|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Morgan Stanley’s MS push into wealth and investment management is more than simple diversification. It’s a deliberate reshaping of the company’s earnings profile away from the boom-and-bust cycle of dealmaking and trading. By 2025, that pivot was unmistakable: wealth and investment management segments together accounted for 54% of total net revenues, up from 26% in 2010.

That mix shift matters because these businesses are powered by recurring revenues (advisory fees, asset-based fees and managed solutions) that are typically more resilient than transaction-driven investment banking (IB). Market levels can swing asset-based fees, but the underlying relationships tend to be “stickier,” supported by clients’ multi-product needs spanning portfolio management, financial planning, lending and cash management.

Morgan Stanley has widened this advantage through targeted acquisitions that expand distribution and deepen engagement. The purchases of E*TRADE and Eaton Vance accelerated its move into scaled wealth channels and investment solutions. It also built a meaningful workplace wealth footprint through Solium (now Shareworks by Morgan Stanley), extending its reach via corporate stock-plan relationships. More recently, the acquisition of EquityZen broadened access to private-market liquidity and investments, capabilities that can further strengthen client retention and wallet share.

The compounding engine behind the strategy is asset growth. By year-end 2025, total client assets across both segments were $9.3 trillion, supported by $356 billion of net new assets, keeping Morgan Stanley within striking distance of its long-stated $10 trillion target.

Likewise, JPMorgan’s JPM Asset & Wealth Management (AWM) segment is a steadier, fee-led profit engine inside the bank, spanning asset management and the private bank. As of Dec. 31, 2025, the company’s assets under management hit $4.8 trillion, and client assets touched $7.1 trillion. Also, Goldman’s GS Asset & Wealth Management (AWM) division is its annuity-like counterweight to trading cycles, driven by management fees, private banking and alternatives. As of Dec. 31, 2025, the company’s assets under supervision were $3.61 trillion.

IB Business: After several false starts, global mergers & acquisitions (M&As) finally witnessed a decisive upswing in the second half of 2025 amid easing regulation hopes and inflation pressures, setting the stage for a stronger 2026.

Per Dealogic, global M&As surged 41% year over year to $4.81 trillion last year, led by a record 70 megadeals. In 2026, M&As are likely to shift from high-risk transformational deals to de-conglomeration and buy-and-build strategies. This back-to-basics focus will likely lift mid-market activity through smaller, synergy-rich add-ons and faster tech integration. With solid GDP growth and a potential rate cut, financing conditions are improving and strategic activity will continue rising.

Against the bright industry prospects, Morgan Stanley is expected to be a winner this year. The company’s IB revenues surged 23% in 2025, riding a wave of deal-making and IPO activity. This followed a 35% jump in IB revenues in 2024 as clarity on several macroeconomic matters emerged.

Looking ahead, a healthy global IB pipeline, an active M&A market, “reopening of the IPO market,” and the company’s leadership position will help it capitalize amid the changing macro situation. Similarly, JPMorgan and Goldman Sachs are expected to record solid IB income growth this year as the industry-wide backdrop turns favorable.

Strategic Collaborations: MS’ partnership with Mitsubishi UFJ Financial Group, Inc. MUFG will likely continue to support its profitability. In 2023, the companies announced plans to deepen their 15-year alliance by merging certain operations within their Japanese brokerage joint ventures. The new partnership saw combined Japanese equity research, sales and execution services for institutional clients at Mitsubishi UFJ Morgan Stanley Securities and Morgan Stanley MUFG Securities. Also, their equity underwriting business has been rearranged between the two brokerage units. These efforts will solidify the company’s position in Japan’s market.

This has helped Morgan Stanley achieve record equity net revenues, particularly in Asia, through outperformance in prime brokerage and derivatives, led by solid client activity amid heightened volatility. The company’s Asia region revenues surged 23% year over year to $9.42 billion in 2025.

Further, in September 2025, Jed Finn, head of wealth management at Morgan Stanley, stated in an interview with Bloomberg that the company has collaborated with Zerohash, a cryptocurrency infrastructure provider, enabling E*TRADE clients to trade in popular cryptocurrencies starting in the first half of 2026. The initiative is expected to boost Morgan Stanley’s revenues through trading spreads, advisory fees on crypto allocations and future services, like custody and tokenization, and support client retention.

Robust Balance Sheet Position: As of Dec. 31, 2025, the company had long-term debt of $341.7 billion, with $26.2 billion expected to mature over the next 12 months. The company’s average liquidity resources were $385.9 billion as of the same date.

Morgan Stanley’s capital distribution plans have been impressive. Following the clearance of the 2025 stress test, it announced an 8% hike in quarterly dividend to $1.00 per share. It reauthorized a multi-year share repurchase program of up to $20 billion (no expiration date). The company has increased its dividend five times in the last five years, with an annualized growth rate of 17.16%.

Given a solid liquidity position and earnings strength, Morgan Stanley is expected to be able to continue with efficient capital distribution activities, thereby enhancing shareholder value.

Similarly, JPMorgan and Goldman increased their quarterly dividends six times during the last five years. Further, JPMorgan has a share repurchase plan of $50 billion, and Goldman has a buyback plan of $40 billion.

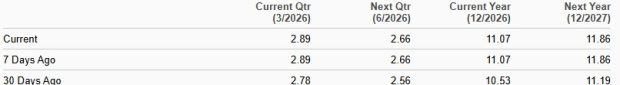

Analysts are bullish on Morgan Stanley. Over the past month, the Zacks Consensus Estimate for 2026 and 2027 earnings has been revised upward to $11.07 and $11.86, respectively.

Estimate Revision Trend

The Zacks Consensus Estimate for Morgan Stanley’s 2026 and 2027 earnings implies year-over-year growth of 8.4% and 7.1%, respectively.

From a valuation perspective, MS stock is currently trading at a forward 12-month price/earnings (P/E) of 16.34X, above the industry’s 14.96X. This indicates stretched valuation.

Forward 12-Month P/E

Meanwhile, JPMorgan and Goldman have a 12-month forward P/E of 14.95X and 16.29X, respectively. This shows that Morgan Stanley is expensive compared with its peers.

Morgan Stanley’s shares have soared 32.8% in the past year, outperforming the industry and the S&P 500. While it fared better than JPMorgan, it lagged Goldman.

1-Year Price Performance

Morgan Stanley’s efforts to become less dependent on capital markets to drive revenue growth and inorganic expansion efforts/strategic alliances, along with declining interest rates and a solid balance sheet, are expected to support its financials. Bullish analyst sentiments are another positive.

However, rising expenses will likely hurt the company’s profitability in the near term. High reliance on trading revenues and a stretched valuation are other headwinds. Nonetheless, a robust M&A backdrop and a pivot toward wealth management will likely drive Morgan Stanley’s financials. Hence, the stock looks like a compelling 2026 bet.

At present, MS carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| Feb-20 |

Lloyd Blankfein Misses Being Goldman Sachs CEOMostly When Theres a Market Crisis

GS

The Wall Street Journal

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite