|

|

|

|

|||||

|

|

Freeport-McMoRan Inc. FCX and Southern Copper Corporation SCCO are two heavyweights in the copper mining industry. Both operate on a global scale, extracting and processing copper and other metals. Also, both are navigating challenges such as fluctuating copper prices and global economic uncertainties. Given the current uncertainties surrounding the U.S.-China trade tensions and their potential impact on copper prices, analyzing these companies' fundamentals is timely and pertinent.

Copper prices surged to a new record high of $5.24 per pound in late March as buyers stocked up the commodity amid concerns that President Donald Trump could impose tariffs on copper, leading to a disruption in the global supply chain. However, prices nosedived to around $4.1 per pound earlier this month amid demand worries due to tariffs, which threatened to cause a broader slowdown globally. Prices of the red metal have moved up lately to roughly $4.9 per pound amid a weakening U.S. dollar on heightened concerns about the prospect of a downturn in the U.S. economy. The trade conflict with China continues to pose risks to copper demand, as the metal is essential in various industries, including electronics and construction.

Let’s dive deep and closely compare the fundamentals of these two copper mining giants to determine which one is a better investment now.

Freeport is well-placed with high-quality copper assets and remains focused on strong execution and advancing its organic growth opportunities. At its Cerro Verde operation in Peru, a large-scale concentrator expansion provided incremental annual production of around 600 million pounds of copper and 15 million pounds of molybdenum. It is evaluating a large-scale expansion at El Abra in Chile to define a large sulfide resource that could potentially support a major mill project similar to the large-scale concentrator at Cerro Verde. FCX is also conducting pre-feasibility studies (expected to be completed by mid-2026) in the Safford/Lone Star operations in Arizona to define a significant sulfide expansion opportunity. It also has expansion opportunities at Bagdad in Arizona to more than double the concentrator capacity of the operation.

Also, PT Freeport Indonesia (PT-FI) substantially completed the construction of the new greenfield smelter in Eastern Java during 2024, with an expected start-up in mid-2025, followed by a full ramp-up by the end of 2025. PT-FI is also developing the Kucing Liar ore body within the Grasberg district with a targeted commencement of production by 2030. Gold production also commenced at the new precious metals refinery in late 2024. Plans are in place to transition PT-FI’s existing energy source from coal to natural gas, which is expected to significantly reduce greenhouse gas emissions at Grasberg.

FCX has a strong liquidity position and generates substantial cash flows, which allow it to finance its growth projects, pay down debt and drive shareholder value. It generated operating cash flows of around $1.4 billion in the fourth quarter. The same for full-year 2024 climbed around 35% year over year to $7.2 billion. It has distributed $4.7 billion to shareholders through dividends and share purchases since June 30, 2021. Freeport ended 2024 with strong liquidity, having $3.9 billion in cash and cash equivalents, $3 billion in availability under the FCX credit facility and $1.5 billion in availability under the PT FI credit facility.

FCX offers a dividend yield of roughly 0.9% at the current stock price. Its payout ratio is 20% (a ratio below 60% is a good indicator that the dividend will be sustainable), with a five-year annualized dividend growth rate of about 21.8%. Backed by strong financial health, the company's dividend is perceived to be safe and reliable.

Despite these positives, Freeport faces headwinds from higher costs. Freeport’s consolidated unit net cash costs per pound of copper for fourth-quarter 2024 were 9% higher than the prior-year level. The company now estimates that consolidated unit net cash costs for the first quarter will be roughly 5% higher than the January 2025 guidance of $2.05 per pound of copper, mainly due to the timing of gold shipments, which has led to lower by-product credits. FCX is grappling with higher unit net cash costs in North America. Higher labor and mining costs are leading to increased unit costs in the region.

Southern Copper has a strong pipeline of world-class copper greenfield projects and various other promising opportunities. The company’s capital investment program for this decade is more than $15 billion. This includes investments in the Buenavista Zinc, Pilares, El Pilar and El Arco projects in Mexico and the Tia Maria, Los Chancas and Michiquillay projects in Peru.

The company continues to build its presence in Peru as the country is the second-largest producer of copper. Peru holds about 9% of the world’s copper reserves. Southern Copper’s Michiquillay is expected to become one of Peru's largest copper mines and will produce 225,000 tons of copper per year (along with by-products of molybdenum, gold and silver) for an expected mine life of more than 25 years. Production is expected to start by 2032.

Southern Copper targets copper production of 967,000 tons for 2025, in line with last year. This growth is expected to be fueled by higher production in Peru and production from its new Buenavista zinc concentrator.

SCCO generated net cash from operating activities of $4.42 billion in 2024, up roughly 24% from $3.57 billion in 2023, attributable to higher net income. SCCO offers a healthy dividend yield of 3.2% at the current stock price. Its payout ratio is 65%, with a five-year annualized dividend growth rate of roughly 13.4%.

On the flip side, Southern Copper remains hamstrung by higher operating costs. It saw a 3% year-over-year increase in total operating costs and expenses in 2024. The increase was mainly due to repair materials, translation differences, workers' participation, fuel, labor costs, reagents, currency translation and other factors. The company has been witnessing higher labor costs due to the ongoing tightness of the labor supply. This, along with ongoing inflation for repair materials, operating materials, inventory consumption, operation contractors and services, will likely continue to weigh on Southern Copper’s margins.

Year to date, FCX stock has lost 10.6%, while SCCO stock has declined 2.2% compared with the Zacks Mining - Non Ferrous industry’s fall of 14.6%.

FCX is currently trading at a forward 12-month earnings multiple of 18.95X, higher than its five-year median. This represents a roughly 4.2% premium when stacked up with the industry average of 18.19X.

SCCO is currently trading at a forward 12-month earnings multiple of 19.66X, lower than its five-year median but above FCX and the industry.

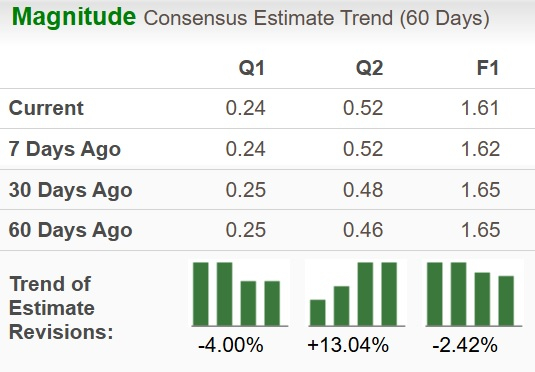

The Zacks Consensus Estimate for FCX’s 2025 sales and EPS implies a year-over-year rise of 3.4% and 8.8%, respectively. The EPS estimates for 2025 have been trending lower over the past 60 days.

The consensus estimate for SCCO’s 2025 sales and EPS implies year-over-year growth of 4.2% and 3.2%, respectively. The EPS estimates for 2025 have been trending southward over the past 60 days.

(Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Both FCX and SCCO currently have a Zacks Rank #3 (Hold), so picking one stock is not easy. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both Freeport and Southern Copper present compelling investment cases. FCX is poised to gain from progress in expansion activities that will boost production capacity. Robust financial health allows FCX to invest in growth projects and drive shareholder value. On the other hand, SCCO is well-positioned to deliver enhanced performance, backed by its constant commitment to increasing low-cost production and growth investments. Leveraging its substantial cash generation capacity, Southern Copper remains committed to returning value to its shareholders while prioritizing the development of projects to uphold its reputation as a low-cost copper producer. However, both companies face the common headwind of higher costs. FCX appears to have a slight edge over SCCO due to its more attractive valuation. In addition, FCX's higher earnings growth projections suggest that it may offer better investment prospects in the current market environment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 6 hours | |

| 8 hours | |

| 11 hours | |

| 16 hours | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite