating electric load growth, driven by data centers, electrification, and industrial demand. Willdan’s policy, forecasting, and data analytics capabilities allow it to engage clients early, then layer in engineering and program management work as projects move forward. Management highlighted that upfront load-growth studies are growing at roughly 50% organically, creating a pipeline effect that supports multi-year revenue visibility.

Strategic acquisitions have also broadened capabilities and geography. Recent deals, including the acquisition of Compass Municipal Advisors, expanded Willdan’s municipal advisory footprint and enhanced cross-selling opportunities in public finance and infrastructure consulting. Importantly, the balance sheet remains conservative, with net debt of about $16 million and a net debt-to-adjusted EBITDA ratio near 0.2X, preserving flexibility for further bolt-on growth.

Despite these strengths, the valuation leaves less room for error. Willdan operates in a competitive and fragmented market, where pricing pressure can emerge if project timing slips or budgets tighten. While government and utility funding have held up well, prolonged economic weakness or policy shifts could slow contract awards or delay project starts.

Execution risk also rises with scale. Sustaining double-digit organic growth requires continued success in hiring, integrating acquisitions and managing complex, multi-discipline projects. Any slowdown in data-center-related demand or delays in grid modernization spending could compress growth rates, making the current multiple harder to justify.

Finally, estimate momentum is neutral rather than positive. With the consensus estimate unchanged, upside from valuation expansion alone appears limited unless earnings growth accelerates beyond current expectations.

Willdan competes with a range of engineering and consulting firms that target utilities, governments, and commercial energy customers. ICF International ICFI competes closely with Willdan in energy efficiency programs, policy advisory and utility consulting. ICF International brings scale and global reach, but it also operates with a broader mix of end markets that can dilute pure-play exposure to U.S. grid modernization trends.

Another key competitor is Tetra Tech TTEK, which has a strong presence in water, environmental services and infrastructure consulting. Tetra Tech benefits from global scale and a broad client base, but its size can limit flexibility in specialized energy efficiency and local government programs where Willdan has built deep, repeat-client relationships. Compared with Tetra Tech, Willdan’s more focused operating model allows it to move faster in niche energy and grid-related opportunities.

Jacobs Solutions J competes at the higher end of infrastructure and engineering services. The company has significantly greater scale and global diversification, but that scale can limit agility in niche energy efficiency and municipal programs where Willdan has built deep expertise. Compared with Jacobs Solutions, Willdan’s smaller size allows it to focus more narrowly on fast-growing pockets of electrification and grid demand.

Willdan’s 23.75X forward P/E reflects a business delivering strong organic growth, expanding margins and improving cash generation in markets with long-term structural tailwinds. The premium looks justified by execution and visibility, but it also embeds expectations for continued outperformance. With stable earnings estimates and a Zacks Rank #3 (Hold), the stock appears fairly valued at current levels. For long-term investors, pullbacks driven by market volatility rather than fundamentals may offer more attractive entry points, while near-term upside likely depends on sustained earnings beats rather than multiple expansion. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite